Region:Global

Author(s):Dev

Product Code:KRAA1680

Pages:85

Published On:August 2025

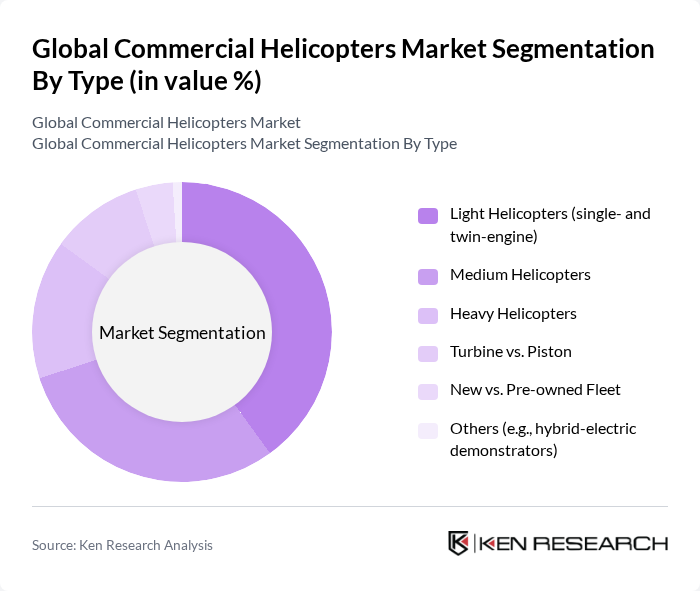

By Type:The market is segmented into various types of helicopters, including light, medium, and heavy helicopters, as well as turbine versus piston engines, new versus pre-owned fleets, and others such as hybrid-electric demonstrators. Among these, light helicopters are gaining traction due to their versatility and lower operational costs, making them popular for various applications including tourism and emergency services.

By End-User:The end-user segmentation includes emergency medical services (HEMS), oil & gas and offshore energy, tourism, charter & VIP/corporate transport, law enforcement & public safety, search & rescue (SAR) and firefighting, utility, aerial work & cargo, and others. The emergency medical services segment is particularly prominent due to the increasing demand for rapid medical response in urban and rural areas.

The Global Commercial Helicopters Market is characterized by a dynamic mix of regional and international players. Leading participants such as Airbus Helicopters, Bell Textron Inc., Leonardo S.p.A., Sikorsky Aircraft (Lockheed Martin), The Boeing Company (Boeing Global Services – civil support), MD Helicopters, LLC, Robinson Helicopter Company, Enstrom Helicopter Corporation, Kaman Corporation, Russian Helicopters (Rostec), Hindustan Aeronautics Limited (HAL), Kawasaki Heavy Industries, Ltd., Korea Aerospace Industries (KAI), Aviation Industry Corporation of China (AVIC) / Avicopter contribute to innovation, geographic expansion, and service delivery in this space.

The future of the commercial helicopter market appears promising, driven by technological advancements and increasing demand for urban air mobility solutions. As cities expand, the integration of helicopters into urban transport systems is expected to gain traction, with investments in infrastructure supporting this trend. Additionally, the development of electric and hybrid helicopters is anticipated to address environmental concerns, making operations more sustainable and appealing to a broader range of customers in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Light Helicopters (single- and twin-engine) Medium Helicopters Heavy Helicopters Turbine vs. Piston New vs. Pre-owned Fleet Others (e.g., hybrid-electric demonstrators) |

| By End-User | Emergency Medical Services (HEMS) Oil & Gas and Offshore Energy Tourism, Charter & VIP/Corporate Transport Law Enforcement & Public Safety Search & Rescue (SAR) and Firefighting Utility, Aerial Work & Cargo Others (news gathering, training) |

| By Application | Passenger Transport (scheduled/charter) Offshore Crew Change & Logistics Emergency Medical Services (EMS/HEMS) Search & Rescue (SAR) Law Enforcement & Border Patrol Firefighting & Disaster Response Aerial Work (utility, powerline/pipe patrol, lifting) Others |

| By Sales Channel | OEM Direct Sales Authorized Dealers/Distributors Pre-owned/Brokerage Leasing & Operating Lease Others |

| By Distribution Mode | Domestic Deliveries International Exports Charter and ACMI Operators Others |

| By Price Range | Entry (piston/light turbine) Mid-Range (light/medium turbine) Premium (super-medium/heavy) Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Helicopter Operators | 120 | Fleet Managers, Operations Directors |

| Helicopter Maintenance Providers | 90 | Maintenance Managers, Maintenance Engineers |

| Aerospace Regulatory Authorities | 50 | Regulatory Officers, Compliance Managers |

| Helicopter Manufacturers | 80 | Product Development Managers, Sales Executives |

| End-User Industries (e.g., Oil & Gas, Emergency Services) | 70 | Procurement Officers, Operations Managers |

The Global Commercial Helicopters Market is valued at approximately USD 7 billion, reflecting a five-year historical analysis. This valuation is driven by increasing demand for air transportation, advancements in technology, and the need for emergency medical services.