Region:Global

Author(s):Dev

Product Code:KRAC0336

Pages:89

Published On:August 2025

By Type:The compound chocolate market is segmented into Milk Compound Chocolate, Dark Compound Chocolate, White Compound Chocolate, Flavored Compound Chocolate, Sugar-Free Compound Chocolate, Organic Compound Chocolate, Chocolate Chips, Chocolate Slabs, Chocolate Coatings, and Others. Milk Compound Chocolate remains the most popular due to its creamy texture and widespread use in confectionery products. Dark Compound Chocolate is gaining traction as consumers increasingly seek products with perceived health benefits, while Flavored and Organic variants are seeing growth among health-conscious and premium-focused consumers. Sugar-Free Compound Chocolate is expanding as regulatory and consumer trends favor reduced sugar intake .

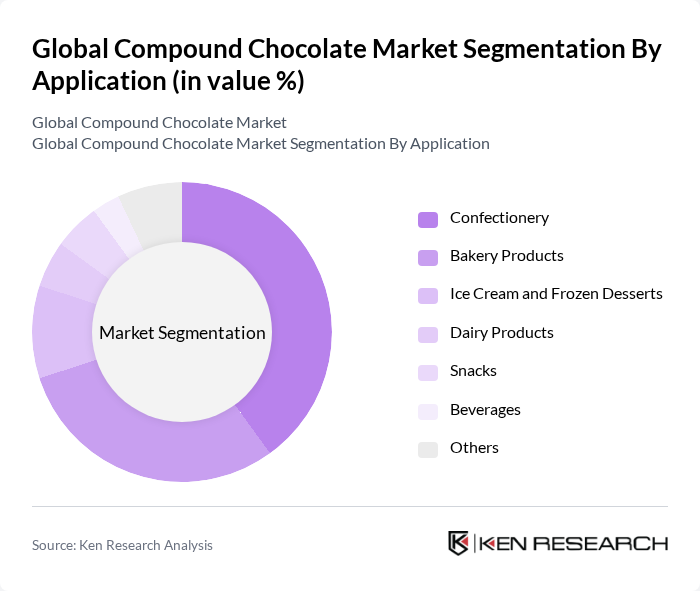

By Application:The compound chocolate market is also segmented by application, including Confectionery, Bakery Products, Ice Cream and Frozen Desserts, Dairy Products, Snacks, Beverages, and Others. The Confectionery segment holds the largest share, driven by high demand for chocolate bars, candies, and sweet treats. Bakery Products are significant due to the widespread use of compound chocolate in cakes, cookies, and pastries. The Ice Cream and Frozen Desserts segment is growing as indulgent dessert trends and technical advantages of compound chocolate (such as heat resistance) support its use in these applications .

The Global Compound Chocolate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Barry Callebaut AG, Cargill, Incorporated, Mondel?z International, Inc., Olam International Limited, Fuji Oil Holdings Inc., The Hershey Company, Nestlé S.A., Mars, Incorporated, Ecom Agroindustrial Corp. Ltd., Puratos Group, Blommer Chocolate Company, AAK AB, Cémoi Chocolatier, Chocoladefabriken Lindt & Sprüngli AG, Guan Chong Berhad (GCB) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the compound chocolate market appears promising, driven by evolving consumer preferences and innovative product development. As health-conscious trends continue to shape purchasing decisions, manufacturers are likely to focus on creating healthier formulations. Additionally, the rise of e-commerce platforms is expected to facilitate broader market access, allowing consumers to explore diverse product offerings. This shift towards online retail will likely enhance market penetration, particularly in regions with growing internet accessibility and digital payment systems.

| Segment | Sub-Segments |

|---|---|

| By Type | Milk Compound Chocolate Dark Compound Chocolate White Compound Chocolate Flavored Compound Chocolate Sugar-Free Compound Chocolate Organic Compound Chocolate Chocolate Chips Chocolate Slabs Chocolate Coatings Others |

| By Application | Confectionery Bakery Products Ice Cream and Frozen Desserts Dairy Products Snacks Beverages Others |

| By End-User | Retail Consumers Food Manufacturers Food Service Providers Industrial Users Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Specialty Stores Convenience Stores Foodservice & B2B Others |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging Flexible Packaging Others |

| By Price Range | Economy Mid-Range Premium |

| By Region | North America (United States, Canada, Mexico) Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Colombia, Peru, Chile, Rest of Latin America) Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Chocolate Sales | 120 | Store Managers, Category Buyers |

| Food Service Industry Insights | 90 | Restaurant Owners, Menu Developers |

| Consumer Preferences in Compound Chocolate | 140 | End Consumers, Chocolate Enthusiasts |

| Manufacturing Process Insights | 80 | Production Managers, Quality Control Specialists |

| Distribution Channel Analysis | 100 | Logistics Coordinators, Supply Chain Analysts |

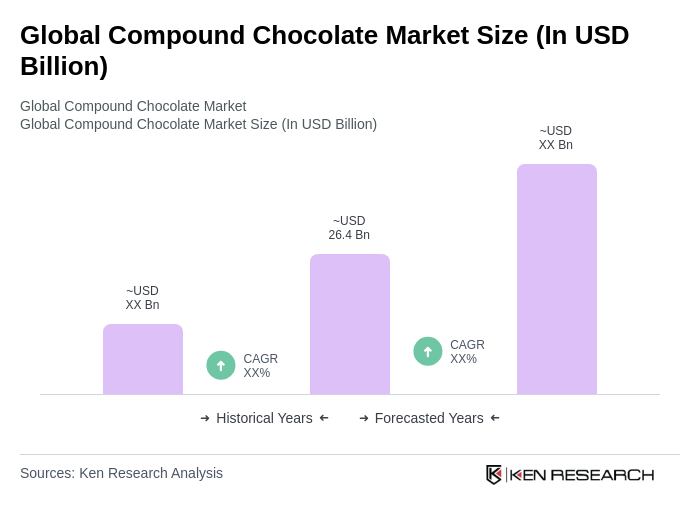

The Global Compound Chocolate Market is valued at approximately USD 26.4 billion, reflecting a significant growth trend driven by the demand for affordable chocolate alternatives, particularly in the confectionery and bakery sectors.