Region:Global

Author(s):Shubham

Product Code:KRAA1900

Pages:100

Published On:August 2025

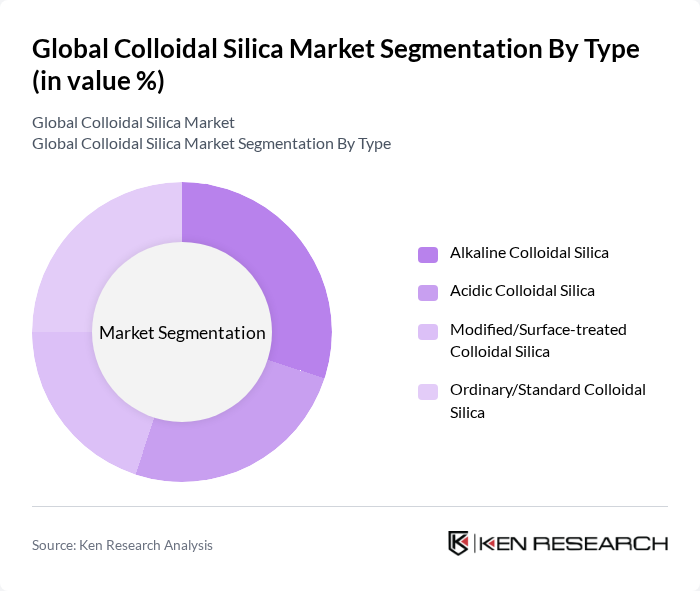

By Type:The colloidal silica market is segmented into four main types: Alkaline Colloidal Silica, Acidic Colloidal Silica, Modified/Surface-treated Colloidal Silica, and Ordinary/Standard Colloidal Silica. Each type serves distinct applications and industries, with varying properties and functionalities that cater to specific customer needs. Alkaline grades are widely used in investment casting binders and paper treatment; acidic and surface?modified grades are preferred for semiconductor slurries, coatings, and catalysis supports requiring controlled charge and dispersion; standard grades serve general industrial polishing, ceramic, and construction uses .

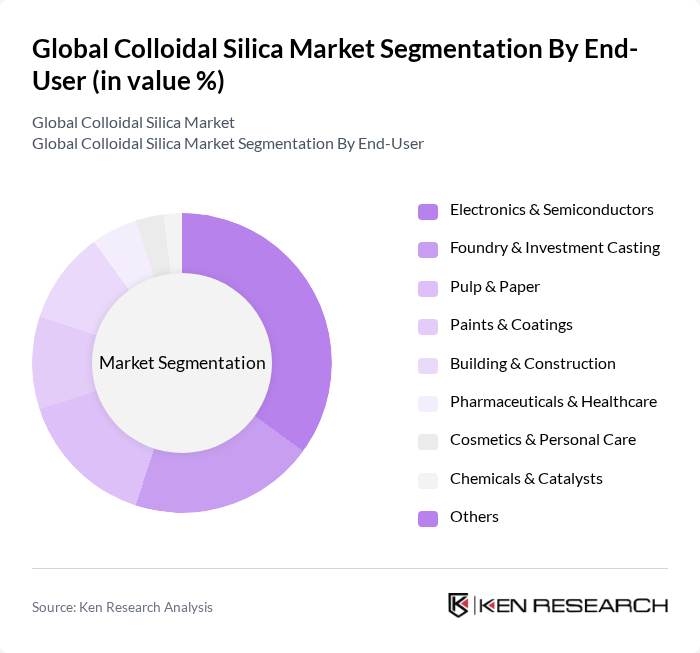

By End-User:The end-user segmentation includes Electronics & Semiconductors, Foundry & Investment Casting, Pulp & Paper, Paints & Coatings, Building & Construction, Pharmaceuticals & Healthcare, Cosmetics & Personal Care, Chemicals & Catalysts, and Others. Each sector utilizes colloidal silica for its unique properties, driving demand across various industries. Electronics/semiconductors rely on colloidal silica as an abrasive in CMP slurries; foundry/casting uses it as a shell binder; paper uses it for retention and surface strength; coatings use it for matting, anti?settling, and hardness; construction employs it to densify and strengthen surfaces; pharma and personal care use high?purity grades as excipients and rheology modifiers; catalysts/chemicals use it as a support and structure?directing aid .

The Global Colloidal Silica Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nissan Chemical Corporation, Fuso Chemical Co., Ltd., NYACOL Nano Technologies, Inc., Nouryon (Nouryon Chemicals Holding B.V.), W. R. Grace & Co., Evonik Industries AG, Cabot Corporation, Merck KGaA, Ecolab Inc. (Nalco Water), AMS Applied Material Solutions, Sterling Chemicals, JLK Industries, Sahajanand Industries Limited, Fujimi Corporation, Nalco Water (an Ecolab company) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the colloidal silica market appears promising, driven by technological advancements and a shift towards sustainable practices. Innovations in product formulations and manufacturing processes are expected to enhance the efficiency and effectiveness of colloidal silica applications. Additionally, the growing emphasis on eco-friendly products will likely lead to increased investments in research and development, fostering collaborations between industry players and research institutions to explore new applications and markets.

| Segment | Sub-Segments |

|---|---|

| By Type | Alkaline Colloidal Silica Acidic Colloidal Silica Modified/Surface-treated Colloidal Silica Ordinary/Standard Colloidal Silica |

| By End-User | Electronics & Semiconductors Foundry & Investment Casting Pulp & Paper Paints & Coatings Building & Construction Pharmaceuticals & Healthcare Cosmetics & Personal Care Chemicals & Catalysts Others |

| By Application | CMP Slurries and Polishing Binders for Investment Casting Paper Retention & Drainage Aids Paints, Coatings, and Surface Treatment Refractories and Ceramics Catalyst Supports Adhesives & Sealants Rheology Control Others |

| By Distribution Channel | Direct Sales Distributors Online & E-procurement Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Medium High |

| By Packaging Type | Bulk Packaging (IBCs, Drums, Tankers) Small Packaging (Pails, Jerrycans) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Coatings and Paints Industry | 100 | Product Development Managers, Technical Directors |

| Pharmaceutical Applications | 80 | Quality Assurance Managers, R&D Scientists |

| Electronics Manufacturing | 90 | Manufacturing Engineers, Supply Chain Managers |

| Construction Materials | 70 | Project Managers, Materials Engineers |

| Personal Care Products | 60 | Formulation Chemists, Brand Managers |

The Global Colloidal Silica Market is valued at approximately USD 640 million, based on a five-year historical analysis. This valuation reflects the market's position within the mid-hundreds of millions, contrasting with broader silica categories that may report multi-billion figures.