Region:Global

Author(s):Rebecca

Product Code:KRAC0297

Pages:81

Published On:August 2025

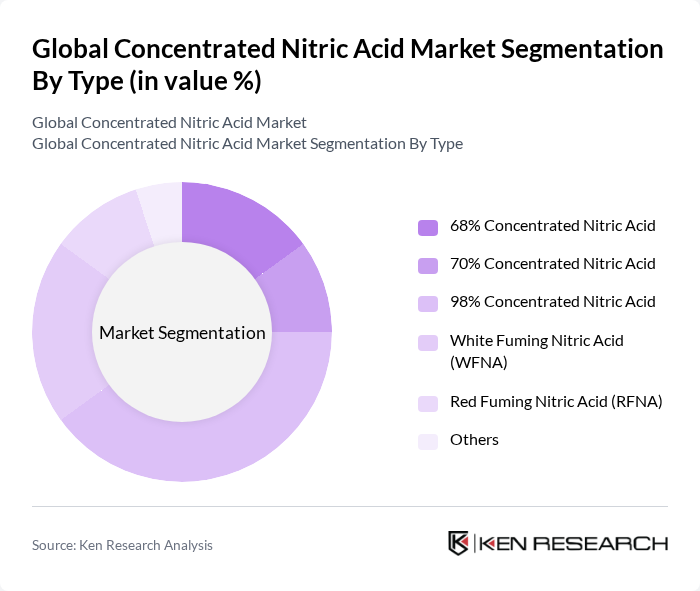

By Type:The concentrated nitric acid market is segmented into various types, including 68% Concentrated Nitric Acid, 70% Concentrated Nitric Acid, 98% Concentrated Nitric Acid, White Fuming Nitric Acid (WFNA), Red Fuming Nitric Acid (RFNA), and Others. Among these, 98% Concentrated Nitric Acid is the leading sub-segment due to its extensive use in high-purity applications, particularly in the production of explosives, fertilizers, and as an oxidizer in aerospace and defense. The demand for high-purity nitric acid is driven by its critical role in various industrial processes, including the manufacture of ammonium nitrate, adipic acid, and nitrobenzene, making it a preferred choice for manufacturers .

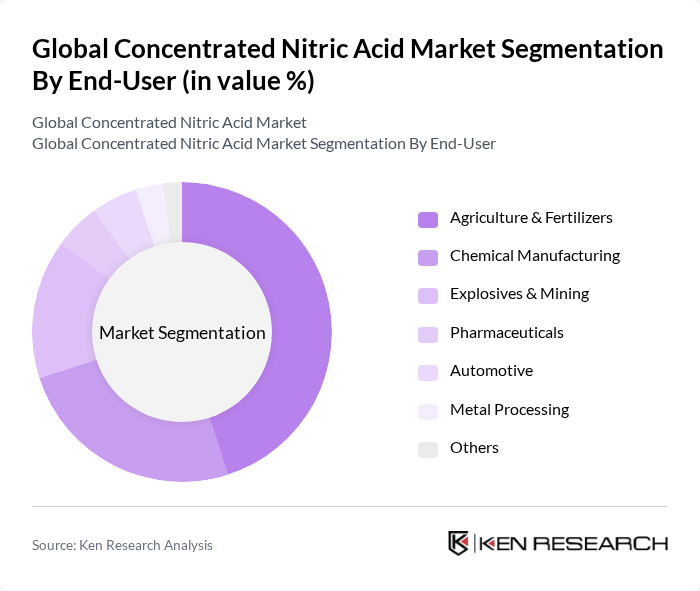

By End-User:The end-user segmentation of the concentrated nitric acid market includes Agriculture & Fertilizers, Chemical Manufacturing, Explosives & Mining, Pharmaceuticals, Automotive, Metal Processing, and Others. The Agriculture & Fertilizers segment holds the largest market share, driven by the increasing need for fertilizers in food production. The growing global population and the need for enhanced agricultural productivity are key factors propelling the demand for nitric acid in this sector. Additionally, the explosives and mining segment is expanding due to the use of nitric acid in ammonium nitrate-based explosives, while chemical manufacturing continues to be a significant end-use due to its application in the synthesis of various industrial chemicals .

The Global Concentrated Nitric Acid Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Yara International ASA, Nutrien Ltd., CF Industries Holdings, Inc., OCI N.V., LSB Industries, Inc., Eastman Chemical Company, INEOS Group Holdings S.A., Mitsubishi Gas Chemical Company, Inc., The Chemours Company, Solvay S.A., AkzoNobel N.V., Huntsman Corporation, Air Products and Chemicals, Inc., Taminco Corporation, Deepak Fertilisers and Petrochemicals Corporation Ltd., Gujarat Narmada Valley Fertilizers & Chemicals Ltd. (GNFC), Rashtriya Chemicals & Fertilizers Ltd. (RCF), Grupa Azoty S.A., EuroChem Group AG contribute to innovation, geographic expansion, and service delivery in this space .

The future of the concentrated nitric acid market appears promising, driven by the increasing focus on sustainable agricultural practices and the need for efficient chemical production. As environmental regulations tighten, companies are likely to invest in cleaner production technologies. Additionally, the growing demand for specialty chemicals and the expansion into emerging markets will create new avenues for growth. These trends indicate a dynamic market landscape, with opportunities for innovation and development in production methods.

| Segment | Sub-Segments |

|---|---|

| By Type | % Concentrated Nitric Acid % Concentrated Nitric Acid % Concentrated Nitric Acid White Fuming Nitric Acid (WFNA) Red Fuming Nitric Acid (RFNA) Others |

| By End-User | Agriculture & Fertilizers Chemical Manufacturing Explosives & Mining Pharmaceuticals Automotive Metal Processing Others |

| By Application | Fertilizers (Ammonium Nitrate, Urea Ammonium Nitrate, etc.) Explosives (ANFO, Nitro Glycerine, etc.) Metal Processing & Etching Dyes & Pigments Pharmaceuticals Rocket Propellants Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, U.K., France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia-Pacific) South America (Brazil, Argentina, Rest of South America) Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of MEA) |

| By Packaging Type | Drums Bulk Containers Cylinders Others |

| By Price Range | Low Price Mid Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Fertilizer Production | 100 | Procurement Managers, Agronomists |

| Explosives Manufacturing | 60 | Production Supervisors, Safety Officers |

| Pharmaceutical Applications | 50 | Quality Control Managers, R&D Scientists |

| Industrial Chemical Processing | 70 | Operations Managers, Chemical Engineers |

| Environmental Compliance and Regulations | 40 | Regulatory Affairs Specialists, Environmental Managers |

The Global Concentrated Nitric Acid Market is valued at approximately USD 30 billion, driven by increasing demand in sectors such as agriculture, chemical manufacturing, and explosives. This valuation is based on a comprehensive five-year historical analysis.