Region:Global

Author(s):Dev

Product Code:KRAB0500

Pages:90

Published On:August 2025

By Type:The market is segmented into various types of services that cater to different aspects of cloud brokerage. The subsegments include Cloud Integration and Aggregation Services, Cloud Orchestration and Management (FinOps/Governance), Cloud Security, Compliance, and Identity Brokerage, Cloud Migration and Modernization Services, Cost Optimization, Billing, and Chargeback, Advisory and Consulting (Strategy, Architecture), and Marketplace and Resell Brokerage. Each of these subsegments plays a crucial role in addressing specific needs of businesses in managing their cloud environments effectively.

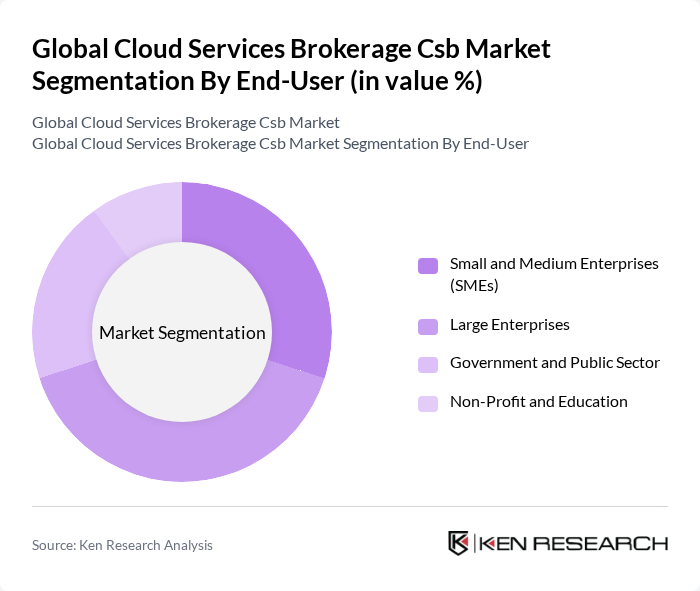

By End-User:The end-user segmentation includes Small and Medium Enterprises (SMEs), Large Enterprises, Government and Public Sector, and Non-Profit and Education. Each of these segments has unique requirements and challenges when it comes to cloud services, influencing their adoption rates and the types of services they utilize. SMEs often seek cost-effective solutions, while large enterprises focus on scalability and security.

The Global Cloud Services Brokerage Csb Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Accenture plc, Capgemini SE, Wipro Limited, DXC Technology Company, Atos SE, Fujitsu Limited, Tata Consultancy Services (TCS), HCLTech, Cognizant Technology Solutions, Infosys Limited, NTT DATA, Inc., Tech Mahindra Limited, Hewlett Packard Enterprise (HPE), Jamcracker, Inc., RightScale (Flexera), AWS Marketplace (Amazon Web Services, Inc.), Microsoft Azure Marketplace (Microsoft Corporation), Google Cloud Marketplace (Google LLC), Oracle Cloud Marketplace (Oracle Corporation), Alibaba Cloud Marketplace (Alibaba Cloud Intelligence) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cloud services brokerage market appears promising, driven by technological advancements and increasing enterprise reliance on cloud solutions. As organizations continue to embrace digital transformation, the demand for automated brokerage services and enhanced integration capabilities will rise. Additionally, the focus on sustainability and compliance will shape service offerings, ensuring that cloud solutions align with regulatory requirements and environmental goals. The market is poised for significant growth as businesses seek innovative solutions to navigate the evolving cloud landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Cloud Integration and Aggregation Services Cloud Orchestration and Management (FinOps/Governance) Cloud Security, Compliance, and Identity Brokerage Cloud Migration and Modernization Services Cost Optimization, Billing, and Chargeback Advisory and Consulting (Strategy, Architecture) Marketplace and Resell Brokerage |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Government and Public Sector Non-Profit and Education |

| By Industry Vertical | IT and Telecommunications Healthcare and Life Sciences Banking, Financial Services and Insurance (BFSI) Retail and E?Commerce Manufacturing and Industrial Education and Research Energy, Utilities, and Public Sector |

| By Service Model | Infrastructure as a Service (IaaS) Platform as a Service (PaaS) Software as a Service (SaaS) Function and Container Services (FaaS/Kubernetes) |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Multi?Cloud |

| By Geographic Presence | North America Europe Asia-Pacific Latin America Middle East and Africa |

| By Pricing Model | Subscription-Based (Per User/Per Account) Usage-Based / Pay-As-You-Go Tiered and Volume-Based Pricing Outcome-Based and Managed Service Contracts |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Cloud Adoption | 120 | IT Managers, Cloud Architects |

| SMB Cloud Brokerage Services | 100 | Business Owners, IT Consultants |

| Public Sector Cloud Integration | 80 | Government IT Officials, Procurement Managers |

| Healthcare Cloud Solutions | 70 | Healthcare IT Directors, Compliance Officers |

| Financial Services Cloud Brokerage | 90 | Chief Technology Officers, Risk Management Heads |

The Global Cloud Services Brokerage (CSB) Market is valued at approximately USD 13.5 billion, reflecting steady growth as enterprises increasingly adopt multi-cloud strategies and seek third-party governance and cost control services.