Region:Global

Author(s):Dev

Product Code:KRAB0427

Pages:81

Published On:August 2025

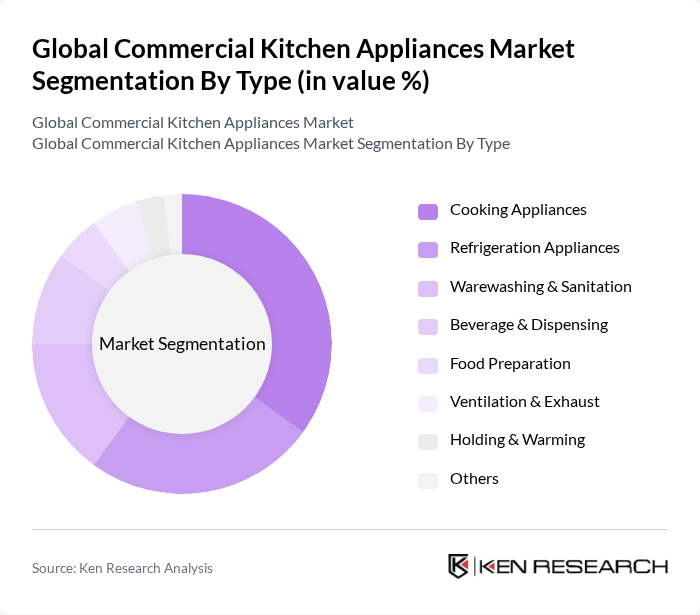

By Type:The market is segmented into various types of appliances, including cooking appliances, refrigeration appliances, warewashing and sanitation, beverage and dispensing, food preparation, ventilation and exhaust, holding and warming, and others. Each sub-segment plays a crucial role in the overall market dynamics, catering to different needs within commercial kitchens.

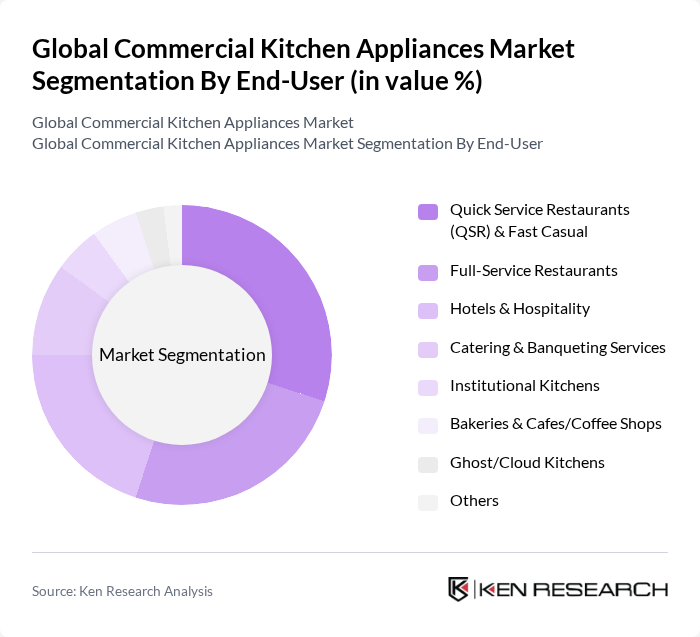

By End-User:The market is segmented based on end-users, including quick service restaurants (QSR) and fast casual, full-service restaurants, hotels and hospitality, catering and banqueting services, institutional kitchens, bakeries and cafes, ghost/cloud kitchens, and others. Each segment has unique requirements and preferences that drive the demand for specific kitchen appliances.

The Global Commercial Kitchen Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Electrolux Professional AB, Hobart (ITW Food Equipment Group), RATIONAL AG, The Middleby Corporation, Welbilt, Inc. (an Ali Group Company), Ali Group S.r.l., Manitowoc Ice (a Welbilt brand), Vulcan (ITW Food Equipment Group), Blodgett (The Middleby Corporation), Scotsman Ice Systems (ALI Group), True Manufacturing Co., Inc., Hoshizaki Corporation, Meiko Maschinenbau GmbH & Co. KG, Winterhalter Gastronom GmbH, Bunn-O-Matic Corporation (BUNN), Franke Coffee Systems (Franke Group), Epta S.p.A. (Commercial Refrigeration), and Turbo Air Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the commercial kitchen appliances market appears promising, driven by technological advancements and a growing emphasis on sustainability. As operators increasingly adopt smart technologies and energy-efficient solutions, the market is likely to witness significant innovation. Additionally, the expansion of the foodservice industry, particularly in emerging markets, will create new opportunities for manufacturers. Companies that prioritize eco-friendly practices and smart integrations will be well-positioned to thrive in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Cooking Appliances (ovens/combi-ovens, ranges, fryers, grills/griddles, steamers, microwaves, cooktops) Refrigeration Appliances (reach-in/freezers, walk-in coolers & freezers, undercounter & prep tables, blast chillers) Warewashing & Sanitation (dishwashers, glasswashers, pot & pan washers, sanitizers) Beverage & Dispensing (ice machines, coffee/espresso machines, beverage dispensers, water filtration) Food Preparation (mixers, slicers, processors, blenders, peelers) Ventilation & Exhaust (hoods, fans, make-up air, demand-controlled ventilation) Holding & Warming (warming cabinets, heat lamps, merchandisers, proofers) Others (point-of-use induction, specialty appliances) |

| By End-User | Quick Service Restaurants (QSR) & Fast Casual Full-Service Restaurants Hotels & Hospitality Catering & Banqueting Services Institutional Kitchens (schools, healthcare, corporate, correctional) Bakeries & Cafes/Coffee Shops Ghost/Cloud Kitchens Others |

| By Distribution Channel | Direct Sales (manufacturers’ sales teams) Dealer/Distributor Networks Online/Direct-to-Operator (e-commerce, manufacturer portals) Wholesale & Foodservice Broadliners Others |

| By Price Range | Entry-Level/Value Mid-Range Premium |

| By Brand Positioning | Premium/Professional Brands Mid-Tier Brands Value/Budget Brands |

| By Application | Cooking & Baking Cold Storage & Prep Food Preparation & Processing Cleaning, Warewashing & Sanitation Beverage Production & Ice |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Kitchen Equipment Users | 120 | Head Chefs, Kitchen Managers |

| Appliance Manufacturers | 90 | Product Development Managers, Sales Directors |

| Food Service Industry Consultants | 60 | Industry Analysts, Business Consultants |

| Distributors and Retailers | 70 | Supply Chain Managers, Sales Representatives |

| Regulatory Bodies and Standards Organizations | 40 | Compliance Officers, Regulatory Affairs Managers |

The Global Commercial Kitchen Appliances Market is valued at approximately USD 100 billion, driven by the increasing demand for energy-efficient appliances, the growth of the foodservice industry, and advancements in technology that enhance kitchen appliance functionality.