Region:Global

Author(s):Shubham

Product Code:KRAC0776

Pages:82

Published On:August 2025

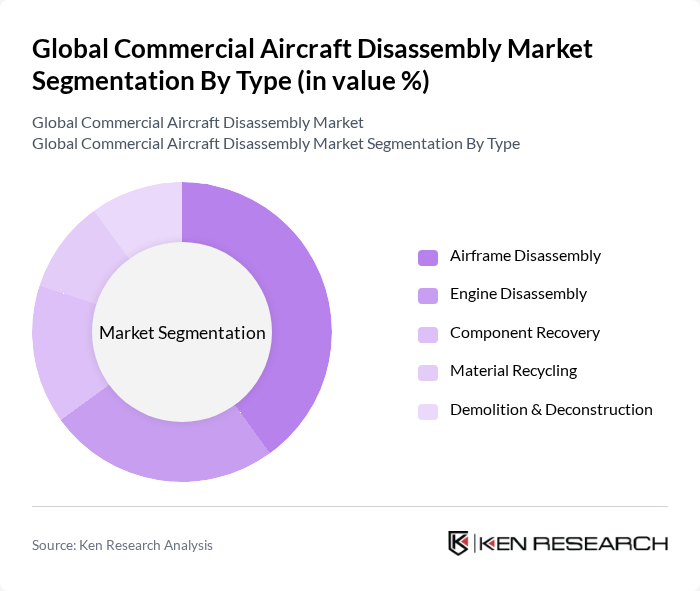

By Type:The market is segmented into various types of disassembly processes, including Airframe Disassembly, Engine Disassembly, Component Recovery, Material Recycling, and Demolition & Deconstruction. Among these,Airframe Disassemblyis currently the leading sub-segment due to the high volume of airframes being retired and the significant value of recovered materials.Engine Disassemblyfollows closely, driven by the high demand for engine parts in the aftermarket. The focus on sustainability and recycling is also pushing theMaterial Recyclingsegment to gain traction, with increasing adoption of advanced sorting and processing technologies to maximize resource recovery and reduce landfill waste .

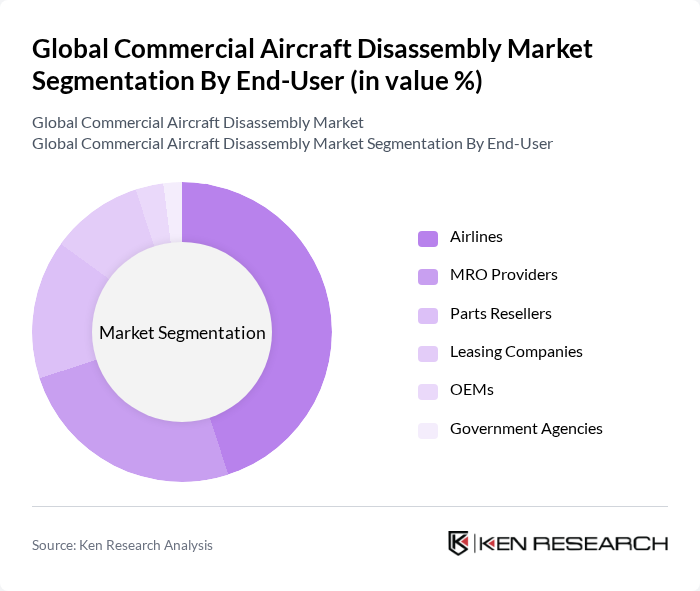

By End-User:The end-user segmentation includes Airlines, MRO (Maintenance, Repair, and Overhaul) Providers, Parts Resellers, Leasing Companies, OEMs (Original Equipment Manufacturers), and Government Agencies.Airlinesare the dominant end-user segment, as they are the primary source of retired aircraft.MRO providersalso play a significant role, as they require disassembly services for maintenance and parts recovery. The increasing trend of leasing aircraft further supports the growth ofParts ResellersandLeasing Companies. OEMs and government agencies participate primarily in regulatory compliance and strategic asset management .

The Global Commercial Aircraft Disassembly Market is characterized by a dynamic mix of regional and international players. Leading participants such as AAR Corp., Air Salvage International Limited, AerSale, Inc., TARMAC Aerosave, Lufthansa Technik AG, Precision Aircraft Solutions, China Aircraft Leasing Group Holdings Ltd., Satair (an Airbus Services Company), GA Telesis, LLC, The Boeing Company, Aircraft Recycling International Limited, Universal Asset Management, Inc., VAS Aero Services, Broward Aviation Services (BAS), eCube Solutions Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the commercial aircraft disassembly market appears promising, driven by increasing environmental awareness and technological advancements. As airlines prioritize sustainability, the demand for disassembly services is expected to rise, particularly in regions with stringent regulations. Additionally, the integration of digital technologies in disassembly operations will enhance efficiency and reduce costs. Companies that adapt to these trends will likely capture significant market share, positioning themselves as leaders in sustainable aviation practices and innovative recycling solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Airframe Disassembly Engine Disassembly Component Recovery Material Recycling Demolition & Deconstruction |

| By End-User | Airlines MRO (Maintenance, Repair, and Overhaul) Providers Parts Resellers Leasing Companies OEMs (Original Equipment Manufacturers) Government Agencies |

| By Component | Avionics Engines Fuselage Landing Gear Cabin Interiors Composite Materials Aluminum & Metal Alloys |

| By Service Type | Full Aircraft Disassembly Partial Disassembly Component Repair and Refurbishment Automated Disassembly Manual Disassembly |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Sales Channel | Direct Sales Online Sales Distributors |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing |

| By Aircraft Type | Narrow Body Aircraft Wide Body Aircraft Regional Jets Freighters |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Aircraft Disassembly Operations | 100 | Operations Managers, Facility Supervisors |

| Aircraft Parts Salvage and Resale | 80 | Procurement Managers, Sales Directors |

| Regulatory Compliance in Disassembly | 60 | Compliance Officers, Environmental Managers |

| Technological Innovations in Disassembly | 50 | R&D Managers, Technology Managers |

| Market Trends and Future Outlook | 70 | Market Analysts, Strategic Planners |

The Global Commercial Aircraft Disassembly Market is valued at approximately USD 6.5 billion, driven by factors such as increasing aircraft retirements, demand for spare parts, and a focus on sustainable aviation practices.