Region:Global

Author(s):Shubham

Product Code:KRAA1845

Pages:90

Published On:August 2025

By Type:The market is segmented into various types, including Smart Home Devices, Wearable Devices, Connected Consumer Electronics, Health & Wellness Devices, Smart Appliances, Connected Vehicles & Infotainment, and Others.Smart Home Devicesare leading due to widespread use of smart speakers, security cameras, lighting, and thermostats that integrate with voice assistants and home platforms to boost convenience and energy efficiency .Wearable Devicesare gaining strong traction for health and fitness monitoring (heart rate, sleep, activity), benefiting from sensor advances and integration with healthcare and sports use cases .

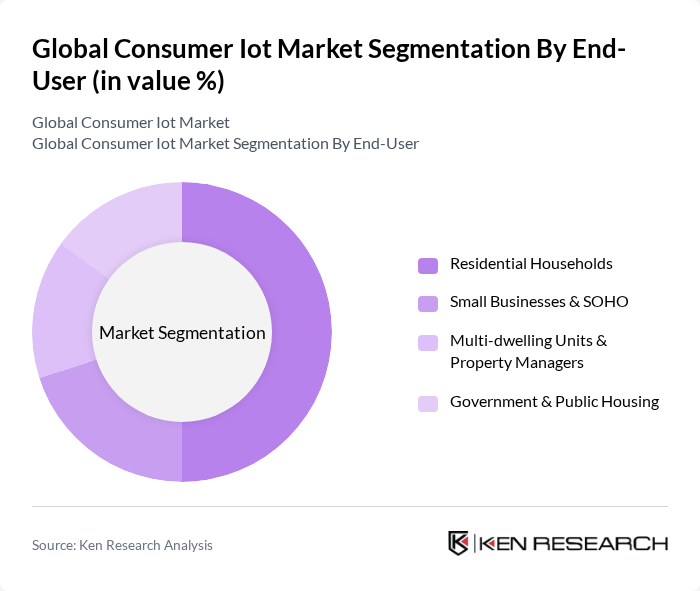

By End-User:The end-user segmentation includes Residential Households, Small Businesses & SOHO, Multi-dwelling Units & Property Managers, and Government & Public Housing.Residential Householdsdominate due to rapid uptake of smart speakers, security systems, lighting, and thermostats for convenience, energy savings, and home safety.Small Businesses & SOHOincreasingly deploy connected cameras, routers, and environmental sensors to improve efficiency, security, and customer experience .

The Global Consumer IoT Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon.com, Inc., Google LLC (Nest), Apple Inc., Samsung Electronics Co., Ltd., Signify N.V. (Philips Hue), Xiaomi Corporation, TP-Link Technologies Co., Ltd., Huawei Technologies Co., Ltd., Bosch Smart Home GmbH, LG Electronics Inc., Sony Group Corporation, Fitbit LLC (Google), Honeywell Home (Resideo Technologies, Inc.), Cisco Systems, Inc., Arlo Technologies, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the consumer IoT market appears promising, driven by technological advancements and increasing consumer engagement. As smart home devices and wearables become more integrated into daily life, the demand for seamless connectivity will rise. Furthermore, the expansion of 5G networks will enhance device interoperability, paving the way for innovative applications. Companies that prioritize security and user education will likely gain a competitive edge, fostering a more robust IoT ecosystem that addresses consumer concerns while capitalizing on emerging trends.

| Segment | Sub-Segments |

|---|---|

| By Type | Smart Home Devices (smart speakers, lighting, thermostats, security cameras, smart TVs) Wearable Devices (smartwatches, fitness bands, hearables, AR/VR) Connected Consumer Electronics (streaming devices, gaming consoles, routers) Health & Wellness Devices (smart scales, BP/glucose monitors, sleep trackers) Smart Appliances (connected refrigerators, washers, ovens, robot vacuums) Connected Vehicles & Infotainment (in-vehicle assistants, dongles, eCall) Others (pet trackers, kids trackers, personal safety devices) |

| By End-User | Residential Households Small Businesses & SOHO Multi-dwelling Units & Property Managers Government & Public Housing |

| By Application | Home Automation & Control Health, Fitness & Personal Safety Home Security & Surveillance Energy Management & Smart Lighting Entertainment & Digital Lifestyle |

| By Distribution Channel | Online Retail & Marketplaces Offline Retail (electronics, carriers, big-box) Direct-to-Consumer & Subscription |

| By Consumer Demographics | Age Group (Gen Z, Millennials, Gen X, Boomers) Income Level (Mass, Affluent, Premium) Geographic Location (Urban, Suburban, Rural) |

| By Pricing Strategy | Premium & Ecosystem Lock-in Mid-tier Value Entry-level & Bundled |

| By Technology Integration | Connectivity (Wi?Fi, Bluetooth/BLE, Zigbee/Z?Wave/Thread, Cellular, UWB) AI & Voice Assistants (Alexa, Google Assistant, Siri) Cloud & Edge Computing Interoperability Standards (Matter, HomeKit, SmartThings) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smart Home Device Users | 120 | Homeowners, Tech Enthusiasts |

| Wearable Technology Consumers | 100 | Fitness Enthusiasts, Health-Conscious Individuals |

| Connected Appliance Owners | 80 | Household Managers, Early Adopters |

| IoT Security Device Users | 70 | Security-Conscious Consumers, Tech-Savvy Individuals |

| Smart Wearable Health Device Users | 90 | Patients with Chronic Conditions, Caregivers |

The Global Consumer IoT Market is valued at approximately USD 240 billion, reflecting significant adoption of smart home devices, wearables, and connected consumer electronics, which enhance convenience and efficiency in daily life.