Region:Global

Author(s):Dev

Product Code:KRAA1579

Pages:92

Published On:August 2025

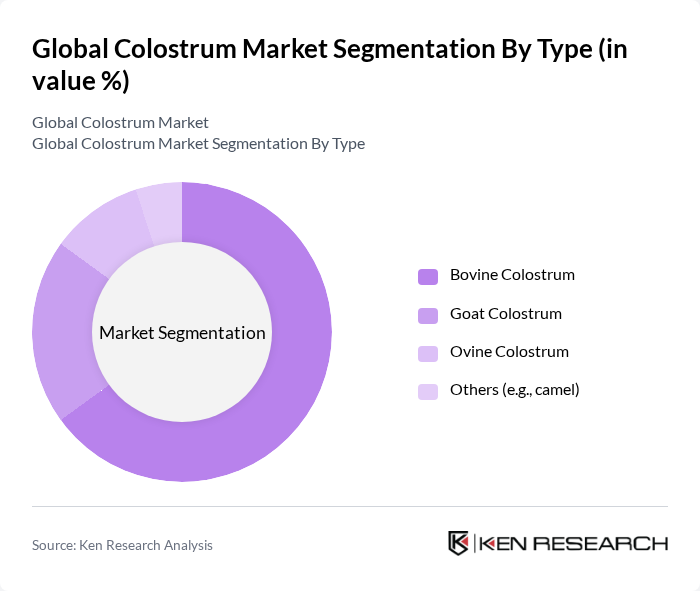

By Type:The colostrum market is segmented into four main types: Bovine Colostrum, Goat Colostrum, Ovine Colostrum, and Others (e.g., camel). Bovine colostrum dominates the market due to its high immunoglobulin content and widespread availability. Goat colostrum is gaining traction due to its digestibility and lower allergenic potential, while ovine colostrum is less common but valued for its unique nutritional profile. The 'Others' category includes camel colostrum, which is emerging in niche markets.

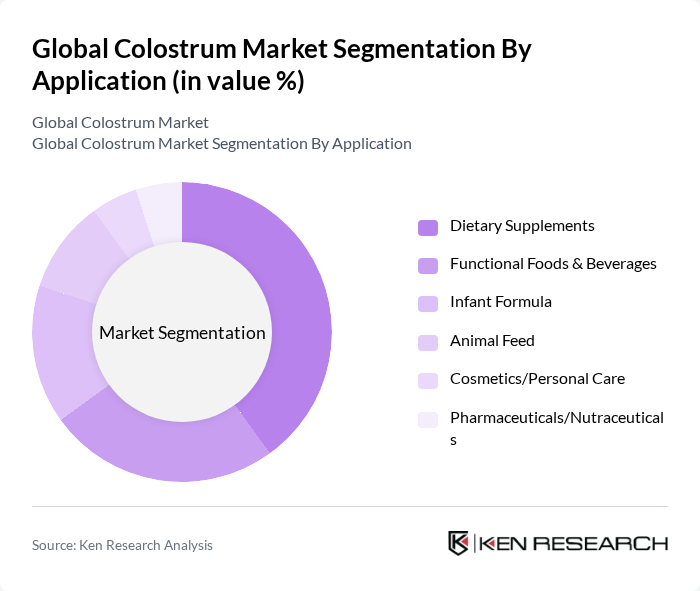

By Application:The applications of colostrum are diverse, including Dietary Supplements, Functional Foods & Beverages, Infant Formula, Animal Feed, Cosmetics/Personal Care, and Pharmaceuticals/Nutraceuticals. Dietary supplements are the leading application segment, driven by increasing health consciousness among consumers. Functional foods are also gaining popularity as consumers seek products that offer health benefits beyond basic nutrition. Infant formula and animal feed applications are significant due to the nutritional advantages of colostrum.

The Global Colostrum Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pantheryx, Inc. (includes APS BioGroup and La Belle), Sterling Technology, Colostrum BioTec GmbH, Ingredia Nutritional (Ingredia S.A.), NIG Nutritionals Limited (Good Health New Zealand), Immuno-Dynamics, Inc., Biostrum Nutritech Pvt. Ltd., McePharma a.s., Biodane Pharma A/S, BioCare Copenhagen A/S, Agati Healthcare Pvt. Ltd., Australian by Nature Pty Ltd, Zuche Pharmaceuticals, Good Health Products Ltd (Swisse Wellness removed), Cure Nutraceuticals Pvt. Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the colostrum market appears promising, driven by increasing health consciousness and a growing preference for natural products. Innovations in product formulations, such as the development of organic and clean-label colostrum products, are expected to attract a broader consumer base. Additionally, the expansion of e-commerce platforms will facilitate easier access to colostrum products, enhancing market reach and consumer engagement, particularly in regions like None where online shopping is gaining traction.

| Segment | Sub-Segments |

|---|---|

| By Type | Bovine Colostrum Goat Colostrum Ovine Colostrum Others (e.g., camel) |

| By Application | Dietary Supplements Functional Foods & Beverages Infant Formula Animal Feed Cosmetics/Personal Care Pharmaceuticals/Nutraceuticals |

| By End-User | B2B (Ingredient buyers: infant formula, nutraceutical, cosmetics, feed manufacturers) B2C (Retail consumers) Institutional/Clinical Others |

| By Distribution Channel | Online Retail (DTC/e-commerce, marketplaces) Supermarkets/Hypermarkets Health Food & Specialty Stores Pharmacies/Drug Stores Others |

| By Formulation | Whole Colostrum Powder Skim Colostrum Powder Specialty Fractions (e.g., IgG-rich, PRP concentrates) Capsules/Tablets Liquid/Ready-to-Drink Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Premium Mid-Range Budget Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Colostrum Product Manufacturers | 90 | Production Managers, Quality Assurance Officers |

| Health and Nutrition Experts | 80 | Dietitians, Nutrition Researchers |

| Retailers of Nutritional Supplements | 70 | Store Managers, Product Buyers |

| Consumers of Colostrum Products | 140 | Health-Conscious Individuals, Parents of Infants |

| Veterinary Professionals | 60 | Veterinarians, Animal Nutritionists |

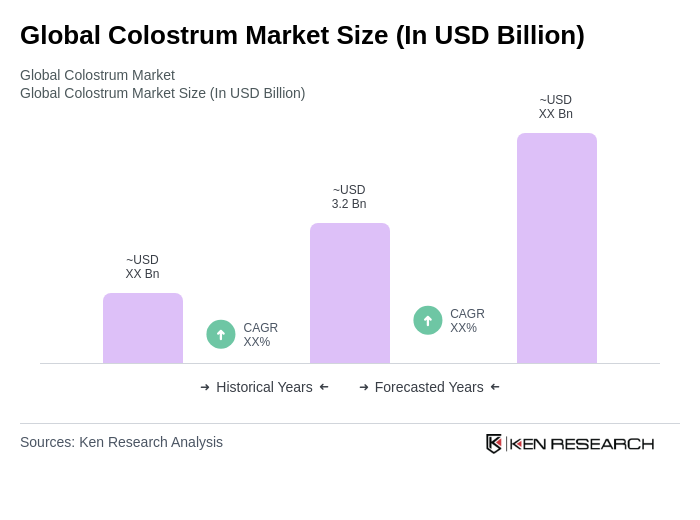

The Global Colostrum Market is valued at approximately USD 3.2 billion, reflecting a significant growth trend driven by increasing consumer awareness of its health benefits, particularly its immune-boosting properties and nutritional value.