Region:Global

Author(s):Geetanshi

Product Code:KRAA2091

Pages:86

Published On:August 2025

By Type:The market is segmented into various types, including Voice Communication, Video Communication, Messaging Services, Collaboration Tools, Contact Center Solutions, and Others. Each of these subsegments plays a crucial role in the overall market dynamics, catering to different communication needs of businesses and consumers. Voice and video communication solutions remain the largest segments, with video conferencing experiencing the fastest growth due to the rise in remote and hybrid work environments .

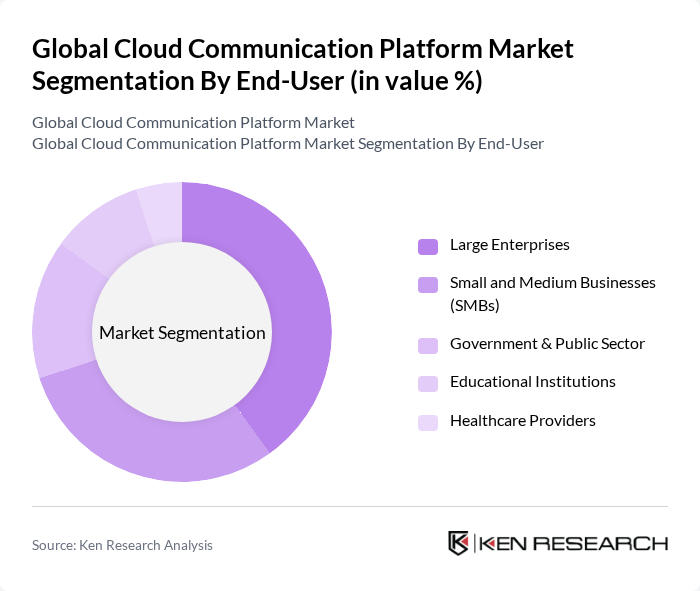

By End-User:The end-user segmentation includes Large Enterprises, Small and Medium Businesses (SMBs), Government & Public Sector, Educational Institutions, and Healthcare Providers. Each segment has unique requirements and preferences, influencing the demand for cloud communication solutions. Large enterprises account for the largest share, while SMBs are rapidly increasing adoption due to the scalability and cost-effectiveness of cloud-based platforms .

The Global Cloud Communication Platform Market is characterized by a dynamic mix of regional and international players. Leading participants such as Twilio Inc., RingCentral Inc., Vonage Holdings Corp., 8x8, Inc., Cisco Systems, Inc., Microsoft Corporation, Zoom Video Communications, Inc., Google Cloud (Alphabet Inc.), Amazon Web Services, Inc. (AWS), Mitel Networks Corporation, Avaya LLC, Fuze, Inc., Talkdesk, Inc., Freshworks Inc., Dialpad, Inc., Plivo Inc., NetFortris, Inc., Genesys Telecommunications Laboratories, Inc., Intermedia Cloud Communications, Inc., Nextiva, Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of cloud communication platforms is poised for transformative growth, driven by technological advancements and evolving business needs. As organizations increasingly prioritize digital transformation, the demand for integrated communication solutions will rise. In future, the emphasis on enhancing customer experience will lead to the development of more intuitive platforms. Additionally, the integration of artificial intelligence in communication tools will streamline operations, making them more efficient and user-friendly, thus reshaping the landscape of business communication.

| Segment | Sub-Segments |

|---|---|

| By Type | Voice Communication (VoIP, SIP Trunking) Video Communication (Video Conferencing, Webinars) Messaging Services (SMS, MMS, OTT Messaging) Collaboration Tools (Team Messaging, File Sharing, Whiteboarding) Contact Center Solutions Others (Fax over IP, Notification Services, APIs) |

| By End-User | Large Enterprises Small and Medium Businesses (SMBs) Government & Public Sector Educational Institutions Healthcare Providers |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Industry Vertical | Healthcare Retail & E-commerce Financial Services (BFSI) IT and Telecommunications Manufacturing Government Education |

| By Region | North America (U.S., Canada, Mexico) Europe (U.K., Germany, France, Rest of Europe) Asia-Pacific (China, Japan, India, Rest of APAC) Latin America (Brazil, Argentina, Rest of LATAM) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| By Sales Channel | Direct Sales Online Sales Value-Added Resellers (VARs) System Integrators |

| By Pricing Model | Subscription-Based Pay-As-You-Go Freemium Tiered Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Cloud Communication Adoption | 120 | IT Managers, CTOs, Business Analysts |

| SME Cloud Communication Solutions | 90 | Small Business Owners, Operations Managers |

| Telecom Operator Perspectives | 60 | Product Managers, Network Engineers |

| Vertical-Specific Use Cases (Healthcare, Education) | 50 | Healthcare Administrators, Educational IT Directors |

| Cloud Communication Trends in Emerging Markets | 70 | Market Analysts, Regional Sales Managers |

The Global Cloud Communication Platform Market is valued at approximately USD 16.5 billion, reflecting significant growth driven by the increasing demand for remote communication solutions and the rise in cloud adoption across various sectors.