Region:Global

Author(s):Dev

Product Code:KRAB0524

Pages:97

Published On:August 2025

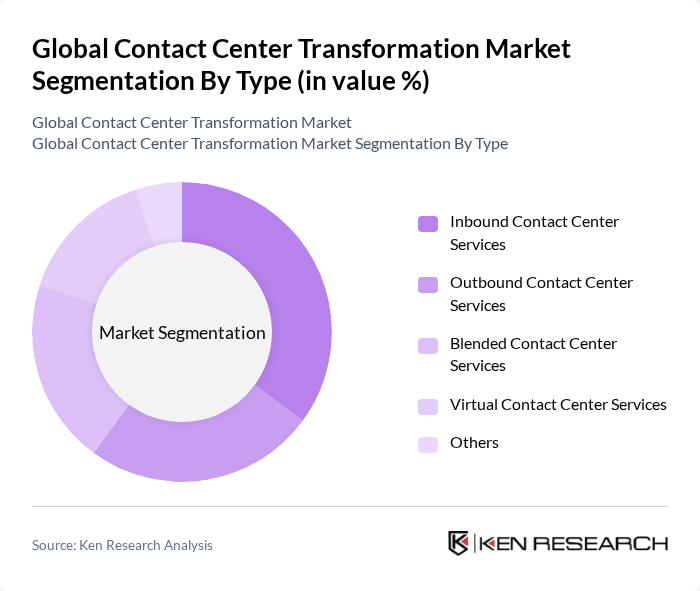

By Type:The market is segmented into various types, including Inbound Contact Center Services, Outbound Contact Center Services, Blended Contact Center Services, Virtual Contact Center Services, and Others. Each of these sub-segments plays a crucial role in addressing different customer needs and operational efficiencies.

The Inbound Contact Center Services segment dominates the market due to the increasing need for customer support, service inquiries, and resolution at scale. Businesses are focusing on enhancing customer satisfaction through effective inbound and self-service strategies—including AI-driven IVR, ASR, chatbots, and knowledge systems—which has led to higher demand for these services. The trend of personalized interactions, first-contact resolution, and retention-focused CX further reinforces this segment’s leadership.

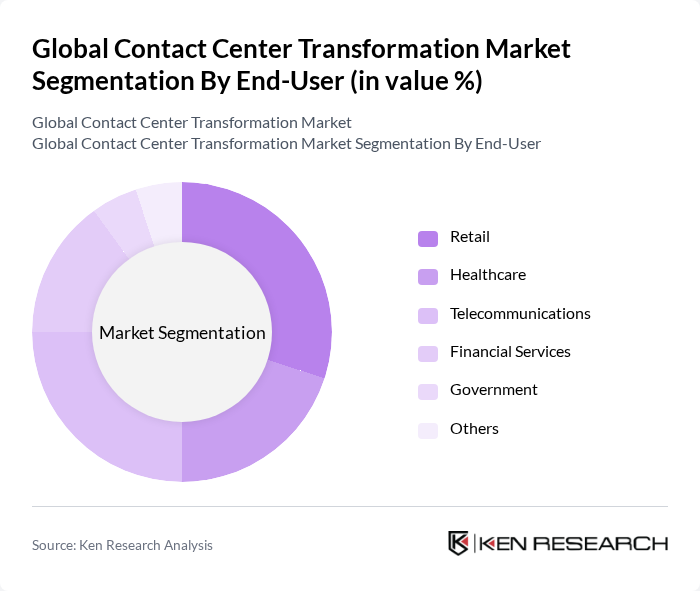

By End-User:The market is segmented by end-users, including Retail, Healthcare, Telecommunications, Financial Services, Government, and Others. Each sector has unique requirements and challenges that influence their contact center strategies.

The Retail sector is the leading end-user in the contact center transformation market, driven by the need for efficient customer service and support during peak shopping seasons. The rise of e-commerce has further intensified the demand for robust contact center solutions to handle inquiries, complaints, and order tracking, making retail a critical segment for growth.

The Global Contact Center Transformation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Genesys, Cisco Systems, Inc., Avaya LLC, NICE Ltd., Five9, Inc., Talkdesk, Inc., Zendesk, Inc., RingCentral, Inc., 8x8, Inc., Mitel Networks Corporation, Alvaria, Inc. (formerly Aspect Software), Freshworks Inc., Twilio Inc., Verint Systems Inc., SAP SE, Amazon Web Services, Inc. (Amazon Connect), Microsoft Corporation (Dynamics 365 Customer Service), Google Cloud (Contact Center AI) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the contact center transformation market is poised for significant evolution, driven by technological advancements and changing consumer expectations. As businesses increasingly adopt AI and automation, the focus will shift towards enhancing customer interactions through personalized experiences. Additionally, the integration of advanced analytics will enable organizations to better understand customer behavior, leading to more effective engagement strategies. This transformation will be crucial for maintaining competitiveness in a rapidly evolving market landscape, particularly in regions with high digital adoption rates.

| Segment | Sub-Segments |

|---|---|

| By Type | Inbound Contact Center Services Outbound Contact Center Services Blended Contact Center Services Virtual Contact Center Services Others |

| By End-User | Retail Healthcare Telecommunications Financial Services Government Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Service Model | Managed Services Professional Services |

| By Industry Vertical | E-commerce Travel and Hospitality Education Utilities |

| By Customer Interaction Channel | Voice Chat Social Media |

| By Pricing Model | Subscription-Based (per seat/user/month) Consumption-Based (usage/volume-based, minutes/messages/API calls) Outcome-Based (per resolved interaction/per SLA tier) License + Maintenance (perpetual/on-premises) Freemium and Tiered Plans (SMB-focused) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecom Customer Support | 150 | Customer Service Managers, Operations Directors |

| Financial Services Call Centers | 100 | Compliance Officers, Call Center Supervisors |

| E-commerce Customer Interaction | 120 | eCommerce Managers, Customer Experience Leaders |

| Healthcare Contact Centers | 90 | Healthcare Administrators, Patient Service Managers |

| Travel and Hospitality Support | 80 | Reservation Managers, Customer Service Agents |

The Global Contact Center Transformation Market is valued at approximately USD 40 billion, driven by the increasing demand for enhanced customer experiences and the integration of advanced technologies like AI and cloud automation in customer service operations.