Region:Global

Author(s):Rebecca

Product Code:KRAA1455

Pages:89

Published On:August 2025

By Type:The market is segmented into B2B Commerce Cloud, B2C Commerce Cloud, C2C Commerce Cloud, Social Commerce Cloud, Mobile Commerce Cloud, Subscription Commerce Cloud, Headless Commerce Cloud, Unified Commerce Cloud, and Others. B2B Commerce Cloud and B2C Commerce Cloud are the most prominent segments, driven by the need for businesses to streamline operations, leverage AI-driven personalization, and enhance customer engagement through integrated digital channels. The rise of headless commerce and subscription-based models is also notable, as businesses seek flexibility and recurring revenue streams .

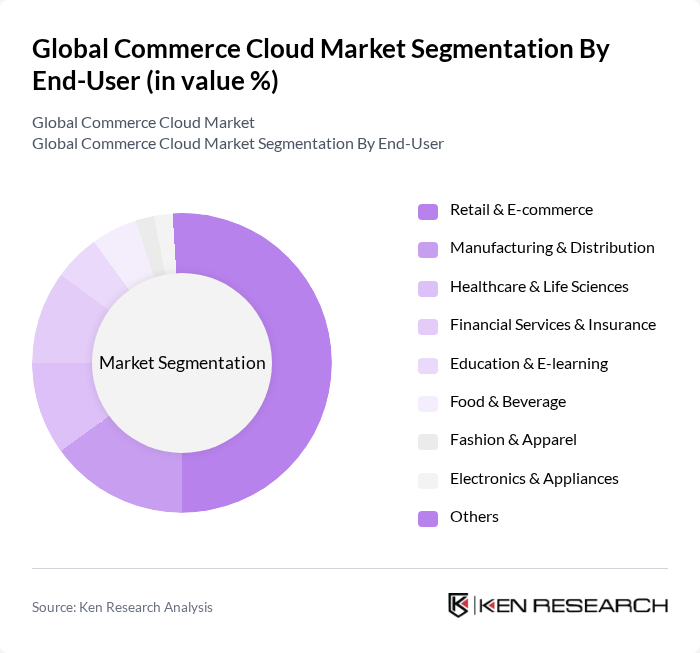

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing & Distribution, Healthcare & Life Sciences, Financial Services & Insurance, Education & E-learning, Food & Beverage, Fashion & Apparel, Electronics & Appliances, and Others. The Retail & E-commerce segment leads, driven by the rapid growth of online shopping, the need for integrated omnichannel solutions, and the adoption of advanced analytics for personalized customer experiences. Manufacturing & Distribution and Financial Services are also significant, leveraging commerce cloud for supply chain optimization and digital customer engagement .

The Global Commerce Cloud Market is characterized by a dynamic mix of regional and international players. Leading participants such as Salesforce.com, Inc., Adobe Inc. (Magento), Shopify Inc., Oracle Corporation, SAP SE, IBM Corporation, Microsoft Corporation, BigCommerce Holdings, Inc., WooCommerce (Automattic Inc.), Wix.com Ltd., Squarespace, Inc., PrestaShop SA, Volusion, LLC, 3dcart (now Shift4Shop), Alibaba Cloud (Alibaba Group), VTEX, commercetools GmbH, Elastic Path Software Inc., Sitecore, Episerver (Optimizely) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the commerce cloud market appears promising, driven by technological advancements and evolving consumer preferences. As businesses increasingly prioritize digital transformation, the integration of artificial intelligence and machine learning will enhance operational efficiencies and customer engagement. Furthermore, the shift towards subscription-based models will provide companies with predictable revenue streams, fostering innovation. The emphasis on sustainability will also shape market dynamics, as consumers demand eco-friendly practices from their preferred brands, influencing commerce cloud solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | B2B Commerce Cloud B2C Commerce Cloud C2C Commerce Cloud Social Commerce Cloud Mobile Commerce Cloud Subscription Commerce Cloud Headless Commerce Cloud Unified Commerce Cloud Others |

| By End-User | Retail & E-commerce Manufacturing & Distribution Healthcare & Life Sciences Financial Services & Insurance Education & E-learning Food & Beverage Fashion & Apparel Electronics & Appliances Others |

| By Sales Channel | Direct Sales Online Marketplaces Value-Added Resellers (VARs) System Integrators Affiliates Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Community Cloud Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises |

| By Pricing Model | Pay-as-you-go Subscription-based Freemium Tiered Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Cloud Solutions | 120 | IT Managers, E-commerce Directors |

| Manufacturing Cloud Integration | 90 | Operations Managers, IT Directors |

| Logistics Cloud Services | 60 | Supply Chain Managers, Logistics Coordinators |

| Financial Services Cloud Adoption | 50 | Chief Technology Officers, Compliance Officers |

| Healthcare Cloud Solutions | 45 | Healthcare IT Specialists, Administrators |

The Global Commerce Cloud Market is valued at approximately USD 36 billion, reflecting a significant growth trajectory driven by the increasing adoption of artificial intelligence, e-commerce expansion, and the demand for seamless customer experiences across various channels.