Region:Global

Author(s):Shubham

Product Code:KRAD0604

Pages:89

Published On:August 2025

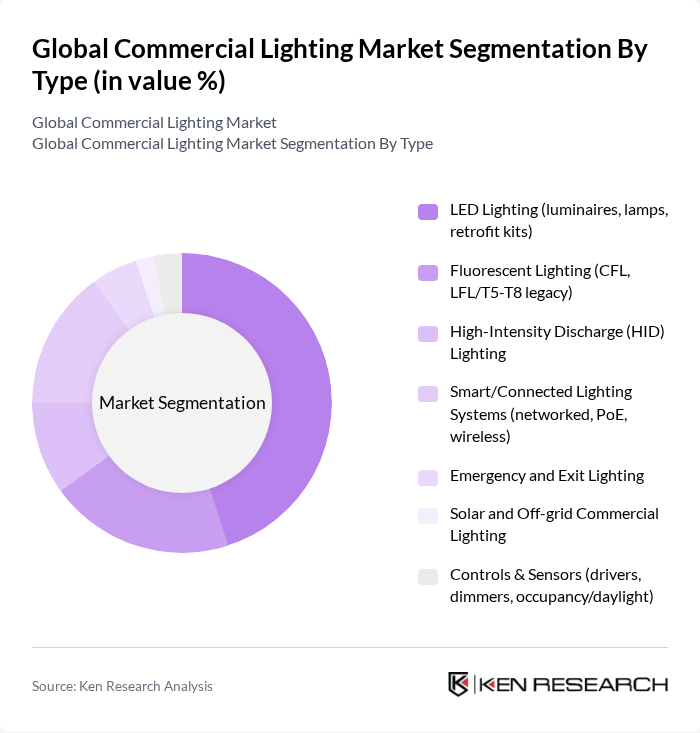

By Type:The market can be segmented into various types of lighting technologies, each catering to different commercial needs.

By End-User:The market is also segmented based on the end-users, which include various sectors that utilize commercial lighting solutions.

The Global Commercial Lighting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Signify N.V. (formerly Philips Lighting), ams-OSRAM AG, Cree LED (SMART Global Holdings), Cooper Lighting Solutions (Signify), GE Current, a Daintree company (Current Lighting Solutions, LLC), Acuity Brands, Inc., Hubbell Lighting, Zumtobel Group AG, Panasonic Corporation, Legrand SA, Lutron Electronics Co., Inc., Schneider Electric SE, Nichia Corporation, Seoul Semiconductor Co., Ltd., Dialight plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the commercial lighting market appears promising, driven by the increasing integration of smart technologies and a heightened focus on sustainability. As businesses prioritize energy efficiency, the adoption of LED and smart lighting solutions is expected to accelerate, particularly in emerging markets. Additionally, the ongoing development of innovative lighting products will cater to diverse consumer needs, enhancing aesthetic appeal and functionality. This evolution will likely reshape the market landscape, fostering growth and investment opportunities in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | LED Lighting (luminaires, lamps, retrofit kits) Fluorescent Lighting (CFL, LFL/T5-T8 legacy) High-Intensity Discharge (HID) Lighting Smart/Connected Lighting Systems (networked, PoE, wireless) Emergency and Exit Lighting Solar and Off-grid Commercial Lighting Controls & Sensors (drivers, dimmers, occupancy/daylight) |

| By End-User | Retail & Shopping Centers Offices & Commercial Real Estate Hospitality (Hotels, Restaurants, Entertainment) Healthcare Facilities Education (K-12, Universities) Industrial & Warehousing Government & Public Infrastructure |

| By Application | Indoor General Lighting (ambient, task) Outdoor Area & Site Lighting (parking, façades) Architectural & Decorative Lighting Street & Roadway Lighting Emergency, Exit & Safety Lighting High-Bay & Low-Bay Lighting Controls & Building Integration (BMS, IoT) |

| By Distribution Channel | Direct to Enterprise/Projects (specification sales) Electrical Distributors Online B2B Marketplaces Wholesalers Retail/Trade Counters ESCOs & Energy-as-a-Service |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Rest of World |

| By Price Range | Value (economy) Mid-range Premium Performance/Industrial-grade Service-based (subscription/EaaS) |

| By Policy Support | Subsidies & Rebates (utility, government) Tax Credits & Accelerated Depreciation Grants & Green Financing Regulatory Standards (efficacy, bans, safety) Building Codes & Smart City Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Office Lighting | 120 | Facility Managers, Office Space Planners |

| Retail Lighting Solutions | 90 | Store Managers, Visual Merchandisers |

| Industrial Lighting Applications | 80 | Plant Managers, Safety Officers |

| Outdoor and Street Lighting | 70 | City Planners, Public Works Directors |

| Smart Lighting Technologies | 85 | IT Managers, Smart City Coordinators |

The Global Commercial Lighting Market is valued at approximately USD 19 billion, reflecting the market for commercial lighting solutions, including luminaires, lamps, and controls, based on a five-year historical analysis.