Region:Global

Author(s):Dev

Product Code:KRAB0415

Pages:86

Published On:August 2025

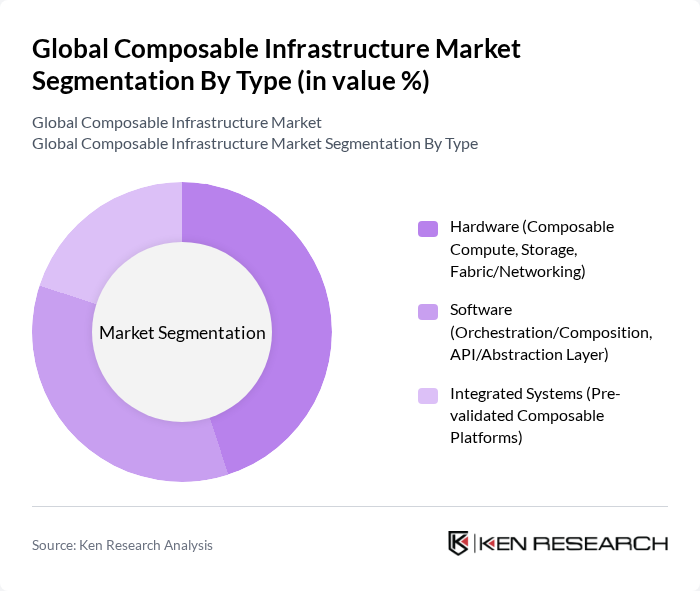

By Type:The composable infrastructure market can be segmented into three main types: Hardware, Software, and Integrated Systems. Each of these segments plays a crucial role in the overall market dynamics, with specific applications and user preferences driving their growth.

The Hardware segment, particularly Composable Compute and Storage, dominates the market due to the increasing need for high-performance computing and efficient data storage solutions. Organizations are investing heavily in hardware that allows for dynamic resource allocation and scalability, which is essential for handling large volumes of data and supporting various applications. The trend towards hybrid cloud environments further enhances the demand for robust hardware solutions that can seamlessly integrate with existing infrastructures.

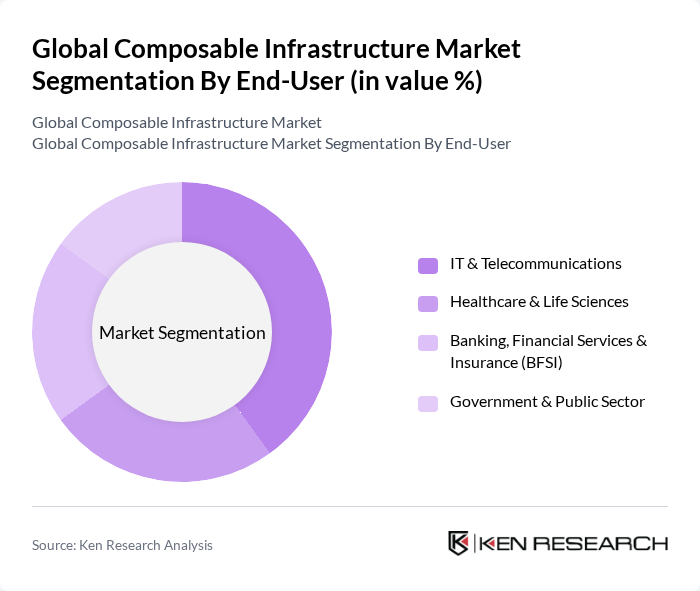

By End-User:The end-user segmentation includes IT & Telecommunications, Healthcare & Life Sciences, Banking, Financial Services & Insurance (BFSI), and Government & Public Sector. Each of these sectors has unique requirements and challenges that composable infrastructure can address effectively.

The IT & Telecommunications sector leads the end-user market due to its continuous demand for innovative solutions that enhance operational efficiency and service delivery. The rapid evolution of technologies such as 5G and IoT necessitates flexible infrastructure that can adapt to changing requirements. Additionally, the increasing focus on digital transformation across various industries drives the adoption of composable infrastructure in sectors like healthcare and BFSI, where data management and security are paramount.

The Global Composable Infrastructure Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hewlett Packard Enterprise (HPE), Cisco Systems, Inc., Dell Technologies Inc., Lenovo Group Limited, Liqid, Inc., Fungible (acquired by Microsoft), DriveScale (acquired by Twitter), TidalScale, Inc., Western Digital Corporation (OpenFlex), Super Micro Computer, Inc. (Supermicro), Intel Corporation (fabric and reference architectures), NVIDIA Corporation (DPUs/GPUs for composable architectures), Hewlett Packard Enterprise (HPE) – HPE Synergy & HPE Alletra, Lenovo – ThinkAgile Composable solutions, Inspur Information (Inspur Systems) contribute to innovation, geographic expansion, and service delivery in this space.

The future of composable infrastructure is promising, driven by technological advancements and evolving business needs. As organizations increasingly prioritize digital transformation, the demand for flexible and scalable IT solutions will continue to rise. The integration of artificial intelligence and machine learning into infrastructure management is expected to enhance operational efficiency. Additionally, the growing emphasis on sustainability will push companies to adopt greener IT practices, further shaping the landscape of composable infrastructure in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Hardware (Composable Compute, Storage, Fabric/Networking) Software (Orchestration/Composition, API/Abstraction Layer) Integrated Systems (Pre-validated Composable Platforms) |

| By End-User | IT & Telecommunications Healthcare & Life Sciences Banking, Financial Services & Insurance (BFSI) Government & Public Sector |

| By Deployment Model | On-Premises (Private Data Centers) Public Cloud Composable Services Hybrid/Multi-Cloud |

| By Component | Compute Resources (CPU/GPU/Accelerators Pools) Storage Resources (NVMe/SSD/HDD Pools) Networking/Fabric Resources (Ethernet/RDMA Fabrics) |

| By Application | Data Center Optimization & Infrastructure Automation Business Continuity & Disaster Recovery DevOps, CI/CD, and Test/Development Environments |

| By Sales Channel | Direct (Vendors/OEMs) Channel Partners/Value-Added Resellers (VARs) System Integrators & Managed Service Providers (MSPs) |

| By Industry Vertical | Retail & E-commerce Manufacturing & Industrial Education & Research Energy, Media, and Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise IT Infrastructure | 120 | IT Managers, CTOs, Infrastructure Architects |

| Cloud Service Providers | 90 | Cloud Operations Managers, Product Managers |

| Data Center Operations | 80 | Data Center Managers, Facility Engineers |

| SMB IT Solutions | 70 | IT Consultants, Business Owners |

| Technology Adoption Trends | 60 | Industry Analysts, Research Directors |

The Global Composable Infrastructure Market is valued at approximately USD 10.3 billion, reflecting a significant growth trend driven by the demand for flexible and scalable IT infrastructure solutions that optimize resource utilization and reduce operational costs.