Region:Global

Author(s):Rebecca

Product Code:KRAB0273

Pages:90

Published On:August 2025

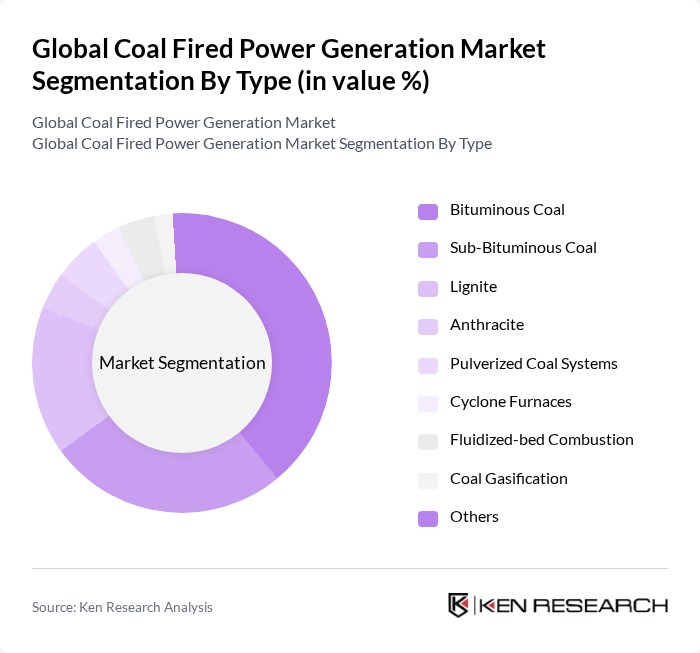

By Type:The market is segmented by coal type and combustion technology, including Bituminous Coal, Sub-Bituminous Coal, Lignite, Anthracite, Pulverized Coal Systems, Cyclone Furnaces, Fluidized-bed Combustion, Coal Gasification, and Others. Bituminous and sub-bituminous coal are the most widely used due to their high energy content and availability. Lignite is used where cost is a priority and supply is local, while anthracite is used in limited applications due to its higher cost and lower availability. Pulverized coal systems and fluidized-bed combustion are the dominant combustion technologies, offering efficiency and emissions control advantages .

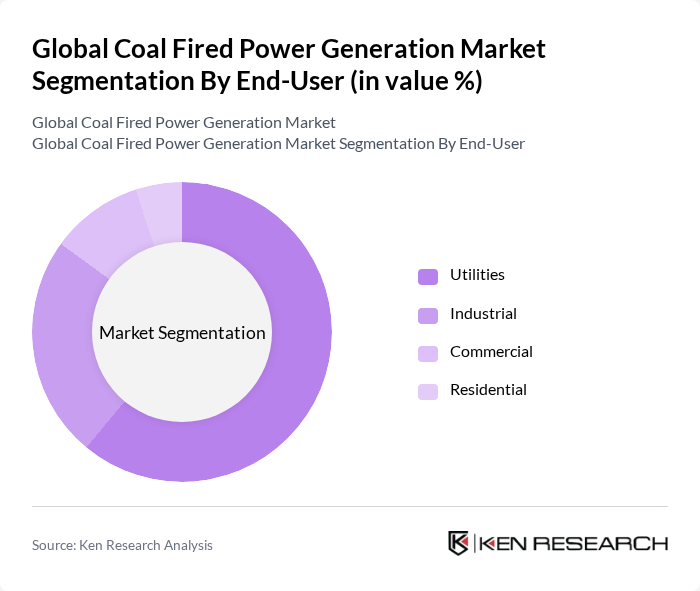

By End-User:The end-user segmentation includes Utilities, Industrial, Commercial, and Residential sectors. Utilities remain the largest consumers of coal-fired power generation, driven by the need for reliable base load power supply to support national grids. The industrial sector follows, utilizing coal for both electricity and process heat in manufacturing. Commercial and residential segments account for a smaller share, primarily in regions with limited access to alternative energy sources .

The Global Coal Fired Power Generation Market is characterized by a dynamic mix of regional and international players. Leading participants such as China Huaneng Group, State Power Investment Corporation (SPIC), China Datang Corporation, NTPC Limited, Southern Company, Duke Energy, RWE AG, ENGIE SA, E.ON SE, American Electric Power (AEP), Adani Power, Eskom Holdings SOC Ltd, FirstEnergy Corp, Portland General Electric (PGE), Uniper SE, STEAG GmbH, Dominion Energy, Shenhua Group, SUEK (Siberian Coal Energy Company), Jindal India Thermal Power, West Bengal Power Development Corporation, Zimbabwe Power Company, and Shahid Rajaee Power Plant contribute to innovation, geographic expansion, and service delivery in this space.

The future of coal-fired power generation is poised for transformation as the industry adapts to evolving energy landscapes. With increasing investments in clean coal technologies and a focus on energy efficiency, coal can maintain its relevance. Additionally, the integration of digital technologies is expected to optimize operations and reduce costs. However, the sector must navigate stringent regulations and competition from renewables, necessitating strategic partnerships and innovation to thrive in a low-carbon future.

| Segment | Sub-Segments |

|---|---|

| By Type | Bituminous Coal Sub-Bituminous Coal Lignite Anthracite Pulverized Coal Systems Cyclone Furnaces Fluidized-bed Combustion Coal Gasification Others |

| By End-User | Utilities Industrial Commercial Residential |

| By Region | North America (United States, Canada, Mexico) Europe (UK, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of MEA) |

| By Technology | Subcritical Technology Supercritical Technology Ultra-Supercritical Technology Integrated Gasification Combined Cycle (IGCC) Combined Heat and Power (CHP) Others |

| By Application | Base Load Power Generation Peak Load Power Generation Backup Power Generation |

| By Investment Source | Private Investments Public Funding International Aid |

| By Policy Support | Government Subsidies Tax Incentives Renewable Energy Credits (RECs) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Coal-Fired Power Generation Operators | 100 | Plant Managers, Operations Directors |

| Energy Policy Makers | 60 | Government Officials, Regulatory Analysts |

| Environmental Impact Assessors | 50 | Environmental Scientists, Compliance Officers |

| Coal Suppliers and Traders | 40 | Supply Chain Managers, Procurement Specialists |

| Energy Market Analysts | 60 | Market Researchers, Financial Analysts |

The Global Coal Fired Power Generation Market is valued at approximately USD 1,300 billion, driven by increasing electricity demand in developing nations and the low cost of coal as a fuel source. This market continues to grow, particularly in the Asia-Pacific region.