Region:Global

Author(s):Rebecca

Product Code:KRAD0282

Pages:85

Published On:August 2025

By Type:

The cloud advertising market is segmented into Display Advertising, Search Advertising, Social Media Advertising, Video Advertising, Mobile Advertising, Native Advertising, Programmatic Advertising, and Others. Social Media Advertising is currently the leading sub-segment, driven by the increasing number of users on platforms such as Facebook, Instagram, and TikTok. Advertisers are allocating larger budgets to social media due to its advanced targeting capabilities, real-time engagement tracking, and the ability to reach highly specific demographics .

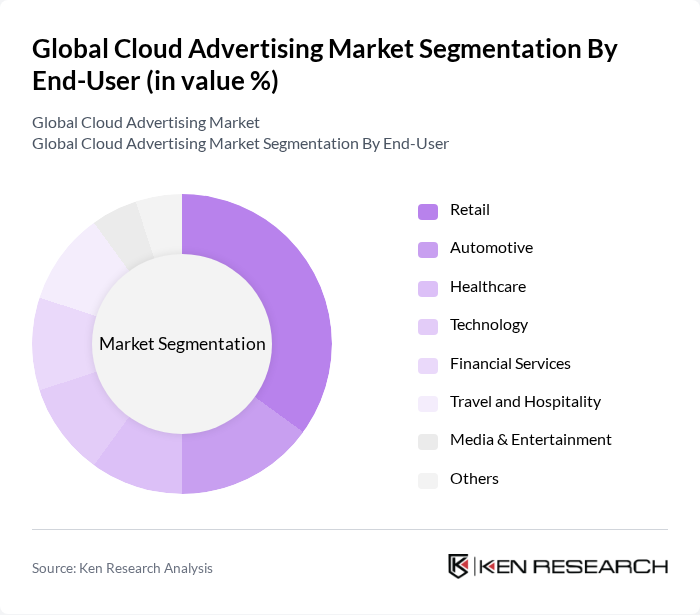

By End-User:

The end-user segmentation includes Retail, Automotive, Healthcare, Technology, Financial Services, Travel and Hospitality, Media & Entertainment, and Others. The Retail sector is the dominant end-user in the cloud advertising market, as retailers are increasingly utilizing cloud-based advertising solutions to enhance customer engagement and drive sales. The continued shift toward e-commerce and omnichannel retailing has further accelerated the adoption of cloud advertising in this sector .

The Global Cloud Advertising Market is characterized by a dynamic mix of regional and international players. Leading participants such as Google LLC, Meta Platforms, Inc. (Facebook), Amazon Advertising LLC, Adobe Inc., Microsoft Corporation, Salesforce, Inc., The Trade Desk, Inc., Yahoo Inc. (formerly Verizon Media), Criteo S.A., Taboola.com Ltd., Outbrain Inc., Snap Inc., Pinterest, Inc., LinkedIn Corporation (Microsoft), ByteDance Ltd. (TikTok), Spotify Technology S.A., Roku, Inc., Magnite, Inc., AppNexus Inc. (Xandr, now part of Microsoft) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the cloud advertising market appears promising, driven by technological advancements and evolving consumer preferences. As businesses increasingly adopt AI-driven solutions, the ability to analyze vast amounts of data will enhance targeting and personalization. Additionally, the integration of cloud advertising with emerging technologies like augmented reality is expected to create immersive advertising experiences, further engaging consumers. This evolution will likely lead to increased investments in cloud infrastructure and innovative advertising strategies, positioning the market for sustained growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Advertising Social Media Advertising Video Advertising Mobile Advertising Native Advertising Programmatic Advertising Others |

| By End-User | Retail Automotive Healthcare Technology Financial Services Travel and Hospitality Media & Entertainment Others |

| By Industry Vertical | E-commerce Telecommunications Education Entertainment Real Estate Manufacturing BFSI (Banking, Financial Services & Insurance) Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Sales Channel | Direct Sales Online Sales Resellers Affiliate Marketing |

| By Geographic Presence | North America (United States, Canada) Europe (UK, Germany, France, Italy, Spain, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, Rest of Asia-Pacific) Latin America (Brazil, Mexico, Argentina, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Startups Non-Profit Organizations |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cloud Advertising in Retail | 60 | Marketing Directors, Digital Strategy Managers |

| Cloud Solutions for E-commerce | 50 | eCommerce Managers, IT Directors |

| Cloud Advertising in Technology Sector | 40 | Product Marketing Managers, Brand Strategists |

| Cloud-Based Advertising Agencies | 45 | Agency Owners, Account Managers |

| Cloud Advertising Effectiveness Studies | 55 | Data Analysts, Marketing Researchers |

The Global Cloud Advertising Market is valued at approximately USD 5 billion, driven by the increasing adoption of digital marketing strategies and the demand for targeted advertising solutions across various industries.