Global Commercial Security Robot Market Overview

- The Global Commercial Security Robot Market is valued at USD 22 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for automation in security operations, advancements in robotics technology, and the rising need for enhanced safety measures across various sectors. The integration of artificial intelligence, machine learning, and connectivity with IoT devices has further propelled market expansion, making security robots more efficient, autonomous, and reliable. Key trends include the adoption of robotics in hazardous environments, smart infrastructure security, and the deployment of robots for real-time monitoring and rapid response applications .

- Key players in this market are concentrated in regions such as North America, Europe, and Asia-Pacific. The United States leads due to its technological advancements, significant investments in security infrastructure, and high adoption rates of security robots in commercial sectors. Germany and the United Kingdom also play significant roles, driven by stringent security regulations and a growing emphasis on public safety. In Asia-Pacific, nations like Japan and China are rapidly adopting these technologies, fueled by urbanization, government initiatives, and increasing security concerns .

- The European Union’s regulatory framework for robotics and artificial intelligence, including the “Artificial Intelligence Act” (Regulation (EU) 2024/1689 of the European Parliament and of the Council), establishes binding requirements for the deployment of AI-powered security robots in public spaces. This regulation, issued by the European Parliament and Council in 2024, mandates risk assessment, transparency, and compliance with safety standards for businesses integrating robotic solutions for monitoring and emergency response across member states .

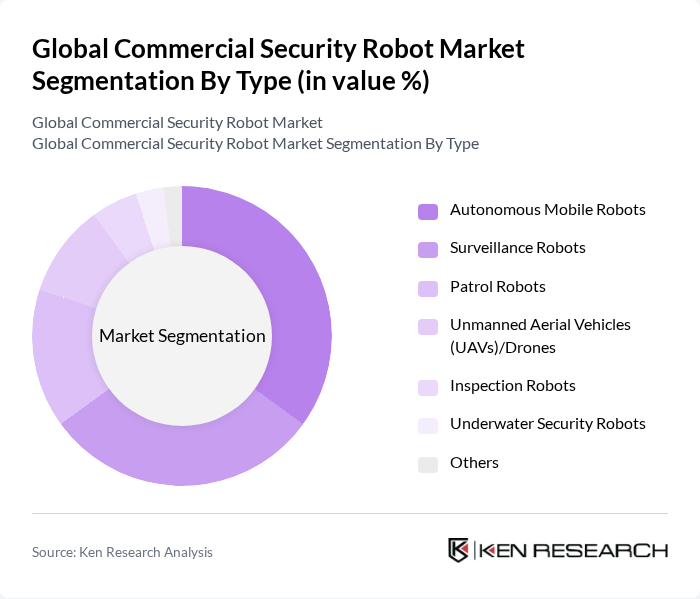

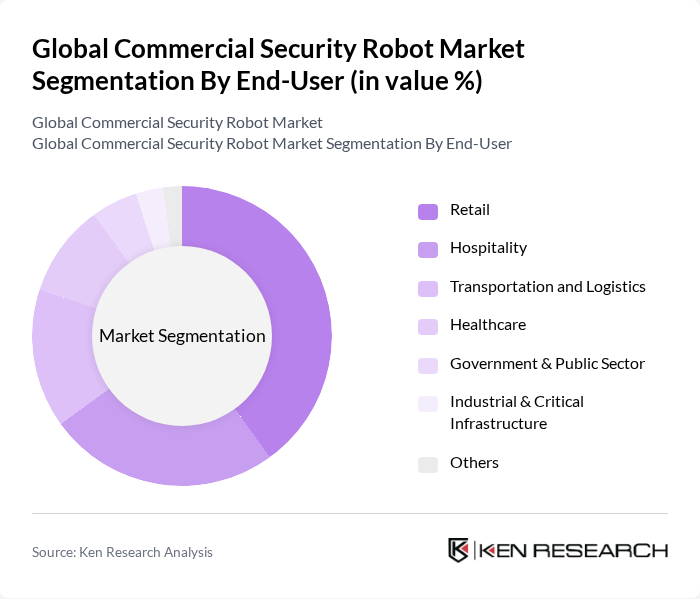

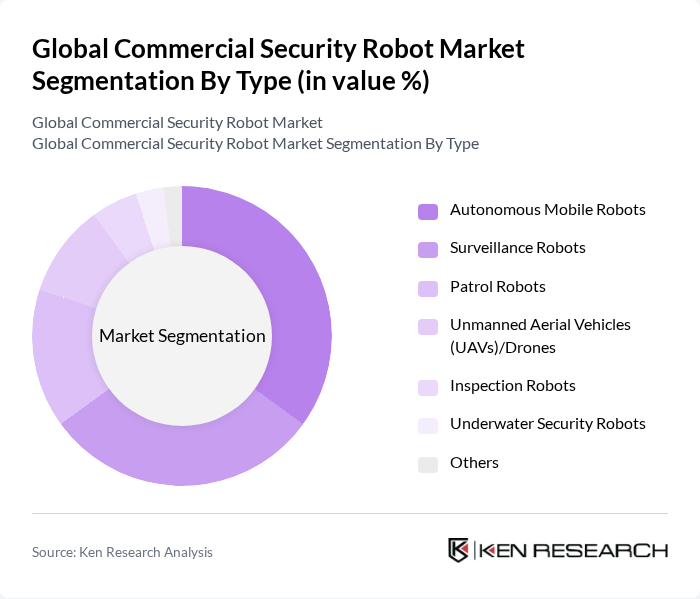

Global Commercial Security Robot Market Segmentation

By Type:The market is segmented into various types of security robots, including Autonomous Mobile Robots, Surveillance Robots, Patrol Robots, Unmanned Aerial Vehicles (UAVs)/Drones, Inspection Robots, Underwater Security Robots, and Others. Among these, Autonomous Mobile Robots and Surveillance Robots are leading the market due to their versatility, adaptability, and effectiveness in diverse commercial applications. The demand for these robots is driven by the need for real-time monitoring, efficient patrolling, and integration with advanced analytics in commercial spaces .

By End-User:The end-user segmentation includes Retail, Hospitality, Transportation and Logistics, Healthcare, Government & Public Sector, Industrial & Critical Infrastructure, and Others. The Retail and Hospitality sectors are the most significant contributors to market growth, as businesses increasingly adopt security robots to enhance customer experience, ensure safety, and automate routine surveillance and service tasks. The demand in these sectors is driven by the need for efficient, scalable, and intelligent security solutions .

Global Commercial Security Robot Market Competitive Landscape

The Global Commercial Security Robot Market is characterized by a dynamic mix of regional and international players. Leading participants such as Knightscope, Inc., Savioke, Inc., Boston Dynamics, Inc., DJI Technology Co., Ltd., Avidbots Corp., Cobalt Robotics, Inc., Robotic Assistance Devices, Inc., SMP Robotics Systems Corp., Aethon, Inc., G4S plc, Elbit Systems Ltd., L3Harris Technologies, Inc., PAL Robotics, S.L., QinetiQ Group plc, Northrop Grumman Corporation contribute to innovation, geographic expansion, and service delivery in this space.

Global Commercial Security Robot Market Industry Analysis

Growth Drivers

- Increasing Demand for Automation:The global push for automation in security operations is driven by the need for efficiency and cost reduction. In future, the global security services market is projected to reach $350 billion, with automation playing a crucial role in this growth. Companies are increasingly adopting security robots to enhance surveillance and response times, leading to a projected increase in robot deployments by 20% annually in commercial sectors, particularly in retail and logistics.

- Rising Safety Concerns:Heightened concerns over safety and security in commercial spaces are propelling the adoption of security robots. In future, the global crime rate is expected to rise by 5%, prompting businesses to invest in advanced security solutions. The demand for security robots is particularly strong in urban areas, where incidents of theft and vandalism are prevalent, leading to an estimated increase in security robot installations by 15% in metropolitan regions.

- Technological Advancements:Rapid advancements in robotics and artificial intelligence are significantly enhancing the capabilities of security robots. In future, the global AI market is projected to reach $500 billion, with a substantial portion allocated to security applications. Innovations such as real-time data processing and improved navigation systems are making security robots more effective, leading to a 30% increase in their operational efficiency compared to traditional security methods.

Market Challenges

- High Initial Investment Costs:One of the primary challenges facing the adoption of security robots is the high initial investment required. In future, the average cost of deploying a security robot is estimated to be around $100,000, which can deter small and medium-sized enterprises from investing. This upfront cost, coupled with ongoing maintenance expenses, poses a significant barrier to widespread adoption in the commercial sector.

- Regulatory Hurdles:Regulatory challenges and compliance issues are significant obstacles for the deployment of security robots. In future, over 60% of countries are expected to implement stricter regulations regarding data privacy and robotic operations in public spaces. These regulations can complicate the approval process for security robot deployment, leading to delays and increased costs for companies looking to integrate these technologies into their security operations.

Global Commercial Security Robot Market Future Outlook

The future of the commercial security robot market appears promising, driven by ongoing technological advancements and increasing demand for enhanced security solutions. As businesses continue to prioritize safety, the integration of AI and machine learning into security robots will become more prevalent, improving their effectiveness. Additionally, the trend towards hybrid security solutions, combining human oversight with robotic efficiency, is expected to gain traction, further solidifying the role of robots in commercial security operations.

Market Opportunities

- Expansion into Emerging Markets:Emerging markets present significant opportunities for growth in the security robot sector. With urbanization rates projected to exceed 50% in regions like Southeast Asia in future, the demand for advanced security solutions is expected to rise sharply, creating a favorable environment for security robot adoption.

- Partnerships with Technology Firms:Collaborations with technology firms can enhance the capabilities of security robots. In future, partnerships focused on integrating IoT technologies are expected to increase, allowing for smarter, more responsive security systems that can adapt to real-time threats, thereby expanding market reach and improving service offerings.