Global Companion Animal Diagnostics Market Overview

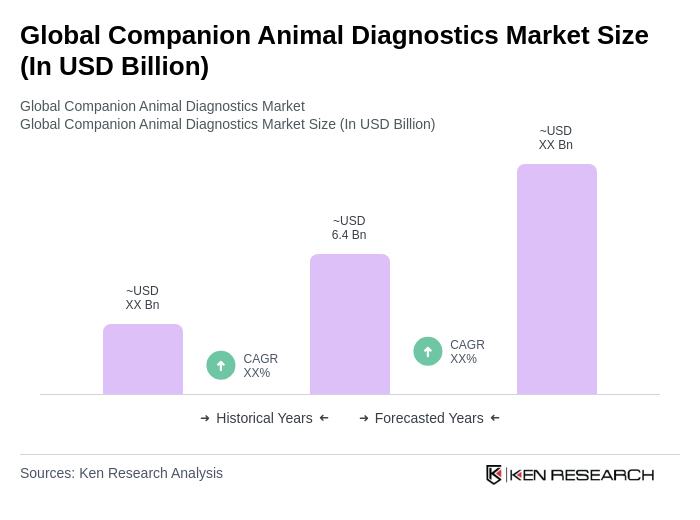

- The Global Companion Animal Diagnostics Market is valued at USD 6.4 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing pet ownership rates, rising awareness about pet health, and advancements in diagnostic technologies. The demand for accurate and timely diagnostics has surged, with over one billion animals kept as pets worldwide and more than half of the world's families having at least one pet. The trend of pet humanization has intensified, with American pet owners spending an average of USD 1,960 annually on their pets, driving higher demand for diagnostic tests and services in veterinary practices.

- North America, particularly the United States, dominates the market with the largest revenue share of approximately 38%, attributed to high pet ownership rates, advanced veterinary healthcare infrastructure, and significant investments in pet health. The region benefits from technological advancements enhancing early disease detection and personalized treatment options for pets. Europe follows closely, with countries like Germany and the UK showing strong demand for innovative diagnostic solutions. The Asia-Pacific region is also emerging rapidly, driven by increasing disposable incomes and a growing awareness of pet health among pet owners, with India anticipated to witness significant growth.

- The U.S. Food and Drug Administration (FDA) administers the Veterinary Feed Directive (VFD) under the Federal Food, Drug, and Cosmetic Act, Section 504, which was updated through final rules published in 2015. This directive establishes a comprehensive framework for the distribution and use of medically important antimicrobials in feed for food-producing animals, requiring veterinary oversight to ensure responsible use of antimicrobial drugs. The VFD rule mandates that such medications can only be administered under the authorization of a licensed veterinarian through a written VFD order, thereby promoting judicious antimicrobial use and reducing the risk of antimicrobial resistance. This framework extends its impact to companion animal health by maintaining high standards in veterinary diagnostics and therapeutic interventions.

Global Companion Animal Diagnostics Market Segmentation

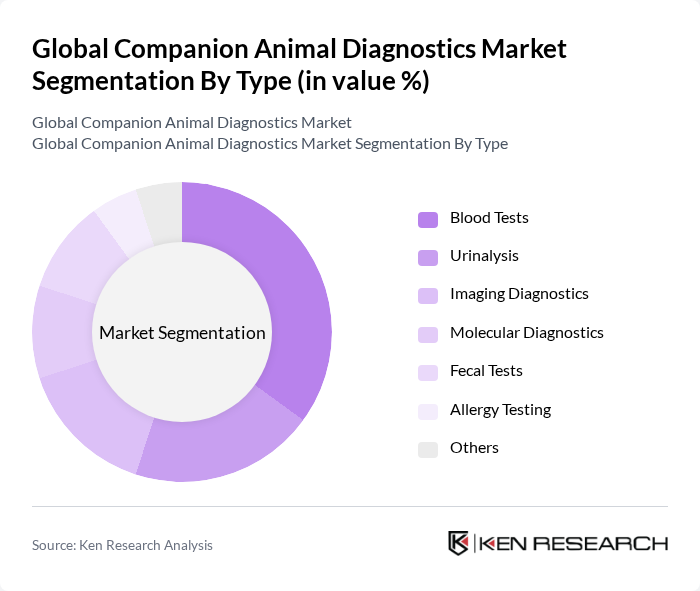

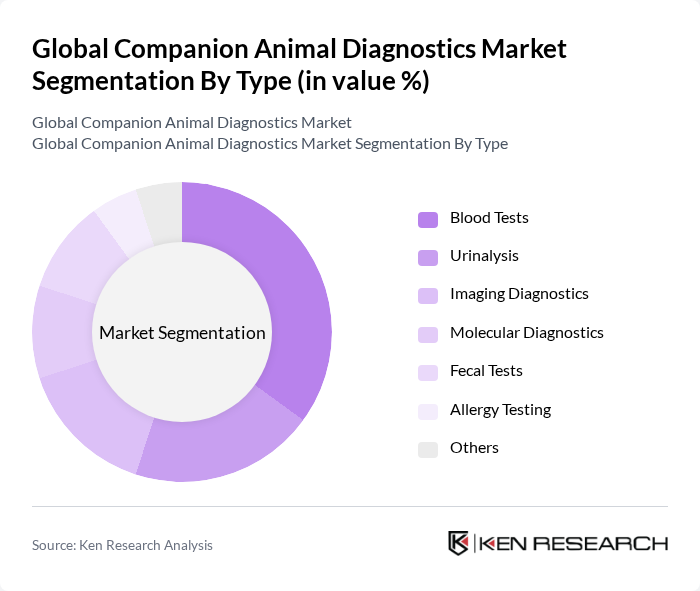

By Type:The market is segmented into various types of diagnostic tests, including Blood Tests, Urinalysis, Imaging Diagnostics, Molecular Diagnostics, Fecal Tests, Allergy Testing, and Others. Among these, clinical chemistry tests, which encompass comprehensive blood testing panels, represent the most widely used diagnostic category due to their ability to provide detailed health information about pets across multiple organ systems. The clinical chemistry segment holds a dominant position with approximately 23% market share. The increasing prevalence of chronic diseases in companion animals, coupled with the growing adoption of point-of-care diagnostics and technological advancements in testing methodologies, has further fueled the demand for blood testing, making it a cornerstone segment in the market.

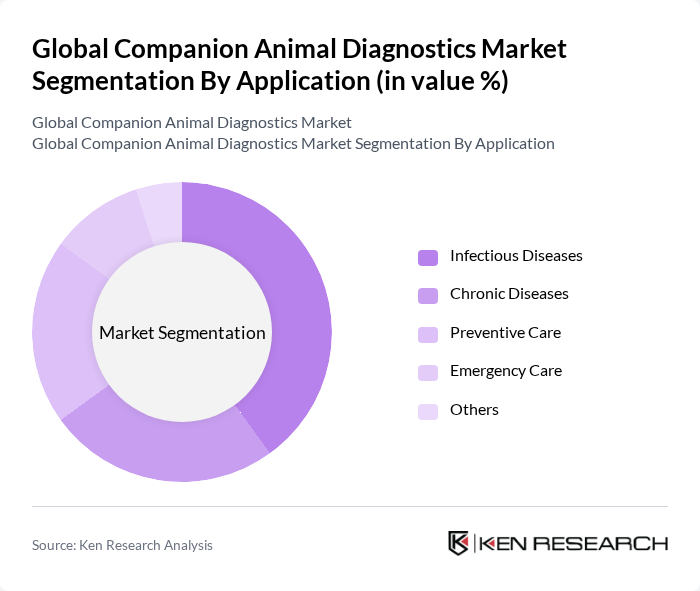

By Application:The applications of companion animal diagnostics include Infectious Diseases, Chronic Diseases, Preventive Care, Emergency Care, and Others. The segment for Infectious Diseases is particularly significant, driven by the rising incidence of zoonotic diseases and the need for rapid diagnosis to control outbreaks. Dogs represent the largest animal segment within the market, reflecting their widespread ownership and the comprehensive veterinary care they receive. This segment's growth is supported by increasing awareness among pet owners regarding the importance of early detection and treatment of infectious conditions, along with the rising medicalization rate of companion animals and greater access to advanced diagnostic services through veterinary hospitals, clinics, and specialized diagnostic laboratories.

Global Companion Animal Diagnostics Market Competitive Landscape

The Global Companion Animal Diagnostics Market is characterized by a dynamic mix of regional and international players. Leading participants such as IDEXX Laboratories, Inc., Zoetis Inc., Neogen Corporation, Virbac S.A., Heska Corporation, Abaxis, Inc., VCA Inc., Thermo Fisher Scientific Inc., QIAGEN N.V., PetDx, Biovet S.A., Elanco Animal Health Incorporated, Scil Animal Care Company contribute to innovation, geographic expansion, and service delivery in this space.

Global Companion Animal Diagnostics Market Industry Analysis

Growth Drivers

- Increasing Pet Ownership:The rise in pet ownership significantly drives the companion animal diagnostics market. In future, approximately 66% of U.S. households are expected to own a pet, translating to around 86.9 million homes. This surge in pet ownership correlates with a growing demand for veterinary services and diagnostics, as pet owners increasingly seek advanced healthcare solutions for their animals. The American Pet Products Association reported that pet industry expenditures reached $136.8 billion, indicating a robust market for diagnostics.

- Advancements in Diagnostic Technologies:Technological innovations in veterinary diagnostics are propelling market growth. In future, the global veterinary diagnostics market is projected to reach $3.2 billion, driven by advancements in molecular diagnostics, imaging technologies, and laboratory automation. These innovations enhance the accuracy and speed of disease detection in companion animals, leading to better health outcomes. The integration of AI and machine learning in diagnostic tools is expected to further streamline processes, making diagnostics more accessible and efficient for veterinary practices.

- Rising Awareness of Animal Health:Increased awareness regarding animal health and wellness is a significant growth driver. In future, it is estimated that 60% of pet owners will prioritize preventive healthcare measures, including regular check-ups and diagnostic tests. This trend is supported by educational campaigns from veterinary organizations and pet health advocates, emphasizing the importance of early disease detection. As a result, the demand for diagnostic services is expected to rise, fostering a more proactive approach to pet healthcare among owners.

Market Challenges

- High Cost of Diagnostic Equipment:The high cost associated with advanced diagnostic equipment poses a significant challenge for veterinary practices. In future, the average price of sophisticated diagnostic machines, such as MRI and CT scanners, can exceed $150,000. This financial barrier limits access to cutting-edge diagnostic tools, particularly for smaller veterinary clinics. Consequently, many practitioners may rely on outdated equipment, which can hinder the quality of care provided to companion animals and affect overall market growth.

- Limited Access to Veterinary Services in Rural Areas:Access to veterinary services remains a challenge, especially in rural regions. In future, it is estimated that over 20% of rural areas in the U.S. will lack adequate veterinary services, impacting the availability of diagnostic testing. This limited access can lead to delayed diagnoses and treatment for companion animals, ultimately affecting their health outcomes. The disparity in service availability creates a significant barrier to market growth in these underserved regions.

Global Companion Animal Diagnostics Market Future Outlook

The future of the companion animal diagnostics market appears promising, driven by technological advancements and changing consumer behaviors. As pet owners increasingly prioritize preventive healthcare, the demand for innovative diagnostic solutions is expected to rise. Additionally, the integration of telemedicine in veterinary care will enhance accessibility, allowing pet owners to consult with veterinarians remotely. This trend, coupled with the growing emphasis on personalized veterinary medicine, will likely shape the market landscape, fostering a more proactive approach to animal health management.

Market Opportunities

- Expansion of Telemedicine in Veterinary Care:The rise of telemedicine presents a significant opportunity for the companion animal diagnostics market. In future, it is projected that telemedicine consultations will increase by 30%, allowing pet owners to access veterinary advice and diagnostics remotely. This shift can enhance service delivery, particularly in underserved areas, improving overall pet health outcomes and driving demand for diagnostic services.

- Development of Point-of-Care Testing:The growing demand for point-of-care testing solutions offers a lucrative opportunity in the diagnostics market. In future, the point-of-care diagnostics segment is expected to grow by 25%, driven by the need for rapid and accurate testing in veterinary practices. This trend will facilitate timely decision-making and treatment, ultimately improving the quality of care for companion animals and expanding market reach.