Region:Global

Author(s):Dev

Product Code:KRAB0518

Pages:92

Published On:August 2025

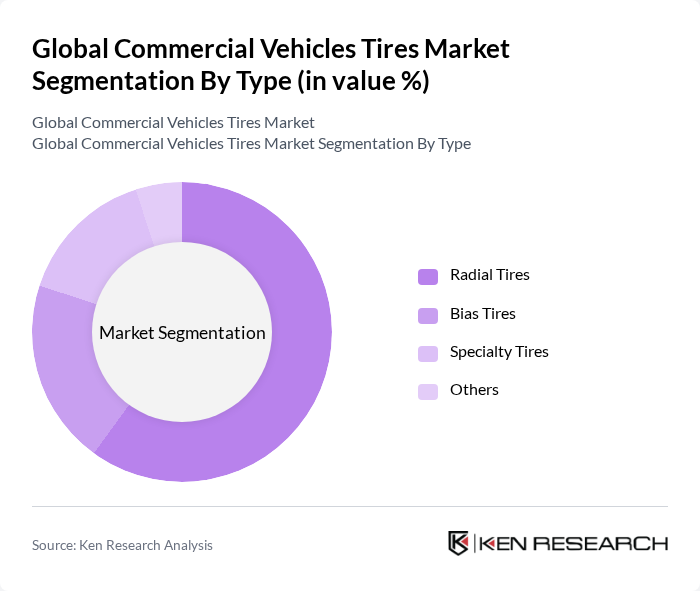

By Type:The market is segmented into Radial Tires, Bias Tires, Specialty Tires, and Others. Radial tires dominate the market due to their superior performance, fuel efficiency, and longevity, making them the preferred choice for commercial vehicles. Bias tires, while still relevant, are gradually being replaced by radial options. Specialty tires cater to specific applications, such as off-road vehicles, and are gaining traction in niche markets.

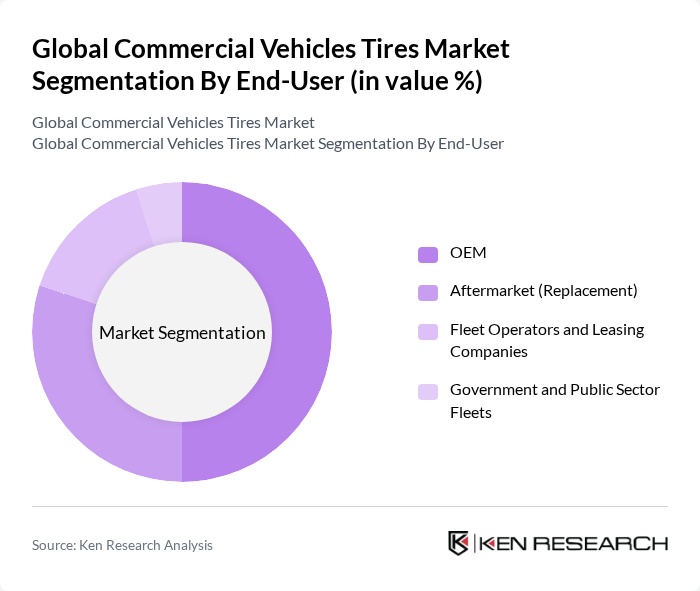

By End-User:The end-user segmentation includes OEM, Aftermarket (Replacement), Fleet Operators and Leasing Companies, and Government and Public Sector Fleets. The OEM segment leads the market as manufacturers increasingly focus on equipping new vehicles with high-quality tires. The aftermarket segment is also significant, driven by the need for replacements and upgrades in existing fleets. Fleet operators prioritize durability and cost-effectiveness, while government fleets often adhere to specific procurement standards.

The Global Commercial Vehicles Tires Market is characterized by a dynamic mix of regional and international players. Leading participants such as Michelin, Bridgestone, Goodyear, Continental, Pirelli, Yokohama, Dunlop (Sumitomo Rubber Industries), Hankook Tire & Technology, BFGoodrich (Michelin Group), Cooper Tire & Rubber Company (Goodyear), Apollo Tyres, Trelleborg (Off-Highway Tires), Nokian Tyres, Kumho Tire, Maxxis (Cheng Shin Rubber), Giti Tire, Sumitomo Rubber Industries, Sailun Group, Zhongce Rubber (ZC Rubber), Linglong Tire contribute to innovation, geographic expansion, and service delivery in this space.

The future of the commercial vehicle tire market in the None region is poised for transformation, driven by technological advancements and sustainability initiatives. The integration of smart tire technologies, which enhance performance monitoring and predictive maintenance, is expected to gain traction. Additionally, the shift towards electric commercial vehicles will create new demand for specialized tires, aligning with global sustainability goals. As manufacturers adapt to these trends, the market is likely to witness significant innovation and growth opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Radial Tires Bias Tires Specialty Tires Others |

| By End-User | OEM Aftermarket (Replacement) Fleet Operators and Leasing Companies Government and Public Sector Fleets |

| By Vehicle Type | Light Commercial Vehicles (LCV, < 3.5 tons) Medium Commercial Vehicles (3.5–16 tons) Heavy Commercial Vehicles (>16 tons) Buses & Coaches |

| By Distribution Channel | OEM (First Fit) Aftermarket – Offline (Dealers, Retailers, Wholesalers) Aftermarket – Online (E-commerce, Direct-to-Fleet) Retreading Services Networks |

| By Price Range | Economy Mid-Range Premium Ultra-Premium/Performance |

| By Region | North America Europe Asia-Pacific Latin America |

| By Application | Long-Haul/Line Haul Transport Regional/Last-Mile Delivery Construction and Mining Public Transport (City/Intercity Bus) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Heavy-Duty Truck Tire Market | 120 | Fleet Managers, Procurement Officers |

| Bus and Coach Tire Segment | 90 | Operations Managers, Maintenance Supervisors |

| Light Commercial Vehicle Tires | 80 | Logistics Coordinators, Vehicle Fleet Owners |

| Specialty Tires for Construction Vehicles | 70 | Construction Equipment Managers, Safety Officers |

| Emerging Markets Tire Demand | 85 | Market Analysts, Regional Sales Managers |

The Global Commercial Vehicles Tires Market is valued at approximately USD 35 billion, driven by increasing demand for commercial vehicles due to urbanization, e-commerce growth, and infrastructure development. This market is expected to continue expanding as logistics and transportation sectors grow globally.