Region:Global

Author(s):Geetanshi

Product Code:KRAA0120

Pages:80

Published On:August 2025

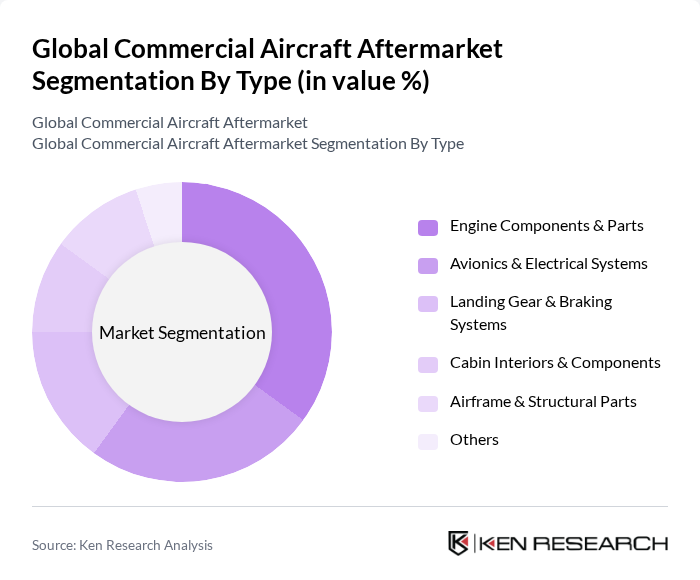

By Type:The aftermarket can be segmented into various types, including Engine Components & Parts, Avionics & Electrical Systems, Landing Gear & Braking Systems, Cabin Interiors & Components, Airframe & Structural Parts, and Others. Among these, Engine Components & Parts dominate the market due to the critical role engines play in aircraft performance and safety. The increasing focus on fuel efficiency, sustainability, and engine reliability drives demand for high-quality engine parts and advanced maintenance services .

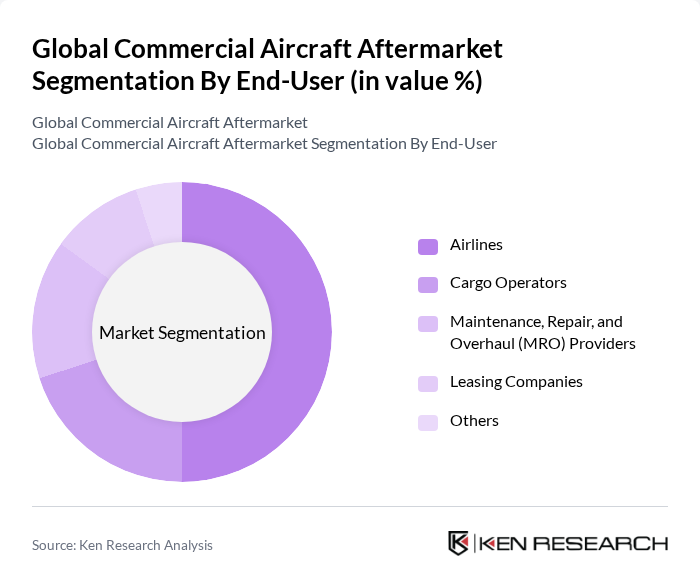

By End-User:The end-user segmentation includes Airlines, Cargo Operators, Maintenance, Repair, and Overhaul (MRO) Providers, Leasing Companies, and Others. Airlines are the leading end-users, driven by the need for regular maintenance and parts replacement to ensure operational efficiency and safety. The increasing number of air travel passengers and the expansion of airline fleets further contribute to the growth of this segment. MRO providers are also seeing strong demand as airlines increasingly outsource maintenance to specialized service partners .

The Global Commercial Aircraft Aftermarket market is characterized by a dynamic mix of regional and international players. Leading participants such as The Boeing Company, Airbus S.A.S., General Electric Company, Honeywell International Inc., Rolls-Royce Holdings plc, Safran S.A., Pratt & Whitney (Raytheon Technologies), Collins Aerospace (RTX Corporation), Thales Group, MTU Aero Engines AG, Liebherr Aerospace, AAR Corp, Satair (an Airbus Services Company), Lufthansa Technik AG, Delta TechOps, Air France Industries KLM Engineering & Maintenance, Moog Inc., VSE Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the commercial aircraft aftermarket is poised for significant transformation, driven by technological advancements and evolving market dynamics. As airlines increasingly adopt digital solutions for maintenance and operations, the demand for innovative aftermarket services will rise. Additionally, sustainability initiatives will shape the industry, pushing for eco-friendly practices and materials. The focus on enhancing operational efficiency and reducing environmental impact will create new avenues for growth, particularly in emerging markets where air travel is expanding rapidly.

| Segment | Sub-Segments |

|---|---|

| By Type | Engine Components & Parts Avionics & Electrical Systems Landing Gear & Braking Systems Cabin Interiors & Components Airframe & Structural Parts Others |

| By End-User | Airlines Cargo Operators Maintenance, Repair, and Overhaul (MRO) Providers Leasing Companies Others |

| By Aircraft Type | Narrow-Body Aircraft Wide-Body Aircraft Regional Jets Freighter Aircraft Others |

| By Service Type | Component Repair & Replacement Engine Overhaul & Maintenance Airframe Maintenance Line Maintenance Modifications & Upgrades Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Distribution Channel | OEMs (Original Equipment Manufacturers) Distributors Online Platforms Others |

| By Maintenance Strategy | Predictive Maintenance Preventive Maintenance Corrective Maintenance Condition-Based Maintenance Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Aircraft MRO Services | 100 | MRO Managers, Technical Directors |

| Aircraft Parts Distribution | 60 | Supply Chain Managers, Parts Procurement Officers |

| Fleet Management Solutions | 50 | Fleet Managers, Operations Analysts |

| Regulatory Compliance in Aftermarket | 40 | Compliance Officers, Quality Assurance Managers |

| Emerging Technologies in Aviation | 45 | Innovation Managers, R&D Engineers |

The Global Commercial Aircraft Aftermarket is valued at approximately USD 48 billion, driven by increasing air travel demand and the need for regular maintenance and parts replacement for aircraft. This market is expected to grow further as fleet sizes expand.