Region:Global

Author(s):Dev

Product Code:KRAA1693

Pages:94

Published On:August 2025

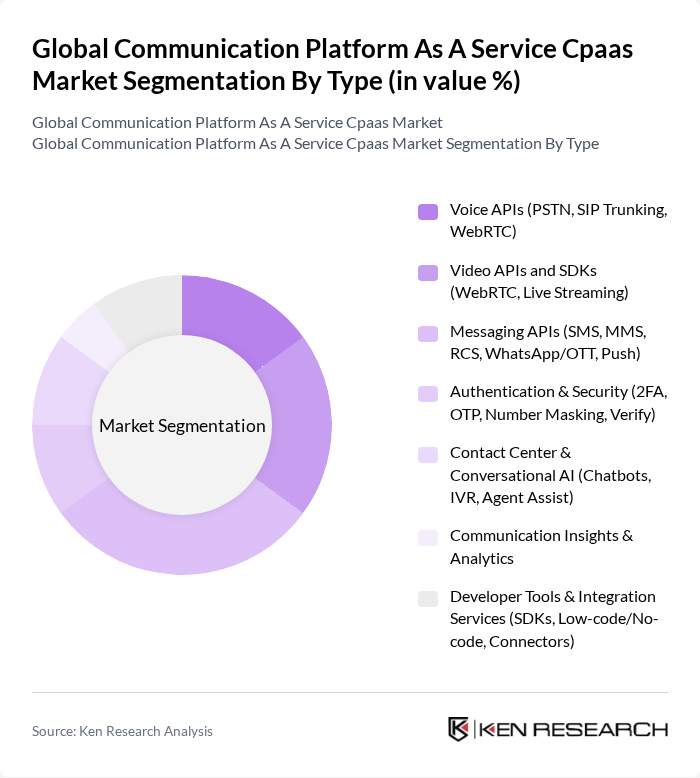

By Type:The CPaaS market can be segmented into various types, including Voice APIs, Video APIs, Messaging APIs, Authentication & Security, Contact Center & Conversational AI, Communication Insights & Analytics, and Developer Tools & Integration Services. Among these, Messaging APIs are currently dominating the market due to enterprise reliance on SMS, OTT apps (e.g., WhatsApp), and push notifications for customer engagement, authentication, and marketing, with traffic mix shifting toward richer channels in response to SMS fees and policy changes.

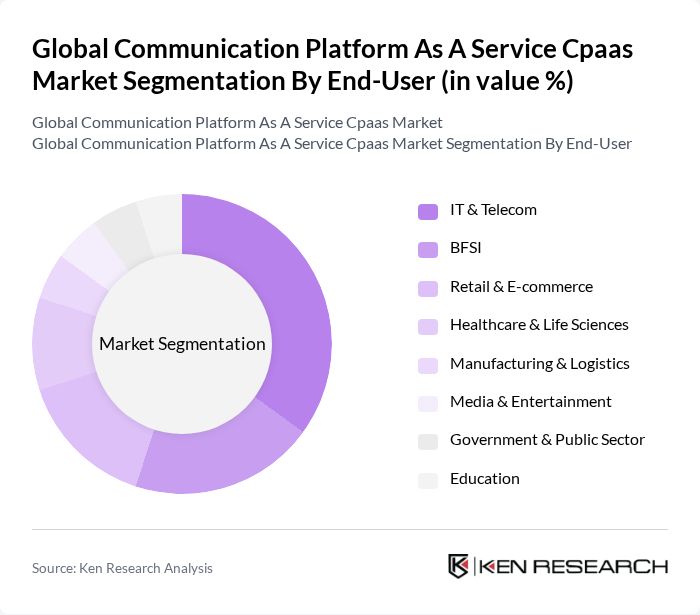

By End-User:The end-user segmentation of the CPaaS market includes IT & Telecom, BFSI, Retail & E-commerce, Healthcare & Life Sciences, Manufacturing & Logistics, Media & Entertainment, Government & Public Sector, and Education. The IT & Telecom sector is leading this market segment, driven by large-scale customer engagement needs, network-API exposure (including 5G), and rapid digital transformation across enterprises leveraging programmable messaging, voice, and video.

The Global Communication Platform As A Service Cpaas Market market is characterized by a dynamic mix of regional and international players. Leading participants such as Twilio Inc., Vonage Holdings Corp. (including Nexmo, the Vonage API Platform), Bandwidth Inc., Plivo Inc., MessageBird B.V., Sinch AB, RingCentral, Inc., 8x8, Inc., Telnyx LLC, Agora, Inc. (Agora.io), Telesign Corporation, Infobip d.o.o., Kaleyra S.p.A. (a Tata Communications company), Wazo Communications Inc., CM.com N.V. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the CPaaS market appears promising, driven by technological advancements and evolving consumer preferences. As businesses increasingly prioritize customer experience, the demand for omnichannel communication solutions is expected to rise. Additionally, the integration of advanced analytics will enable companies to make data-driven decisions, enhancing operational efficiency. With the ongoing expansion of cloud infrastructure, CPaaS providers are well-positioned to capitalize on emerging trends, ensuring sustained growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Voice APIs (PSTN, SIP Trunking, WebRTC) Video APIs and SDKs (WebRTC, Live Streaming) Messaging APIs (SMS, MMS, RCS, WhatsApp/OTT, Push) Authentication & Security (2FA, OTP, Number Masking, Verify) Contact Center & Conversational AI (Chatbots, IVR, Agent Assist) Communication Insights & Analytics Developer Tools & Integration Services (SDKs, Low-code/No-code, Connectors) |

| By End-User | IT & Telecom BFSI Retail & E-commerce Healthcare & Life Sciences Manufacturing & Logistics Media & Entertainment Government & Public Sector Education |

| By Application | Customer Engagement & Support (Omnichannel, Notifications) Marketing & Promotions (Campaigns, A2P Messaging) Sales & Commerce (Conversational Commerce, Lead Gen) Identity & Fraud Prevention (KYC, 2FA, Number Lookup) Collaboration & Internal Communications Telehealth & Remote Services |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Pricing Model | Pay-as-you-go (per message/minute/session) Subscription-based (bundles/packages) Tiered/Volume-based Pricing Enterprise Contracts (committed use, custom SLAs) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Customer Size | Small & Medium Enterprises (SMEs) Large Enterprises |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Communication Solutions | 120 | IT Managers, Communication Directors |

| Healthcare CPaaS Applications | 100 | Healthcare IT Specialists, Operations Managers |

| Retail Customer Engagement Platforms | 80 | Marketing Managers, Customer Experience Leads |

| Financial Services Communication Tools | 70 | Compliance Officers, IT Security Managers |

| Education Sector Communication Solutions | 60 | Academic Administrators, IT Support Staff |

The Global CPaaS market is valued at approximately USD 19.5 billion, reflecting strong enterprise adoption of programmable communications and a growing demand for real-time communication solutions across various sectors.