Region:Global

Author(s):Shubham

Product Code:KRAA2724

Pages:90

Published On:August 2025

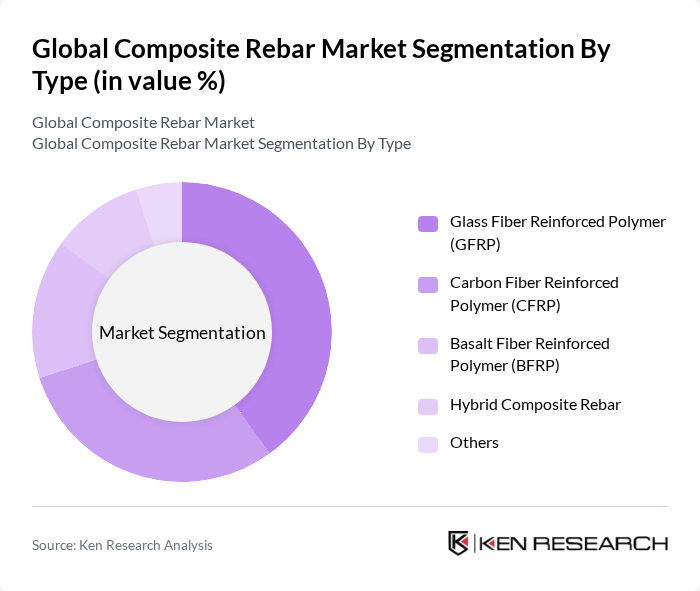

By Type:The market is segmented into various types of composite rebar, including Glass Fiber Reinforced Polymer (GFRP), Carbon Fiber Reinforced Polymer (CFRP), Basalt Fiber Reinforced Polymer (BFRP), Hybrid Composite Rebar, and Others. Each type has unique properties that cater to different construction needs. GFRP is widely used due to its high tensile strength, corrosion resistance, and cost-effectiveness, making it suitable for bridges, marine structures, and highways. CFRP offers superior strength-to-weight ratios and is preferred in high-performance applications where weight savings are critical. BFRP provides excellent chemical resistance and is increasingly adopted in environments with high exposure to aggressive agents. Hybrid composite rebar combines multiple fibers to optimize performance for specialized applications .

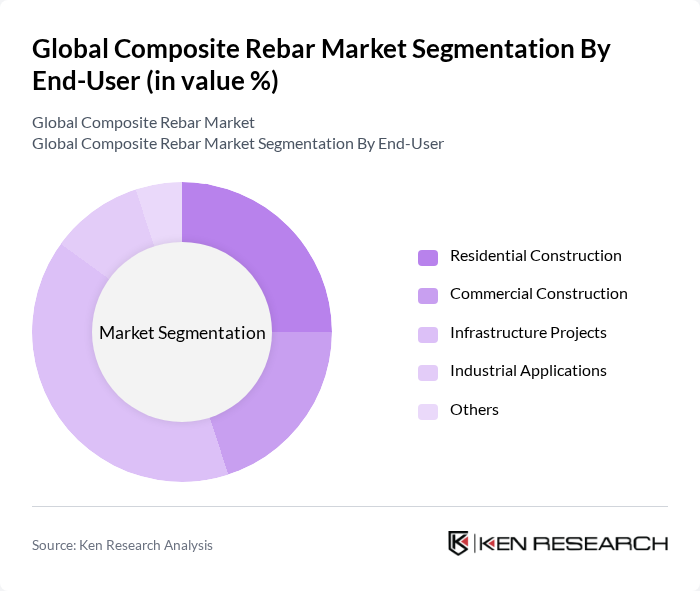

By End-User:The end-user segmentation includes Residential Construction, Commercial Construction, Infrastructure Projects, Industrial Applications, and Others. The infrastructure projects segment is particularly dominant due to the increasing investments in public infrastructure and the need for durable materials that can withstand environmental challenges such as corrosion, moisture, and chemical exposure. Composite rebar is increasingly specified for bridges, tunnels, marine structures, and highways, where longevity and reduced maintenance are critical. Residential and commercial construction segments are also witnessing growing adoption as builders seek sustainable and high-performance alternatives to traditional steel rebar .

The Global Composite Rebar Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sika AG, BASF SE, Owens Corning, Pultrall Inc., Hughes Brothers Inc., Aslan FRP (Neuvokas Corporation), Dextra Group, Composite Rebar Technologies, Inc., FiReP International AG, Marshall Composite Technologies LLC, Fiberline Composites A/S, Schöck Bauteile GmbH, ZYFLEX Composite Materials Co., Ltd., Advanced Composite Products & Technology, Inc. (ACPT), and Strongwell Corporation contribute to innovation, geographic expansion, and service delivery in this space. These companies are focused on expanding their product portfolios, investing in R&D for advanced materials, and strengthening their distribution networks to meet the growing global demand for composite rebar .

The future of the composite rebar market appears promising, driven by increasing environmental regulations and a shift towards sustainable construction practices. As governments worldwide implement stricter building codes and sustainability initiatives, the demand for innovative materials that reduce carbon footprints is expected to rise. Additionally, advancements in manufacturing technologies will likely enhance the performance and affordability of composite rebar, making it a more attractive option for construction projects across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Glass Fiber Reinforced Polymer (GFRP) Carbon Fiber Reinforced Polymer (CFRP) Basalt Fiber Reinforced Polymer (BFRP) Hybrid Composite Rebar Others |

| By End-User | Residential Construction Commercial Construction Infrastructure Projects Industrial Applications Others |

| By Application | Bridges Highways Buildings Marine Structures Water Treatment Plants Underground Construction Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Range Mid Price Range High Price Range Others |

| By Performance Characteristics | Tensile Strength Corrosion Resistance Weight Durability Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Infrastructure Projects | 100 | Project Managers, Civil Engineers |

| Residential Construction | 80 | Architects, Builders |

| Commercial Developments | 60 | Construction Managers, Developers |

| Composite Rebar Suppliers | 50 | Sales Managers, Product Specialists |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

The Global Composite Rebar Market is valued at approximately USD 1.2 billion, driven by the increasing demand for lightweight and corrosion-resistant materials in construction and infrastructure projects.