Region:Global

Author(s):Shubham

Product Code:KRAC0695

Pages:93

Published On:August 2025

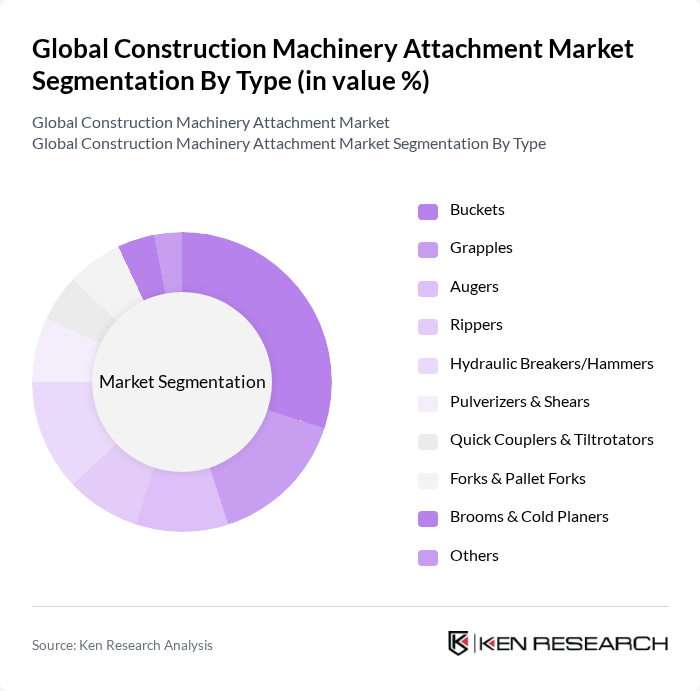

By Type:The market is segmented into various types of attachments, including buckets, grapples, augers, rippers, hydraulic breakers/hammers, pulverizers & shears, quick couplers & tiltrotators, forks & pallet forks, brooms & cold planers, and others. Among these, buckets are the most widely used due to their versatility in various construction applications, making them a dominant sub-segment .

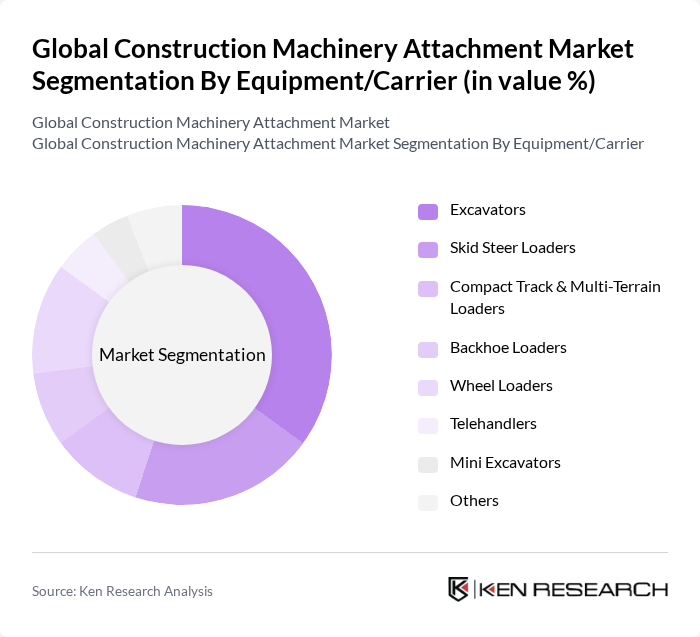

By Equipment/Carrier:The market is segmented based on the type of equipment or carrier, including excavators, skid steer loaders, compact track & multi-terrain loaders, backhoe loaders, wheel loaders, telehandlers, mini excavators, and others. Excavators are the leading equipment type, as they are widely used in various construction activities, making them a crucial segment in the market .

The Global Construction Machinery Attachment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Caterpillar Work Tools (Caterpillar Inc.), Komatsu Attachments (Komatsu Ltd.), Volvo Construction Equipment Attachments, Hitachi Construction Machinery Attachments, JCB Attachments (J.C. Bamford Excavators Ltd.), Liebherr Attachments (Liebherr Group), Epiroc Rock Drills AB (Hydraulic breakers, demolition tools), Sandvik Rock Processing Solutions (Rammer), Stanley Infrastructure (Stanley Black & Decker), Okada Aiyon Co., Ltd., Kinshofer GmbH (Including Demarec, Doherty), Rototilt Group AB, Engcon AB, Paladin Attachments (IAE Industries LLC), Bobcat Company (Doosan Bobcat), Wacker Neuson SE, Manitou Group, SANY Group, Hyundai Construction Equipment (HYUNDAI Doosan Infracore), CASE Construction Equipment (CNH Industrial), Takeuchi Manufacturing Co., Ltd., XCMG (Xuzhou Construction Machinery Group) Attachments, JLG Industries, Inc. (Attachment accessories), Caterpillar-Authorized Work Tool Dealers (Aggregated), MB Crusher S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the construction machinery attachment market appears promising, driven by ongoing technological advancements and a shift towards sustainable practices. As urbanization accelerates, the demand for efficient and eco-friendly construction solutions will likely increase. Additionally, the integration of smart technologies and IoT in machinery is expected to enhance operational efficiency. Companies that invest in innovation and sustainability will be well-positioned to capitalize on emerging opportunities in this evolving landscape, ensuring long-term growth and competitiveness.

| Segment | Sub-Segments |

|---|---|

| By Type | Buckets Grapples Augers Rippers Hydraulic Breakers/Hammers Pulverizers & Shears Quick Couplers & Tiltrotators Forks & Pallet Forks Brooms & Cold Planers Others |

| By Equipment/Carrier | Excavators Skid Steer Loaders Compact Track & Multi-Terrain Loaders Backhoe Loaders Wheel Loaders Telehandlers Mini Excavators Others |

| By Application | Excavation & Earthmoving Material Handling Site Preparation & Roadwork Demolition & Recycling Landscaping & Forestry Concrete & Utility Others |

| By End-User | Construction Contractors Rental Companies Mining & Quarrying Municipalities & Utilities Agriculture Oil & Gas/Pipeline Others |

| By Sales Channel | OEM (Factory-Fit/Dealer Installed) Aftermarket/Independent Dealers Online Sales Rental Services Others |

| By Distribution Mode | Dealer/Distributor Network Direct Sales E-commerce Auction Platforms Others |

| By Price Range | Low-End Mid-Range High-End |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Equipment Rental Companies | 100 | Fleet Managers, Rental Operations Directors |

| Heavy Machinery Manufacturers | 80 | Product Development Managers, Sales Executives |

| Construction Project Managers | 120 | Site Managers, Project Coordinators |

| Agricultural Machinery Users | 70 | Farm Equipment Operators, Agricultural Engineers |

| Mining Equipment Operators | 90 | Operations Managers, Safety Officers |

The Global Construction Machinery Attachment Market is valued at approximately USD 7 billion, driven by increasing demand for construction and infrastructure development, along with the adoption of advanced machinery that enhances operational efficiency.