Region:Global

Author(s):Shubham

Product Code:KRAA1706

Pages:94

Published On:August 2025

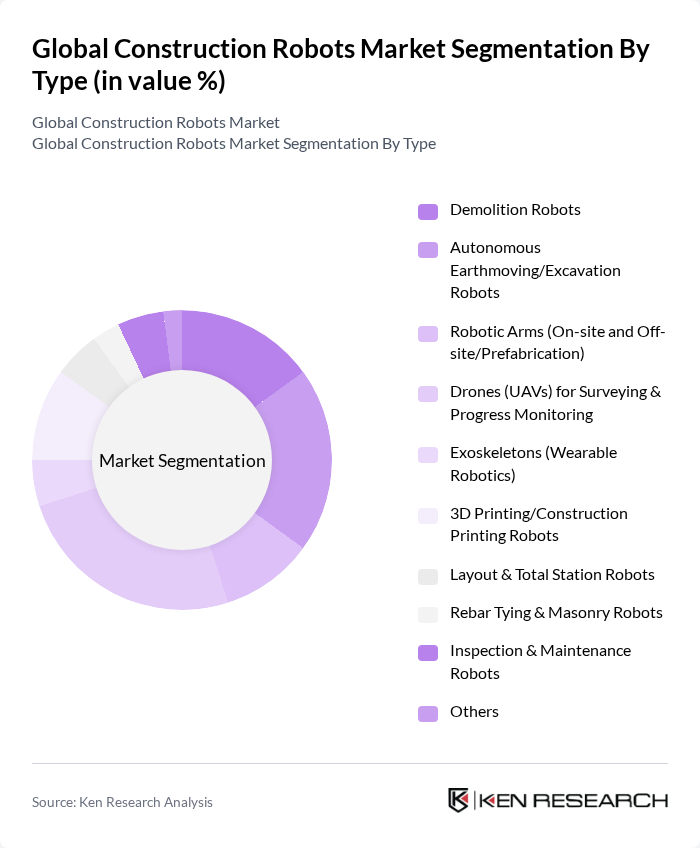

By Type:The market is segmented into various types of construction robots, each serving distinct functions within the construction process. The subsegments include Demolition Robots, Autonomous Earthmoving/Excavation Robots, Robotic Arms (On-site and Off-site/Prefabrication), Drones (UAVs) for Surveying & Progress Monitoring, Exoskeletons (Wearable Robotics), 3D Printing/Construction Printing Robots, Layout & Total Station Robots, Rebar Tying & Masonry Robots, Inspection & Maintenance Robots, and Others. Among these, Drones for Surveying & Progress Monitoring have gained significant traction for site mapping, progress tracking, and safety inspections due to faster data capture, lower operating costs, and reduced exposure to hazardous environments.

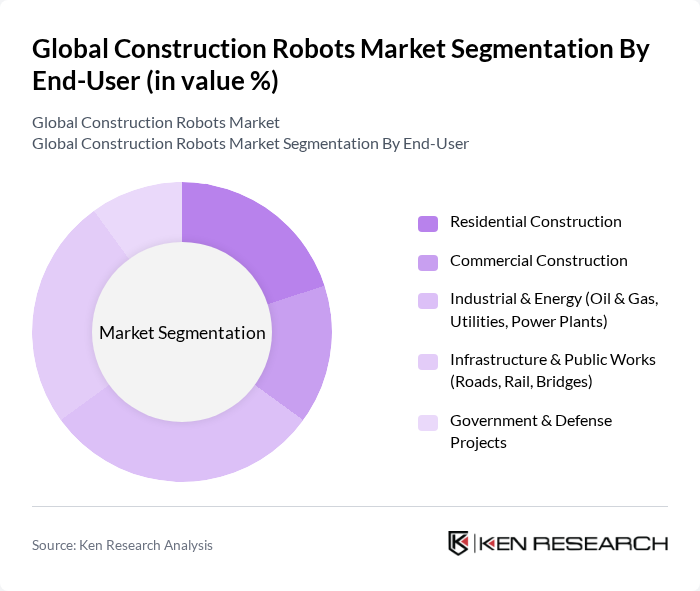

By End-User:The end-user segmentation includes Residential Construction, Commercial Construction, Industrial & Energy (Oil & Gas, Utilities, Power Plants), Infrastructure & Public Works (Roads, Rail, Bridges), and Government & Defense Projects. The Industrial & Energy sector is a leading adopter for tasks in hazardous or hard-to-access environments, where robots enhance safety, repeatability, and uptime across inspection, demolition, autonomous earthmoving for energy projects, and layout.

The Global Construction Robots Market is characterized by a dynamic mix of regional and international players. Leading participants such as Boston Dynamics (Spot), Built Robotics, Komatsu Ltd., Caterpillar Inc., CYBERDYNE Inc., FBR Ltd (formerly Fastbrick Robotics), Hilti Group (Jaibot), KUKA AG, ABB Ltd., Yaskawa Electric Corporation, Doosan Robotics Inc., Brokk AB, DJI Technology Co., Ltd., Trimble Inc., TyBOT (Advanced Construction Robotics, Inc.), Dusty Robotics, Exyn Technologies, Sarcos Technology and Robotics Corporation, ICON Technology, Inc., Construction Robotics LLC (SAM100) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the construction robots market appears promising, driven by ongoing technological advancements and increasing demand for automation. As companies seek to enhance productivity and address labor shortages, the integration of AI and machine learning into robotic systems will likely become more prevalent. Additionally, the trend towards modular construction and smart construction sites will further propel the adoption of robotics, creating a more efficient and sustainable construction environment in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Demolition Robots Autonomous Earthmoving/Excavation Robots Robotic Arms (On-site and Off-site/Prefabrication) Drones (UAVs) for Surveying & Progress Monitoring Exoskeletons (Wearable Robotics) D Printing/Construction Printing Robots Layout & Total Station Robots Rebar Tying & Masonry Robots Inspection & Maintenance Robots Others |

| By End-User | Residential Construction Commercial Construction Industrial & Energy (Oil & Gas, Utilities, Power Plants) Infrastructure & Public Works (Roads, Rail, Bridges) Government & Defense Projects |

| By Application | Site Surveying & Layout Earthmoving & Excavation Material Handling & Logistics Demolition & Nuclear Dismantling Concrete, Masonry & Rebar Work D Printing/On-site Fabrication Inspection, Monitoring & Progress Documentation Safety, Cleaning & Maintenance |

| By Component | Hardware (Sensors, Controllers, Actuators, Powertrain) Software (Autonomy, Navigation, BIM Integration) Services (Deployment, Training, Maintenance, RaaS) |

| By Sales Channel | Direct (OEM to Contractor/Owner) Distributors/Value-Added Resellers Online/Marketplace |

| By Distribution Mode | Project-Based (Direct to Project/Jobsite) Fleet/Equipment Rental E-commerce |

| By Price Range | Entry-Level (? USD 25,000) Mid-Range (USD 25,001–250,000) High-End (? USD 250,001) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Robotics | 120 | Project Managers, Site Engineers |

| Commercial Construction Automation | 90 | Construction Executives, Technology Officers |

| Infrastructure Robotics Applications | 80 | Urban Planners, Civil Engineers |

| Robotic Process Automation in Construction | 60 | IT Managers, Automation Specialists |

| Robotics in Construction Safety Management | 100 | Safety Officers, Compliance Managers |

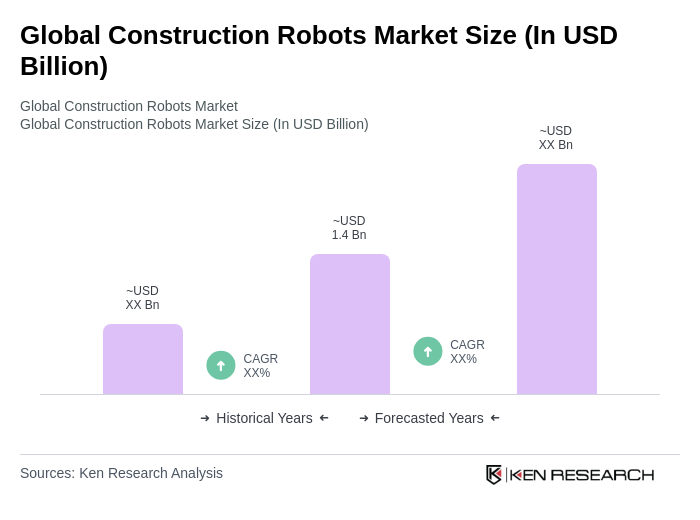

The Global Construction Robots Market is valued at approximately USD 1.4 billion, driven by the increasing demand for automation to enhance efficiency, safety, and productivity in construction processes amidst labor shortages and stringent safety regulations.