Region:Global

Author(s):Dev

Product Code:KRAA1655

Pages:91

Published On:August 2025

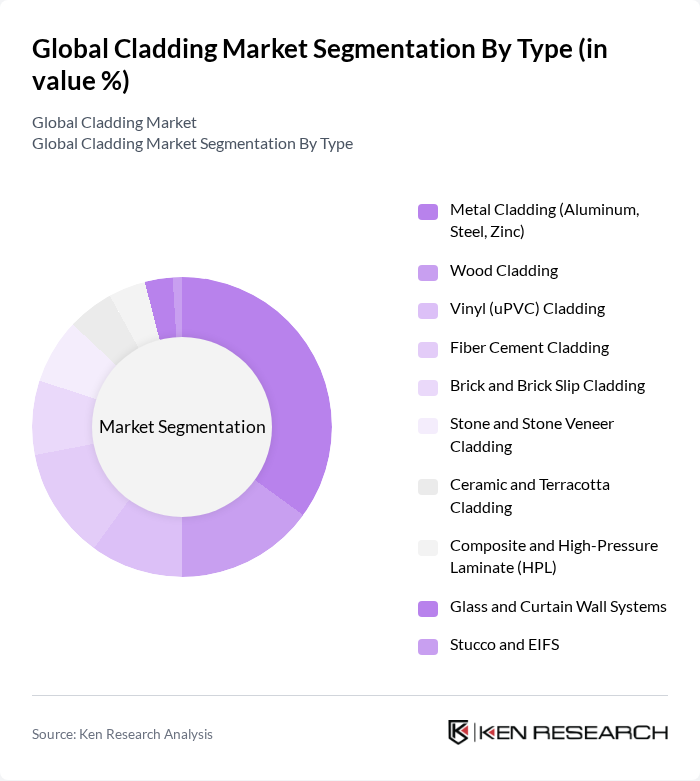

By Type:The cladding market is segmented into various types, including Metal Cladding (Aluminum, Steel, Zinc), Wood Cladding, Vinyl (uPVC) Cladding, Fiber Cement Cladding, Brick and Brick Slip Cladding, Stone and Stone Veneer Cladding, Ceramic and Terracotta Cladding, Composite and High-Pressure Laminate (HPL), Glass and Curtain Wall Systems, and Stucco and EIFS. Among these, Metal Cladding is the most dominant segment due to its durability, low maintenance, and aesthetic appeal, making it a preferred choice for both residential and commercial buildings.

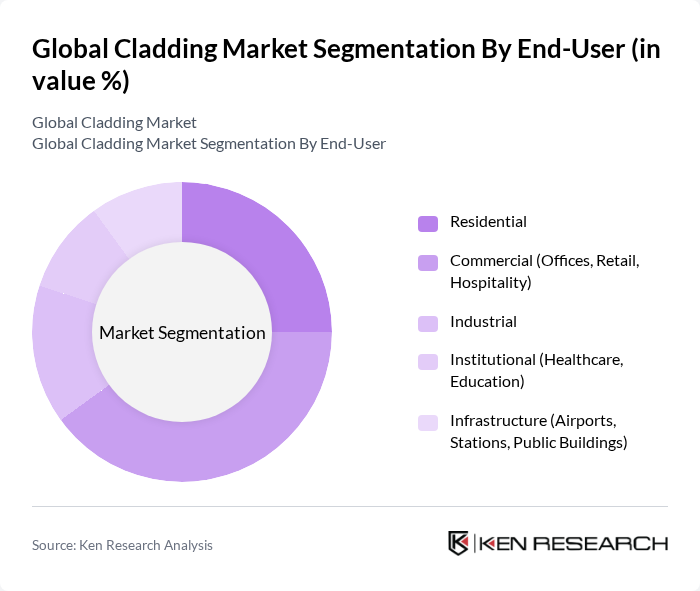

By End-User:The end-user segmentation includes Residential, Commercial (Offices, Retail, Hospitality), Industrial, Institutional (Healthcare, Education), and Infrastructure (Airports, Stations, Public Buildings). The Commercial segment is leading due to the increasing demand for aesthetically pleasing and energy?efficient buildings in urban areas, supported by green building programs, corporate net?zero targets, and façade retrofits to improve energy performance and fire safety.

The Global Cladding Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kingspan Group plc, Compagnie de Saint?Gobain S.A., James Hardie Industries plc, Etex Group NV (Eternit, Equitone), ROCKWOOL A/S, Nichiha Corporation, Trespa International B.V., Cembrit A/S (Swisspearl Group), Sika AG, Cornerstone Building Brands, Inc., Nucor Corporation (CENTRIA, Metl-Span), Arconic Corporation (Reynobond, Reynolux), Alcoa Corporation, ALCOM Group Berhad (ALCOM ACP), Shandong Jixiang Decoration Co., Ltd. (Jixiang ACP), Mulk Holdings International (ALUBOND U.S.A.), Valcan Ltd (Vitrabond, VitraDual), 3A Composites (ALUCOBOND), Tata Steel (Colorcoat/Building Envelope), BlueScope Steel Limited (Lysaght, COLORBOND) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cladding market is poised for significant transformation, driven by technological advancements and sustainability initiatives. As smart technologies become integrated into building designs, cladding solutions will evolve to enhance energy efficiency and aesthetic appeal. Additionally, the growing emphasis on green building practices will likely lead to increased demand for innovative materials that meet environmental standards, fostering a competitive landscape that prioritizes sustainability and performance in construction.

| Segment | Sub-Segments |

|---|---|

| By Type | Metal Cladding (Aluminum, Steel, Zinc) Wood Cladding Vinyl (uPVC) Cladding Fiber Cement Cladding Brick and Brick Slip Cladding Stone and Stone Veneer Cladding Ceramic and Terracotta Cladding Composite and High-Pressure Laminate (HPL) Glass and Curtain Wall Systems Stucco and EIFS |

| By End-User | Residential Commercial (Offices, Retail, Hospitality) Industrial Institutional (Healthcare, Education) Infrastructure (Airports, Stations, Public Buildings) |

| By Application | New Construction Renovation and Retrofit Rainscreen and Ventilated Facades Roofing and Soffits Interior Wall Cladding |

| By Distribution Channel | Direct Sales (Projects/Spec-Bid) Distributors and Dealers Online and E-Procurement |

| By Material Source | Domestic Sourcing Imported Materials |

| By Price Range | Budget Mid-Range Premium |

| By Policy Support | Green Building Certifications (LEED, BREEAM) Energy Efficiency Incentives Fire Safety and Compliance Upgrades |

| By Region | North America Europe Asia-Pacific Middle East & Africa South America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Building Cladding | 120 | Architects, Project Managers |

| Residential Cladding Solutions | 100 | Home Builders, Contractors |

| Industrial Cladding Applications | 90 | Facility Managers, Engineers |

| Cladding Material Suppliers | 70 | Sales Managers, Product Development Leads |

| Regulatory Compliance in Cladding | 60 | Compliance Officers, Quality Assurance Managers |

The Global Cladding Market is valued at approximately USD 260275 billion, based on a five-year historical analysis. This valuation is supported by various industry sources indicating the market is in the mid-to-high USD 200 billion range.