Region:Global

Author(s):Dev

Product Code:KRAA2534

Pages:100

Published On:August 2025

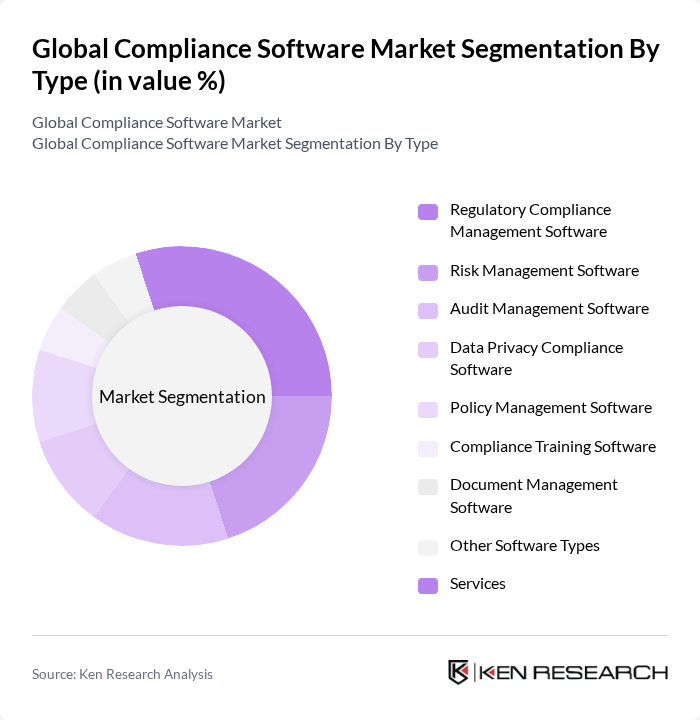

By Type:The compliance software market is segmented into various types, including Regulatory Compliance Management Software, Risk Management Software, Audit Management Software, Data Privacy Compliance Software, Policy Management Software, Compliance Training Software, Document Management Software, Other Software Types, and Services. Each of these sub-segments addresses specific compliance needs, such as automating regulatory reporting, managing enterprise risk, tracking audit trails, ensuring data privacy, managing policy documentation, delivering compliance training, and supporting document control and workflow automation .

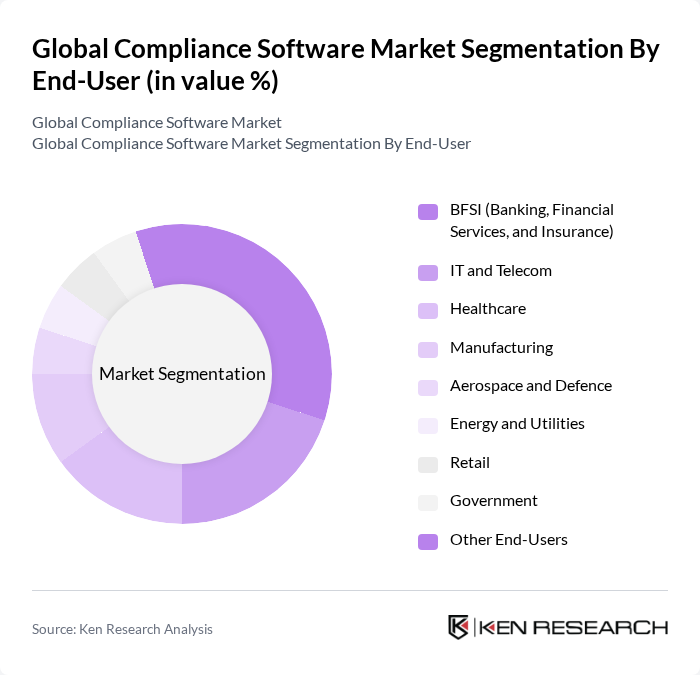

By End-User:The end-user segmentation of the compliance software market includes BFSI (Banking, Financial Services, and Insurance), IT and Telecom, Healthcare, Manufacturing, Aerospace and Defence, Energy and Utilities, Retail, Government, and Other End-Users. Each sector has unique compliance requirements, such as anti-money laundering and KYC in BFSI, HIPAA in healthcare, and GDPR in IT and Telecom, driving the demand for tailored software solutions .

The Global Compliance Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, IBM Corporation, Microsoft Corporation, SAS Institute Inc., MetricStream Inc., LogicGate Inc., ComplyAdvantage, TrustArc Inc., RSA Security LLC, NAVEX Global Inc., SAI Global, Enablon (Wolters Kluwer), Convercent (by OneTrust), Diligent Corporation, Broadcom Inc., Accupoint Software, CoreTechnologie GmbH, RiskWatch International, ZenGRC (Reciprocity, Inc.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the compliance software market appears promising, driven by technological advancements and increasing regulatory scrutiny. As organizations prioritize compliance, the integration of AI and machine learning into compliance solutions is expected to enhance efficiency and accuracy. Furthermore, the shift towards cloud-based solutions will facilitate easier access and scalability, allowing businesses to adapt quickly to changing regulations. This dynamic environment will likely foster innovation and create new opportunities for compliance software providers.

| Segment | Sub-Segments |

|---|---|

| By Type | Regulatory Compliance Management Software Risk Management Software Audit Management Software Data Privacy Compliance Software Policy Management Software Compliance Training Software Document Management Software Other Software Types Services |

| By End-User | BFSI (Banking, Financial Services, and Insurance) IT and Telecom Healthcare Manufacturing Aerospace and Defence Energy and Utilities Retail Government Other End-Users |

| By Deployment Mode | Cloud-Based On-Premises Hybrid |

| By Region | North America Europe Asia-Pacific Latin America Middle East and Africa Australia and New Zealand |

| By Compliance Type | Environmental Compliance Financial Compliance Health and Safety Compliance Data Protection Compliance Other Compliance Types |

| By Company Size | Small Enterprises Medium Enterprises Large Enterprises |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-Per-Use Other Pricing Models |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Compliance | 100 | Compliance Officers, Risk Management Directors |

| Healthcare Regulatory Compliance | 60 | Healthcare Administrators, Compliance Managers |

| Manufacturing Compliance Solutions | 50 | Quality Assurance Managers, Operations Directors |

| Data Privacy Compliance | 70 | Data Protection Officers, IT Security Managers |

| Environmental Compliance Software | 40 | Sustainability Officers, Environmental Compliance Managers |

The Global Compliance Software Market is valued at approximately USD 32 billion, reflecting significant growth driven by increasing regulatory requirements, data privacy concerns, and the need for organizations to streamline compliance processes.