Region:Global

Author(s):Dev

Product Code:KRAC0430

Pages:92

Published On:August 2025

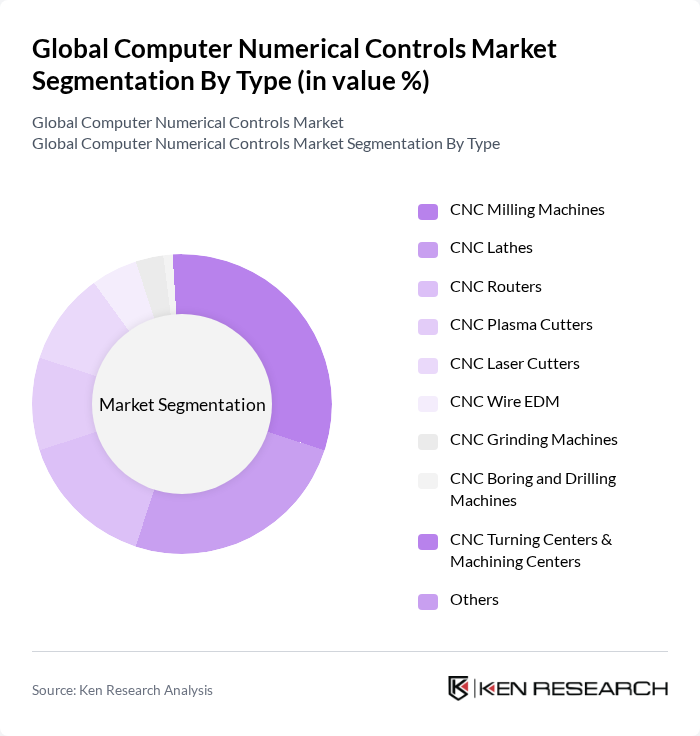

By Type:The CNC market is segmented into various types, including CNC Milling Machines, CNC Lathes, CNC Routers, CNC Plasma Cutters, CNC Laser Cutters, CNC Wire EDM, CNC Grinding Machines, CNC Boring and Drilling Machines, CNC Turning Centers & Machining Centers, and Others. Among these, CNC Milling Machines and CNC Lathes remain the most prominent due to versatility and wide adoption for complex, high-precision parts across automotive and aerospace, supported by multi-axis capabilities and digital controls that enable higher throughput and quality .

By End-User:The CNC market is also segmented by end-user industries, including Automotive, Aerospace & Defense, Electronics & Semiconductor, Healthcare & Medical Devices, Industrial Machinery & Equipment, Energy & Power (Oil & Gas, Renewables), Furniture & Woodworking, and Others. The automotive sector is the largest end-user, supported by high-precision components, EV-related machining, and automation in vehicle manufacturing; aerospace & defense closely follows due to stringent tolerances and lightweight complex part production .

The Global Computer Numerical Controls Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, FANUC Corporation, Haas Automation, Inc., Mitsubishi Electric Corporation, Okuma Corporation, DMG MORI AG, Yaskawa Electric Corporation, KUKA AG, Hurco Companies, Inc., EMCO GmbH, Fagor Automation, S. Coop., Heidenhain GmbH, JTEKT Corporation (JTEKT Machine Tools), Mazak Corporation (Yamazaki Mazak), Makino Milling Machine Co., Ltd., GSK CNC Equipment Co., Ltd., Bosch Rexroth AG, Schneider Electric SE, NUM AG, Beckhoff Automation GmbH & Co. KG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the CNC market in None is poised for transformative growth, driven by technological advancements and evolving industry needs. As manufacturers increasingly embrace Industry 4.0 principles, the integration of AI and IoT will redefine operational efficiencies. Additionally, the focus on sustainable practices will lead to the development of eco-friendly CNC solutions, aligning with global environmental goals. This convergence of technology and sustainability will create a dynamic landscape for innovation and investment in future.

| Segment | Sub-Segments |

|---|---|

| By Type | CNC Milling Machines CNC Lathes CNC Routers CNC Plasma Cutters CNC Laser Cutters CNC Wire EDM CNC Grinding Machines CNC Boring and Drilling Machines CNC Turning Centers & Machining Centers Others |

| By End-User | Automotive Aerospace & Defense Electronics & Semiconductor Healthcare & Medical Devices Industrial Machinery & Equipment Energy & Power (Oil & Gas, Renewables) Furniture & Woodworking Others |

| By Application | Prototyping Production (Mass & Batch) Tooling & Mold Making Maintenance, Repair & Overhaul (MRO) Micro?machining & High-precision Tasks Others |

| By Component | Hardware (Controllers, Drives, Motors, HMI) Software (CAD/CAM, CNC Programming, Simulation) Services (Installation, Training, Maintenance) |

| By Sales Channel | Direct OEM Sales Authorized Distributors & System Integrators Online Sales & E-commerce Others |

| By Distribution Mode | Offline Online |

| By Price Range | Entry-Level Mid-Range High-End / Premium |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aerospace CNC Applications | 100 | Manufacturing Engineers, Production Managers |

| Automotive CNC Machining | 120 | Quality Control Managers, Operations Directors |

| Medical Device Manufacturing | 80 | R&D Managers, Compliance Officers |

| Metalworking Industry Insights | 90 | Shop Floor Supervisors, Tooling Engineers |

| Emerging CNC Technologies | 70 | Product Development Engineers, Technology Analysts |

The Global Computer Numerical Controls Market is valued at approximately USD 90 billion, reflecting a robust demand driven by automation, smart factory adoption, and precision manufacturing across various sectors, including automotive, aerospace, electronics, and healthcare.