Region:Global

Author(s):Rebecca

Product Code:KRAC0237

Pages:92

Published On:August 2025

By Type:The CPOE systems market can be segmented into four main types: Standalone CPOE Systems, Integrated CPOE Systems, Web-Based CPOE Systems, and Cloud-Based CPOE Systems. Among these, Integrated CPOE Systems are gaining significant traction due to their ability to seamlessly connect with existing healthcare IT systems, enhancing workflow efficiency and data accuracy. Integrated systems are preferred in large hospital networks for their interoperability and support of complex clinical workflows .

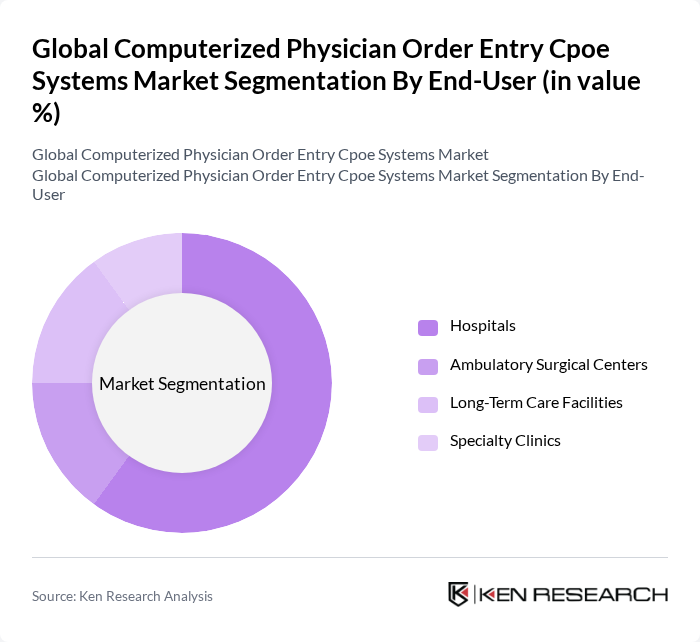

By End-User:The end-user segmentation includes Hospitals, Ambulatory Surgical Centers, Long-Term Care Facilities, and Specialty Clinics. Hospitals are the leading end-users of CPOE systems, driven by the need for improved patient safety, reduced medication errors, and enhanced operational efficiency. Hospitals benefit most from CPOE adoption due to high patient volumes and complex medication management needs .

The Global Computerized Physician Order Entry CPOE Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Epic Systems Corporation, Oracle Cerner, Allscripts Healthcare Solutions, Inc., MEDITECH (Medical Information Technology, Inc.), McKesson Corporation, Siemens Healthineers, Athenahealth, Inc., NextGen Healthcare, Inc., GE HealthCare, Philips Healthcare, Oracle Corporation, IBM Watson Health, eClinicalWorks LLC, Infor Healthcare, MEDHOST, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of CPOE systems is poised for significant transformation, driven by technological advancements and evolving healthcare needs. As healthcare providers increasingly focus on value-based care, the integration of artificial intelligence and machine learning into CPOE systems is expected to enhance clinical decision-making. Furthermore, the growing emphasis on interoperability standards will facilitate seamless data exchange, improving patient outcomes and operational efficiency across healthcare facilities.

| Segment | Sub-Segments |

|---|---|

| By Type | Standalone CPOE Systems Integrated CPOE Systems Web-Based CPOE Systems Cloud-Based CPOE Systems |

| By End-User | Hospitals Ambulatory Surgical Centers Long-Term Care Facilities Specialty Clinics |

| By Component | Software Hardware Services |

| By Deployment Mode | On-Premise Cloud-Based |

| By Pricing Model | Subscription-Based One-Time License Fee |

| By User Type | Physicians Nurses Pharmacists |

| By Application | Medication Management Clinical Task Management Diagnostics (Lab/Radiology Orders) Patient Monitoring |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital CPOE System Implementation | 120 | IT Managers, Clinical Informatics Specialists |

| Physician User Experience | 90 | Physicians, Nurse Practitioners |

| Healthcare Administrator Insights | 60 | Hospital Administrators, Chief Information Officers |

| CPOE System Vendor Feedback | 50 | Product Managers, Sales Executives |

| Regulatory Compliance Perspectives | 40 | Compliance Officers, Quality Assurance Managers |

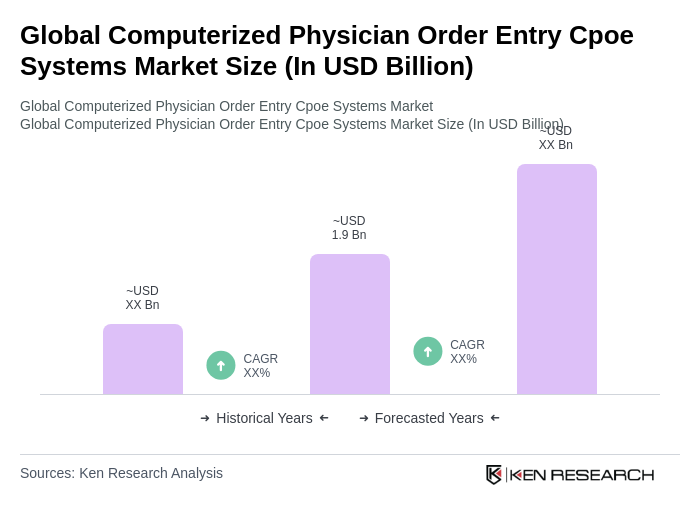

The Global CPOE Systems Market is valued at approximately USD 1.9 billion, reflecting a significant growth trend driven by the adoption of electronic health records, improved patient safety, and the demand for efficient healthcare delivery systems.