Region:Global

Author(s):Shubham

Product Code:KRAC0630

Pages:91

Published On:August 2025

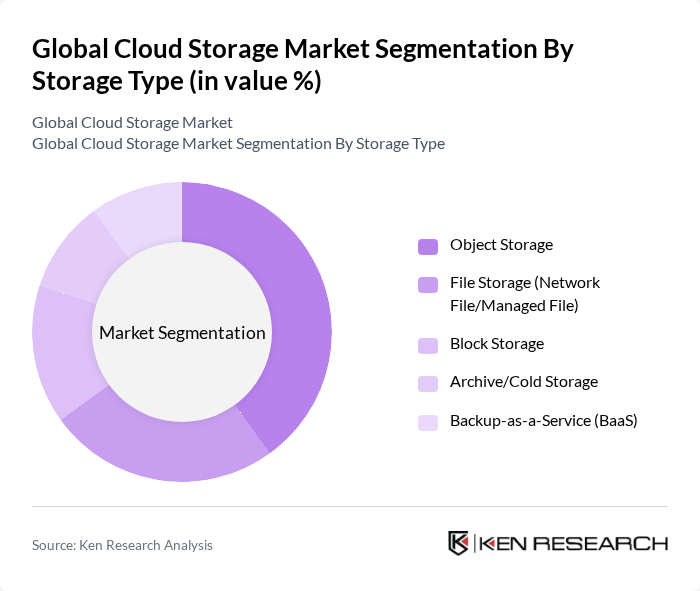

By Storage Type:The storage type segmentation includes various subsegments such as Object Storage, File Storage (Network File/Managed File), Block Storage, Archive/Cold Storage, and Backup-as-a-Service (BaaS). Among these, Object Storage is currently the leading subsegment due to its scalability and cost-effectiveness for unstructured data, and its native compatibility with modern cloud applications and analytics. File Storage is gaining traction for collaborative workloads, VDI, and lift-and-shift enterprise applications requiring shared POSIX/NFS/SMB access. The demand for Backup-as-a-Service is increasing as businesses prioritize cyber-resilience, ransomware recovery, and regulatory retention needs through managed backup and immutable storage tiers .

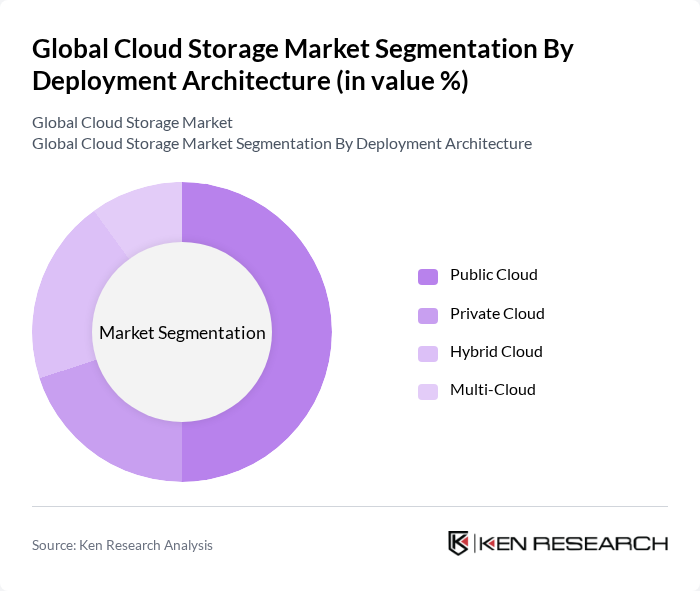

By Deployment Architecture:The deployment architecture segmentation includes Public Cloud, Private Cloud, Hybrid Cloud, and Multi-Cloud. Public Cloud is the dominant segment due to cost-effectiveness, elastic scalability, global availability, and rich ecosystem services that appeal to startups through large enterprises. Hybrid Cloud is gaining popularity as organizations combine on-premises and public cloud for data sovereignty, performance, and cost control. Multi-Cloud strategies are increasingly adopted to avoid vendor lock-in, optimize workloads across providers, and strengthen business continuity and disaster recovery posture .

The Global Cloud Storage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon Web Services, Inc. (Amazon S3, EFS, EBS, Glacier), Microsoft Corporation (Azure Blob, Files, Disks, Archive), Google LLC (Google Cloud Storage, Filestore, Persistent Disk), IBM Corporation (IBM Cloud Object Storage), Oracle Corporation (OCI Object, Block, File, Archive), Alibaba Cloud (Object Storage Service, File Storage NAS), Huawei Cloud (OBS, NAS), Wasabi Technologies, Inc., Backblaze, Inc., Snowflake Inc. (external tables/cloud storage integration), NetApp, Inc. (Cloud Volumes, StorageGRID), Dell Technologies Inc. (Apex/Cloud Storage Services), HPE (Hewlett Packard Enterprise) – HPE GreenLake for Storage, Box, Inc., Dropbox, Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the cloud storage market in the None region appears promising, driven by technological advancements and evolving business needs. The integration of AI and machine learning into cloud services is expected to enhance data management and security, making cloud solutions more attractive. Additionally, the growing emphasis on sustainability will likely lead to the development of eco-friendly data centers, aligning with global environmental goals and further boosting market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Storage Type | Object Storage File Storage (Network File/Managed File) Block Storage Archive/Cold Storage Backup-as-a-Service (BaaS) |

| By Deployment Architecture | Public Cloud Private Cloud Hybrid Cloud Multi-Cloud |

| By Organization Size | Small and Medium Enterprises (SMEs) Large Enterprises |

| By Workload/Application | Backup and Recovery Archiving and Compliance Disaster Recovery File Sharing and Collaboration Analytics and Data Lakes Media Content Storage and CDN Integration |

| By Industry Vertical | BFSI (Banking, Financial Services, and Insurance) Healthcare and Life Sciences IT and Telecommunications Retail and Consumer Goods Media and Entertainment Manufacturing Government and Public Sector Education |

| By Service Model | Infrastructure as a Service (IaaS) – Storage Platform as a Service (PaaS) – Data Services Software as a Service (SaaS) – Storage/Content Collaboration |

| By Pricing/Billing Model | Pay-as-you-go (Consumption-based) Subscription/Committed Use Tiered Storage Pricing (Hot/Warm/Cold/Archive) Egress/Request-Based Charges |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Cloud Storage Solutions | 150 | IT Directors, Cloud Strategy Managers |

| SME Cloud Adoption Trends | 100 | Business Owners, IT Managers |

| Public Sector Cloud Implementations | 80 | Government IT Officials, Data Compliance Officers |

| Healthcare Data Storage Solutions | 70 | Healthcare IT Managers, Data Security Officers |

| Cloud Storage for E-commerce Platforms | 90 | E-commerce Managers, IT Infrastructure Leads |

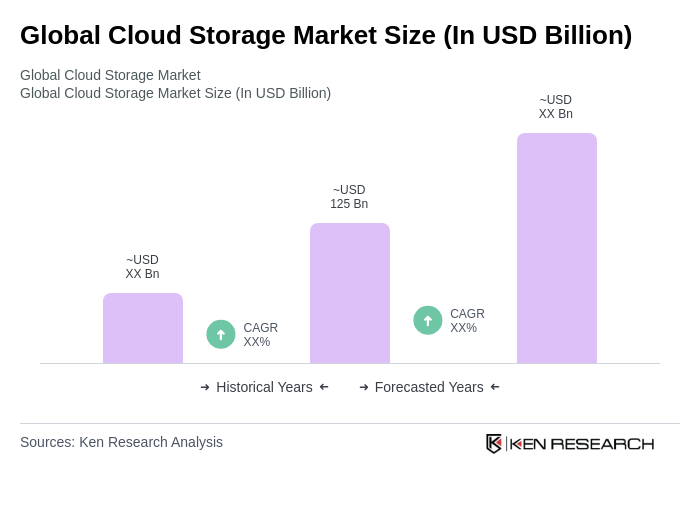

The Global Cloud Storage Market is valued at approximately USD 125 billion, reflecting significant growth driven by increasing data storage demands, digital transformation, and the need for scalable and cost-effective storage solutions across various sectors.