Region:Global

Author(s):Shubham

Product Code:KRAB0757

Pages:89

Published On:August 2025

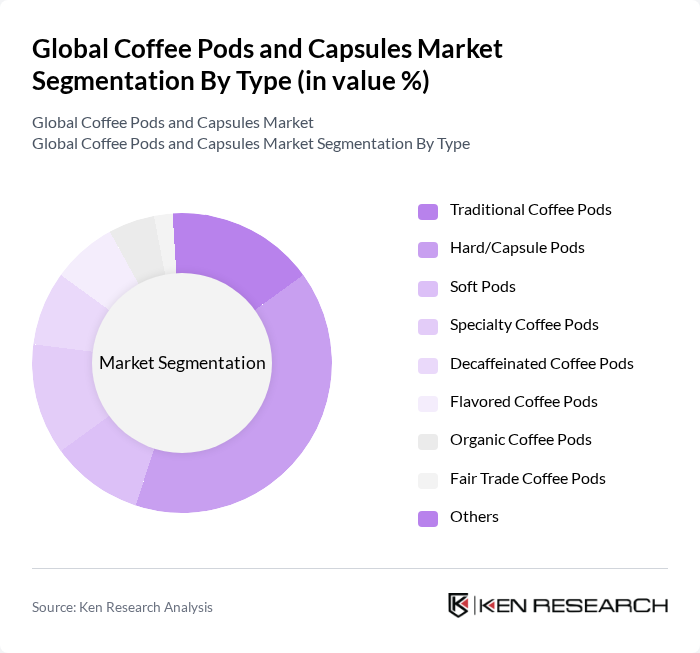

By Type:The market is segmented into various types of coffee pods and capsules, including Traditional Coffee Pods, Hard/Capsule Pods, Soft Pods, Specialty Coffee Pods, Decaffeinated Coffee Pods, Flavored Coffee Pods, Organic Coffee Pods, Fair Trade Coffee Pods, and Others. Among these,Hard/Capsule Podsare currently leading the market due to their convenience and compatibility with popular coffee machines. Consumers are increasingly opting for these pods for their ease of use and the wide variety of flavors available.

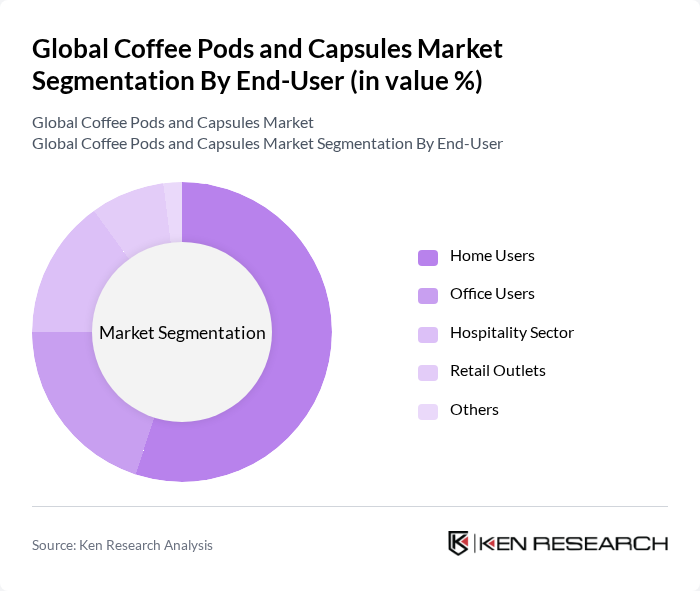

By End-User:The end-user segmentation includes Home Users, Office Users, Hospitality Sector, Retail Outlets, and Others.Home Usersdominate the market as more consumers are investing in single-serve coffee machines for personal use. The convenience of brewing a fresh cup of coffee at home without the hassle of traditional brewing methods has significantly influenced consumer behavior, leading to increased sales in this segment. The shift towards at-home consumption accelerated by the pandemic has further strengthened this trend.

The Global Coffee Pods and Capsules Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A., Keurig Dr Pepper Inc., JDE Peet's N.V., Luigi Lavazza S.p.A., Starbucks Corporation, illycaffè S.p.A., The Kraft Heinz Company, Tchibo GmbH, Caffè Nero Group Ltd., Costa Limited (Costa Coffee), Peet's Coffee & Tea, Inc., Tim Hortons Inc., Blue Bottle Coffee, Inc., Nespresso S.A., Dualit Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the coffee pods and capsules market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands are likely to invest in eco-friendly solutions, enhancing their market appeal. Additionally, the rise of subscription services is expected to reshape purchasing behaviors, providing consumers with tailored experiences. Innovations in brewing technology will further enhance product offerings, ensuring that the market remains dynamic and responsive to consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Traditional Coffee Pods Hard/Capsule Pods Soft Pods Specialty Coffee Pods Decaffeinated Coffee Pods Flavored Coffee Pods Organic Coffee Pods Fair Trade Coffee Pods Others |

| By End-User | Home Users Office Users Hospitality Sector Retail Outlets Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Coffee Shops Convenience Stores Others |

| By Packaging Type | Plastic Pods Aluminum Pods Paper & Fiber Pods Biodegradable/Compostable Pods Multi-Pack Capsules Bulk Packaging Eco-Friendly Packaging Others |

| By Flavor Profile | Classic Coffee Fruity Flavors Nutty Flavors Spicy Flavors Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers Quality-Conscious Customers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Coffee Pod Sales | 150 | Store Managers, Category Buyers |

| Consumer Preferences for Coffee Capsules | 120 | Regular Coffee Drinkers, Occasional Users |

| Manufacturing Insights from Coffee Pod Producers | 100 | Production Managers, Quality Control Officers |

| Distribution Channel Analysis | 80 | Logistics Coordinators, Supply Chain Analysts |

| Market Trends in Specialty Coffee | 90 | Industry Analysts, Coffee Shop Owners |

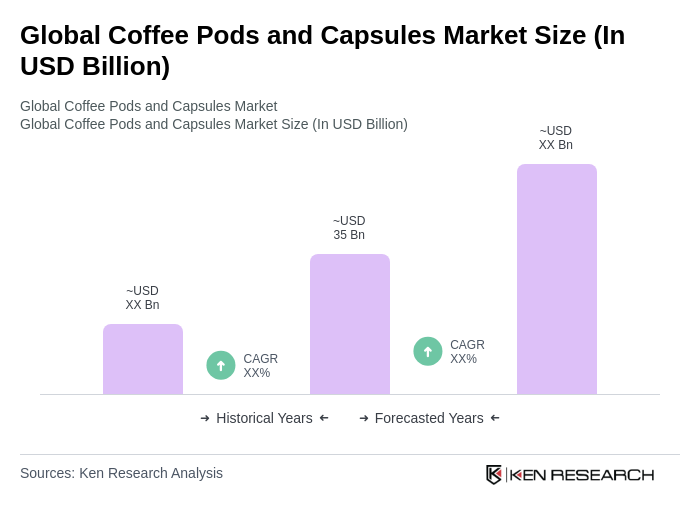

The Global Coffee Pods and Capsules Market is valued at approximately USD 35 billion, reflecting a significant growth trend driven by consumer demand for convenience and premium coffee experiences.