Region:Global

Author(s):Dev

Product Code:KRAA9645

Pages:84

Published On:November 2025

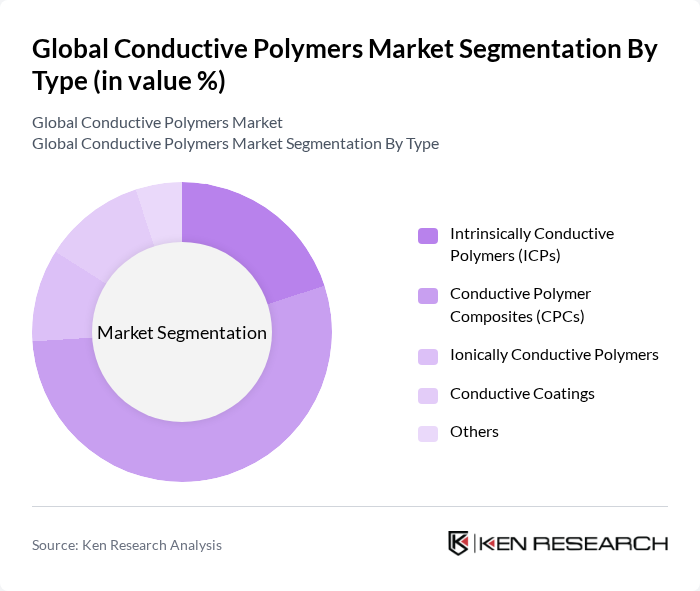

By Type:The market is segmented into various types of conductive polymers, including Intrinsically Conductive Polymers (ICPs), Conductive Polymer Composites (CPCs), Ionically Conductive Polymers, Conductive Coatings, and Others. Among these, Conductive Polymer Composites (CPCs) are currently dominating the market due to their superior mechanical integrity, ease of fabrication, and enhanced conductivity when combined with advanced fillers such as carbon nanotubes and graphene. The increasing demand for lightweight, high-performance, and multifunctional materials in electronics, automotive, and energy storage applications is further propelling the growth of this subsegment .

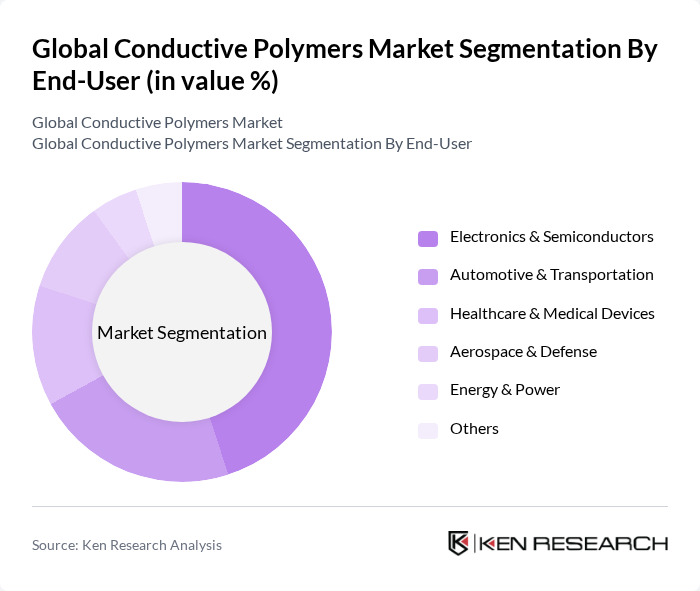

By End-User:The end-user segmentation includes Electronics & Semiconductors, Automotive & Transportation, Healthcare & Medical Devices, Aerospace & Defense, Energy & Power, and Others. The Electronics & Semiconductors segment is leading the market, driven by the rapid growth of consumer electronics, increasing integration of conductive polymers in electronic devices, and rising demand for flexible, lightweight, and miniaturized components. The automotive sector is also witnessing significant adoption of conductive polymers, especially in electric vehicles, EMI shielding, and battery technologies. Expanding applications in healthcare, such as biosensors and medical devices, further contribute to market growth .

The Global Conductive Polymers Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, DuPont de Nemours, Inc., Mitsubishi Chemical Corporation, Heraeus Holding GmbH, 3M Company, Covestro AG, Agfa-Gevaert Group, Celanese Corporation, Solvay S.A., Eastman Chemical Company, LG Chem Ltd., SABIC, Arkema S.A., Henkel AG & Co. KGaA, Hyperion Catalysis International, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the conductive polymers market appears promising, driven by technological advancements and increasing applications across various sectors. As industries prioritize lightweight and sustainable materials, the demand for conductive polymers is expected to rise. Innovations in manufacturing processes will likely enhance product performance and reduce costs, making these materials more accessible. Additionally, the integration of conductive polymers in emerging technologies, such as smart textiles and renewable energy solutions, will further solidify their market position in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Intrinsically Conductive Polymers (ICPs) Conductive Polymer Composites (CPCs) Ionically Conductive Polymers Conductive Coatings Others |

| By End-User | Electronics & Semiconductors Automotive & Transportation Healthcare & Medical Devices Aerospace & Defense Energy & Power Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Application | Anti-static Packaging & Coatings EMI Shielding Capacitors Sensors & Actuators Batteries & Energy Storage Solar Cells Printed Circuit Boards Others |

| By Material Source | Polyaniline (PANI) Polypyrrole (PPy) Poly(3,4-ethylenedioxythiophene) (PEDOT:PSS) Conductive Polymer Nanocomposites Others |

| By Processing Method | Solution Processing Melt Processing In-situ Polymerization Others |

| By Market Channel | Direct Sales Distributors Online Sales Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electronics Industry Applications | 120 | Product Managers, Design Engineers |

| Automotive Conductive Solutions | 90 | Procurement Managers, R&D Managers |

| Healthcare Device Manufacturing | 70 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Energy Storage Systems | 60 | Battery Engineers, Project Managers |

| Consumer Electronics Market | 80 | Market Analysts, Product Development Managers |

The Global Conductive Polymers Market was valued at approximately USD 5.0 billion, driven by increasing demand for advanced materials in sectors such as electronics, automotive, and healthcare, as well as the trend towards miniaturization in electronic devices.