Region:Global

Author(s):Geetanshi

Product Code:KRAD0141

Pages:87

Published On:August 2025

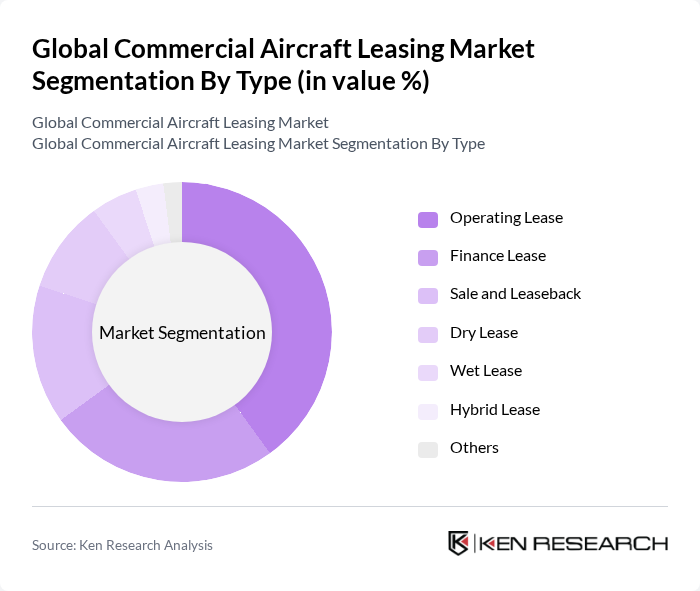

By Type:The market is segmented into various types of leasing arrangements, including Operating Lease, Finance Lease, Sale and Leaseback, Dry Lease, Wet Lease, Hybrid Lease, and Others. Each type serves different financial and operational needs of airlines, influencing their choice based on factors such as cost, flexibility, and duration of use. Operating leases are preferred for their flexibility and reduced financial risk, while finance leases are chosen for longer-term asset control. Sale and leaseback arrangements help airlines unlock capital from owned assets, and wet leases are used for short-term capacity needs or entry into new markets .

The Operating Lease segment dominates the market due to its flexibility and lower financial risk for airlines. This type of lease allows airlines to operate aircraft without the burden of ownership, making it particularly attractive for low-cost carriers and those looking to expand their fleets without significant capital investment. The trend towards operational efficiency and cost management further solidifies the preference for operating leases among airlines .

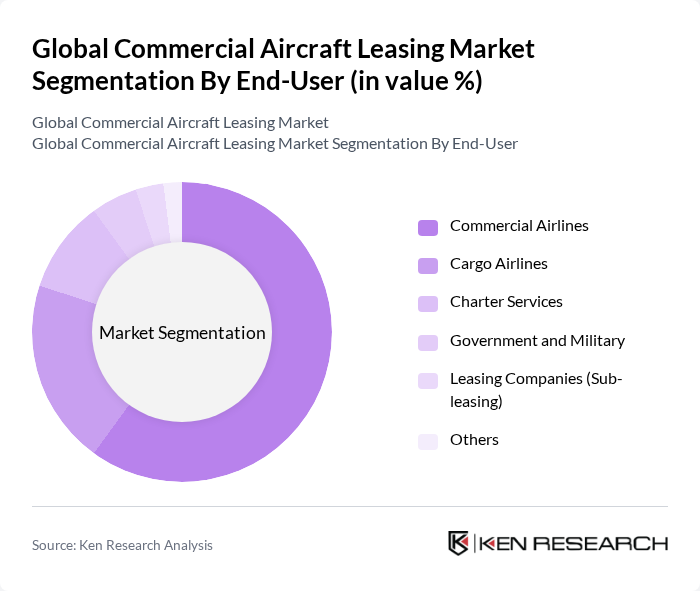

By End-User:The market is segmented by end-users, including Commercial Airlines, Cargo Airlines, Charter Services, Government and Military, Leasing Companies (Sub-leasing), and Others. Each end-user category has distinct requirements and operational models that influence their leasing choices. Commercial airlines prioritize fleet flexibility and cost management, cargo airlines focus on capacity for logistics and e-commerce, charter services require short-term solutions, and government/military users seek specialized aircraft for defense and official purposes .

Commercial Airlines represent the largest end-user segment, driven by the increasing demand for passenger air travel and the need for fleet expansion. The growth of low-cost carriers and the recovery of the aviation sector post-pandemic have further fueled this demand. Cargo Airlines also show significant growth due to the rise in e-commerce and global trade, necessitating more cargo aircraft to meet logistics needs .

The Global Commercial Aircraft Leasing Market is characterized by a dynamic mix of regional and international players. Leading participants such as AerCap Holdings N.V., GECAS (General Electric Capital Aviation Services), Avolon, Air Lease Corporation, SMBC Aviation Capital, BOC Aviation, Nordic Aviation Capital, ICBC Leasing, Aviation Capital Group, DAE Capital, Fly Leasing Limited, CDB Aviation, Castlelake, Wilmington Trust, BBAM Aircraft Leasing & Management, Aircastle Limited, Jackson Square Aviation, Macquarie AirFinance, ALAFCO Aviation Lease and Finance Company, TrueNoord contribute to innovation, geographic expansion, and service delivery in this space .

The future of the commercial aircraft leasing market appears promising, driven by technological advancements and a growing emphasis on sustainability. As airlines increasingly adopt digital leasing platforms, operational efficiencies are expected to improve significantly. Furthermore, the push for greener aircraft will likely lead to innovative leasing models that cater to environmentally conscious operators. The market is poised for transformation as lessors adapt to these trends, ensuring they remain competitive in a rapidly evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Operating Lease Finance Lease Sale and Leaseback Dry Lease Wet Lease Hybrid Lease Others |

| By End-User | Commercial Airlines Cargo Airlines Charter Services Government and Military Leasing Companies (Sub-leasing) Others |

| By Aircraft Type | Narrow-Body Aircraft Wide-Body Aircraft Regional Jets Cargo Aircraft Turboprop Aircraft Others |

| By Lease Duration | Short-Term Lease (<3 years) Medium-Term Lease (3-7 years) Long-Term Lease (>7 years) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Financing Source | Bank Financing Private Equity Public Funding Asset-Backed Securities Others |

| By Customer Type | Large Airlines Regional Airlines Charter Operators Cargo Operators Aircraft Leasing Companies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Aircraft Leasing | 150 | Leasing Executives, Financial Analysts |

| Regional Aircraft Leasing | 90 | Regional Airline Managers, Fleet Planners |

| Business Jet Leasing | 60 | Corporate Aviation Managers, Charter Service Operators |

| Leasing Market Trends | 100 | Aviation Consultants, Market Researchers |

| Aircraft Financing Solutions | 70 | Banking Executives, Investment Analysts |

The Global Commercial Aircraft Leasing Market is valued at approximately USD 183 billion, reflecting a significant demand for air travel and the operational flexibility that leasing provides to airlines, allowing them to expand their fleets without substantial capital investment.