Region:Global

Author(s):Dev

Product Code:KRAA1507

Pages:89

Published On:August 2025

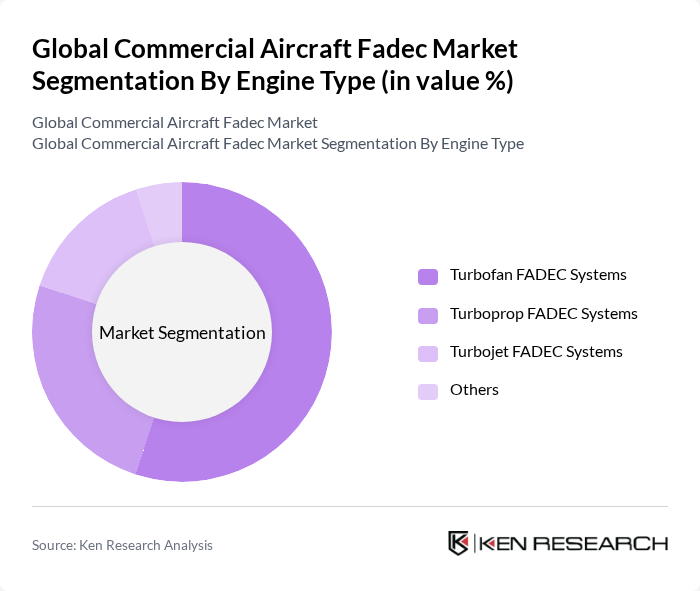

By Engine Type:The engine type segmentation includes various FADEC systems that cater to different aircraft engines. The primary subsegments are Turbofan FADEC Systems, Turboprop FADEC Systems, Turbojet FADEC Systems, and Others. Among these, Turbofan FADEC Systems dominate the market due to their widespread use in commercial aviation, offering enhanced fuel efficiency and performance. The increasing number of commercial aircraft deliveries and the trend towards more fuel-efficient engines further solidify the position of turbofan systems in the market.

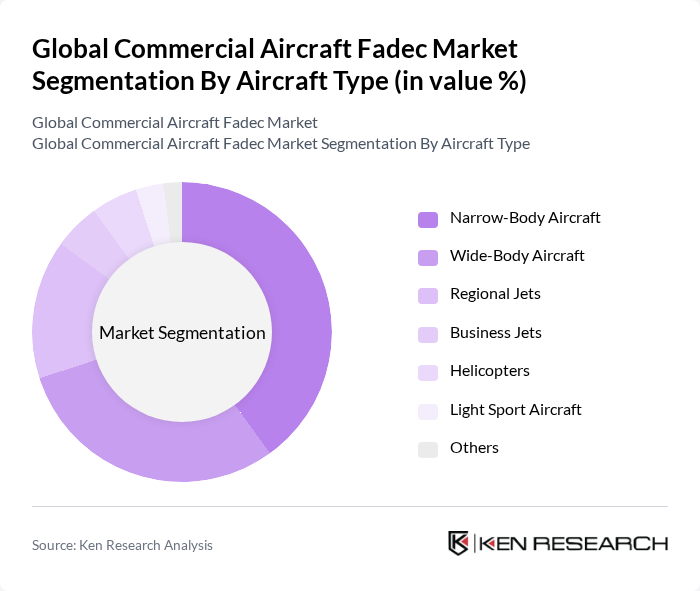

By Aircraft Type:The aircraft type segmentation encompasses various categories, including Narrow-Body Aircraft, Wide-Body Aircraft, Regional Jets, Business Jets, Helicopters, Light Sport Aircraft, and Others. Narrow-Body Aircraft are the leading segment, driven by their high demand for short to medium-haul flights. The increasing passenger traffic and the need for cost-effective travel solutions have led airlines to invest in narrow-body aircraft, which in turn boosts the demand for FADEC systems tailored for these aircraft. Wide-body aircraft also represent a significant share due to their use in long-haul operations and international travel, while regional jets and business jets continue to see steady adoption of FADEC systems for improved operational efficiency and compliance with emission standards.

The Global Commercial Aircraft Fadec Market is characterized by a dynamic mix of regional and international players. Leading participants such as Honeywell International Inc., Safran S.A., Thales Group, Rockwell Collins, Inc. (Collins Aerospace), Moog Inc., BAE Systems plc, General Electric Company, Pratt & Whitney (Raytheon Technologies Corporation), Curtiss-Wright Corporation, Parker Hannifin Corporation, Mitsubishi Heavy Industries, Ltd., Liebherr Group, Woodward, Inc., Elbit Systems Ltd., Rolls-Royce Holdings plc, FADEC International contribute to innovation, geographic expansion, and service delivery in this space.

The future of the FADEC market appears promising, driven by ongoing technological advancements and a strong focus on sustainability. As airlines increasingly prioritize fuel efficiency and emissions reduction, the demand for innovative FADEC solutions is expected to rise. Additionally, the integration of artificial intelligence and predictive maintenance technologies will enhance operational efficiency, further solidifying the role of FADEC systems in modern aviation. The market is poised for significant growth as these trends continue to evolve.

| Segment | Sub-Segments |

|---|---|

| By Engine Type | Turbofan FADEC Systems Turboprop FADEC Systems Turbojet FADEC Systems Others |

| By Aircraft Type | Narrow-Body Aircraft Wide-Body Aircraft Regional Jets Business Jets Helicopters Light Sport Aircraft Others |

| By Component | Electronic Control Units Sensors Actuators Software Others |

| By End-User | Commercial Airlines Cargo Operators Charter Services Aircraft Manufacturers MRO Service Providers Others |

| By Geography | North America (United States, Canada) Europe (United Kingdom, Germany, France, Italy, Russia, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, Australia, Rest of Asia-Pacific) Latin America (Brazil, Mexico, Rest of Latin America) Middle East & Africa (United Arab Emirates, Saudi Arabia, Turkey, South Africa, Rest of Middle East & Africa) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Aircraft Operators | 100 | Fleet Managers, Operations Directors |

| Aerospace Component Manufacturers | 60 | Product Development Engineers, Sales Managers |

| Regulatory Bodies and Aviation Authorities | 40 | Policy Makers, Safety Inspectors |

| Maintenance, Repair, and Overhaul (MRO) Providers | 50 | Maintenance Managers, Technical Directors |

| Aviation Technology Consultants | 40 | Consultants, Industry Analysts |

The Global Commercial Aircraft Fadec Market is valued at approximately USD 2.5 billion, driven by the increasing demand for fuel-efficient aircraft and advancements in technology that enhance flight safety and performance.