Region:Global

Author(s):Dev

Product Code:KRAA1617

Pages:90

Published On:August 2025

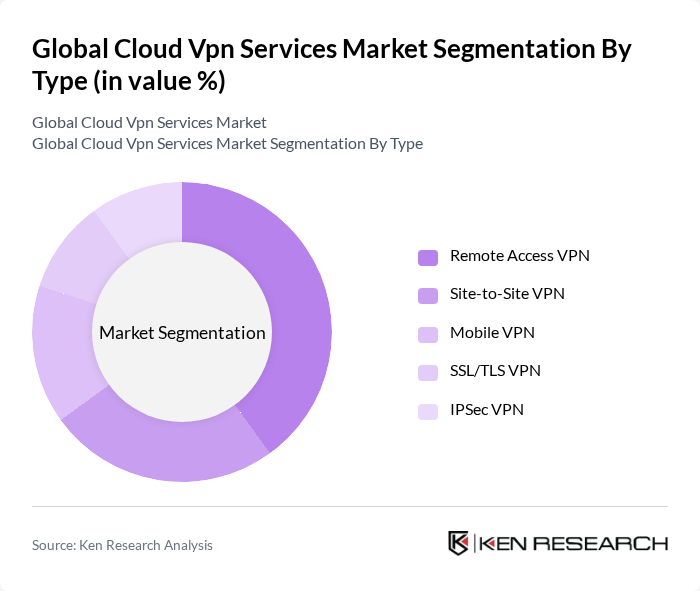

By Type:The market is segmented into various types of VPN services, including Remote Access VPN, Site-to-Site VPN, Mobile VPN, SSL/TLS VPN, and IPSec VPN. Among these, Remote Access VPN is the most dominant segment, driven by the increasing number of remote workers and the need for secure access to corporate networks. The growing trend of Bring Your Own Device (BYOD) policies in organizations further supports the demand for Remote Access VPN solutions.

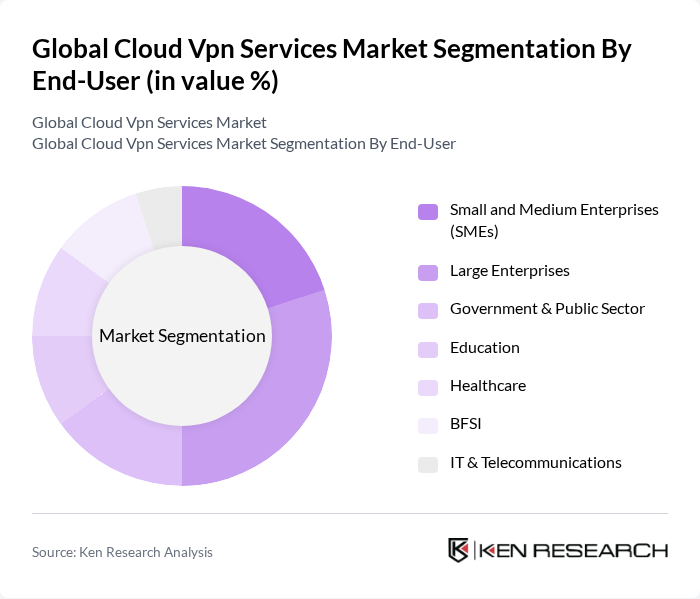

By End-User:The end-user segmentation includes Small and Medium Enterprises (SMEs), Large Enterprises, Government & Public Sector, Education, Healthcare, BFSI, and IT & Telecommunications. The BFSI sector is the leading end-user, as financial institutions prioritize secure data transmission and compliance with stringent regulations. The increasing cyber threats faced by this sector necessitate robust VPN solutions, making it a key driver of market growth.

The Global Cloud VPN Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cisco Systems, Inc. (Cisco AnyConnect / Cisco Secure Client, Meraki VPN), Palo Alto Networks, Inc. (Prisma Access/GlobalProtect), Zscaler, Inc. (Zscaler Private Access), Fortinet, Inc. (FortiGate/FortiSASE), Cloudflare, Inc. (Cloudflare Zero Trust/Cloudflare Tunnel), Check Point Software Technologies Ltd. (Harmony Connect), Broadcom Inc. (Symantec Secure Access Cloud), Akamai Technologies, Inc. (Akamai Guardicore/Enterprise Application Access), Verizon Communications Inc. (Verizon Business Virtual Network Services), AT&T Inc. (AT&T Business VPN/NetBond for Cloud), Google LLC (Google Cloud VPN), Amazon Web Services, Inc. (AWS Site-to-Site VPN & Client VPN), Microsoft Corporation (Azure VPN Gateway, Azure Virtual WAN), Oracle Corporation (Oracle Cloud Infrastructure VPN), IBM Corporation (IBM Cloud VPN/Cloud Internet Services) contribute to innovation, geographic expansion, and service delivery in this space.

The future of cloud VPN services is poised for significant transformation, driven by technological advancements and evolving security needs. As organizations increasingly adopt zero-trust security models, the demand for integrated VPN solutions will rise. Additionally, the growing emphasis on multi-factor authentication will enhance security protocols. The market is expected to witness innovations in AI-driven VPN technologies, improving user experience and security, while also expanding into emerging markets where digital transformation is accelerating.

| Segment | Sub-Segments |

|---|---|

| By Type | Remote Access VPN Site-to-Site VPN Mobile VPN SSL/TLS VPN IPSec VPN |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Government & Public Sector Education Healthcare BFSI IT & Telecommunications |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Model | Subscription-Based (Per-User/Per-Tunnel) Pay-As-You-Go (Consumption-Based) Tiered Plans (Standard/Business/Enterprise) Bundled with SASE/SD-WAN Suites |

| By Service Type | Managed VPN Services (MSSP) Self-Managed (Cloud-Native) VPN SD-WAN with Integrated VPN |

| By Security Features | Encryption Standards (AES-256/ChaCha20, IPSec/IKEv2) Multi-Factor Authentication Zero-Trust Network Access (ZTNA) Integration Threat Detection/IDS and CASB Integration |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Cloud VPN Adoption | 120 | IT Managers, Network Administrators |

| Small Business VPN Solutions | 100 | Business Owners, IT Consultants |

| Government Sector VPN Usage | 80 | Cybersecurity Officers, IT Policy Makers |

| Healthcare Data Protection via VPN | 70 | Healthcare IT Directors, Compliance Officers |

| Education Sector VPN Implementation | 60 | IT Administrators, Educational Technology Coordinators |

The Global Cloud VPN Services Market is valued at approximately USD 13 billion, with estimates ranging from USD 13.05 billion to USD 13.11 billion based on recent analyses. This growth is driven by the increasing demand for secure remote access solutions.