Region:Global

Author(s):Dev

Product Code:KRAD0566

Pages:97

Published On:August 2025

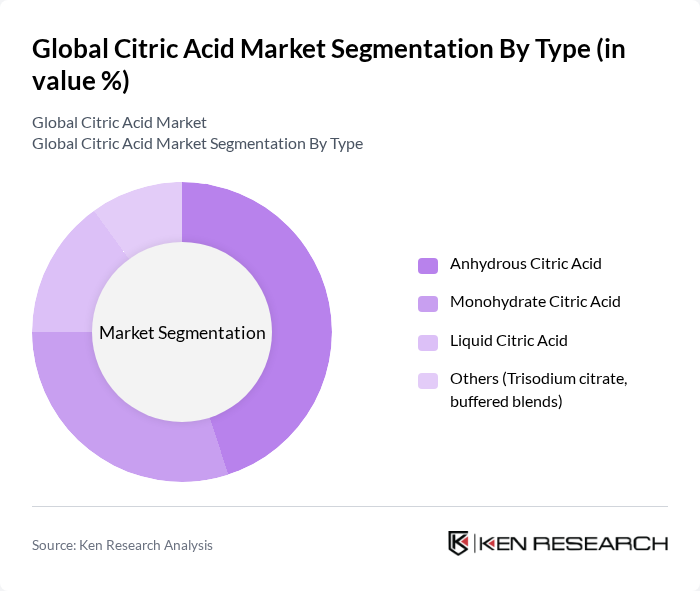

By Type:The market is segmented into Anhydrous Citric Acid, Monohydrate Citric Acid, Liquid Citric Acid, and Others (Trisodium citrate, buffered blends). Anhydrous Citric Acid is the leading subsegment due to extensive use in food and beverage applications as a preservative and flavor enhancer, aided by its handling and stability advantages in dry formulations . Monohydrate Citric Acid follows closely, with notable usage in pharmaceuticals and personal care owing to solubility and processing characteristics for tablets and effervescents . Demand for Liquid Citric Acid is growing in cleaning, descaling, and certain industrial processing due to ready-to-use handling in liquid systems .

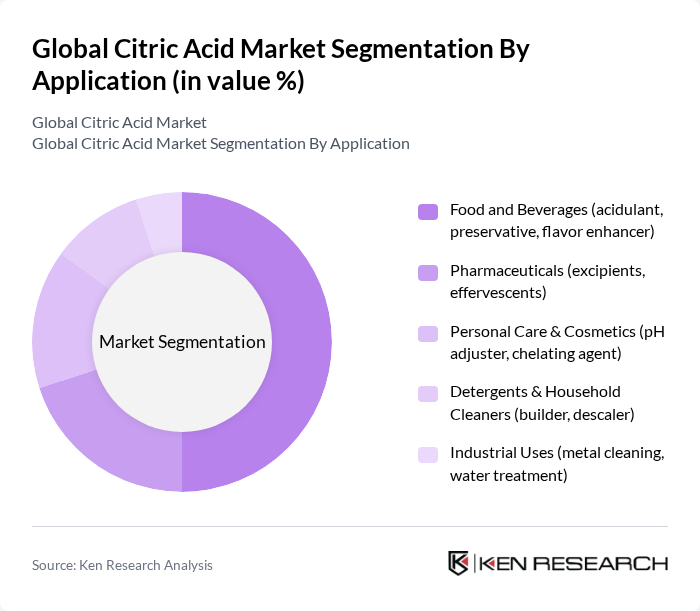

By Application:The applications of citric acid include Food and Beverages, Pharmaceuticals, Personal Care & Cosmetics, Detergents & Household Cleaners, and Industrial Uses. The Food and Beverages segment dominates, driven by demand for natural preservatives, flavor enhancement, and acidification in beverages, confectionery, and processed foods . Pharmaceuticals is significant, as citric acid is used as an excipient, effervescent agent, and buffering agent in oral solids and liquids . Personal Care & Cosmetics is growing on increased use as a pH adjuster and chelating agent in skin and hair formulations, while Detergents & Household Cleaners leverage its scale, chelation, and descaling capabilities in eco-forward cleaners .

The Global Citric Acid Market is characterized by a dynamic mix of regional and international players. Leading participants such as Weifang Ensign Industry Co., Ltd., RZBC Group Co., Ltd., Cofco Biochemical (Anhui) Co., Ltd., Jungbunzlauer Suisse AG, S.A. Citrique Belge N.V., Gadot Biochemical Industries Ltd., Huangshi Xinghua Biochemical Co., Ltd., Niran (Thailand) Co., Ltd., Archer Daniels Midland Company (ADM), Cargill, Incorporated, Tate & Lyle PLC, Merck KGaA (for pharma-grade supplies), Jiangsu Guoxin Union Energy Co., Ltd., BBCA Group (Anhui BBCA Biochemical Co., Ltd.), Shandong Juxian Hongde Citric Acid Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the citric acid market appears promising, driven by increasing consumer demand for natural preservatives and clean label products. As health-conscious consumers prioritize transparency in ingredient sourcing, manufacturers are likely to innovate and adapt their offerings. Additionally, advancements in fermentation technology are expected to enhance production efficiency, reducing costs and environmental impact. The market is poised for growth as companies align with sustainability trends and respond to evolving consumer preferences, particularly in emerging markets.

| Segment | Sub-Segments |

|---|---|

| By Type | Anhydrous Citric Acid Monohydrate Citric Acid Liquid Citric Acid Others (Trisodium citrate, buffered blends) |

| By Application | Food and Beverages (acidulant, preservative, flavor enhancer) Pharmaceuticals (excipients, effervescents) Personal Care & Cosmetics (pH adjuster, chelating agent) Detergents & Household Cleaners (builder, descaler) Industrial Uses (metal cleaning, water treatment) |

| By End-User | Food Processing Companies Beverage Manufacturers Pharmaceutical Manufacturers Personal Care & Cosmetics Manufacturers Home & Industrial Cleaning Product Manufacturers |

| By Distribution Channel | Direct Sales (contract supply to F&B, pharma) Distributors/Traders Online/B2B Portals Others (toll manufacturers, agents) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Packaging Type | Bulk Packaging (25 kg bags, 500–1000 kg FIBCs) Retail/Small Packs (?5 kg, consumer/SMB) Liquid IBCs/Drums |

| By Grade/Function | Food Grade Pharmaceutical Grade Industrial Grade |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Manufacturers | 120 | Product Development Managers, Quality Assurance Heads |

| Pharmaceutical Companies | 90 | Regulatory Affairs Specialists, R&D Managers |

| Cosmetic and Personal Care Brands | 80 | Formulation Chemists, Brand Managers |

| Citric Acid Distributors | 70 | Sales Managers, Supply Chain Coordinators |

| Research Institutions and Universities | 60 | Academic Researchers, Industry Analysts |

The Global Citric Acid Market is valued at approximately USD 3.2 billion, driven primarily by its demand in the food and beverage industry as an acidulant, preservative, and flavor enhancer, alongside its applications in pharmaceuticals and personal care products.