Region:Global

Author(s):Rebecca

Product Code:KRAD6298

Pages:100

Published On:December 2025

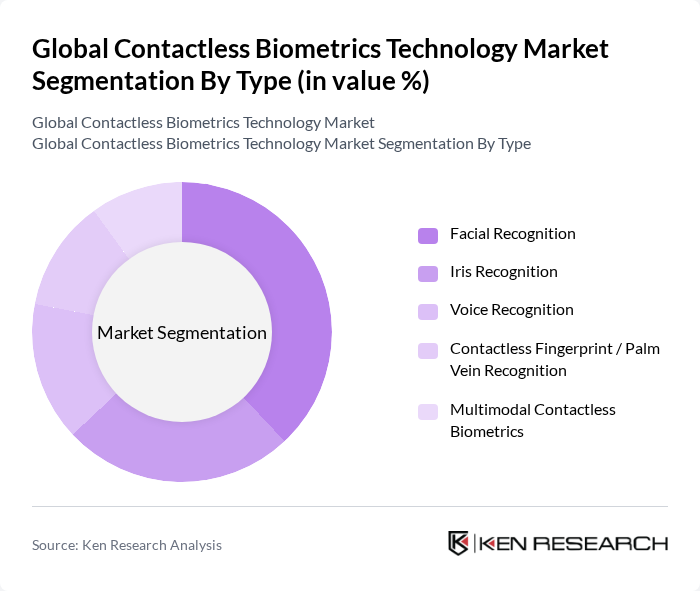

By Type:The contactless biometrics technology market is segmented into various types, including facial recognition, iris recognition, voice recognition, contactless fingerprint/palm vein recognition, and multimodal contactless biometrics. Among these, facial recognition is the most widely adopted due to its ease of use and integration into existing systems. The demand for iris recognition is also growing, particularly in high-security applications, while voice recognition is gaining traction in consumer electronics.

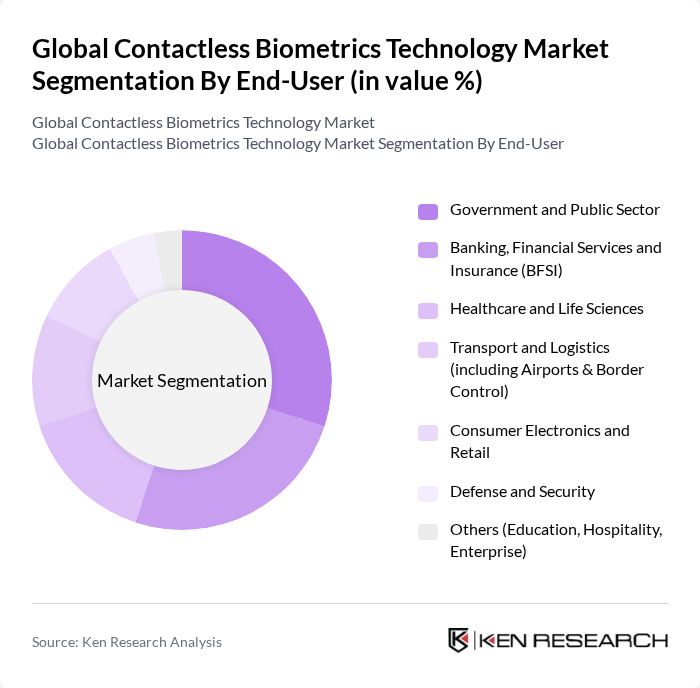

By End-User:The end-user segmentation includes government and public sector, banking, financial services and insurance (BFSI), healthcare and life sciences, transport and logistics, consumer electronics and retail, defense and security, and others. The government and public sector segment leads the market due to the increasing need for secure identification systems in public services and law enforcement. The BFSI sector is also a significant contributor, driven by the need for secure transactions and identity verification.

The Global Contactless Biometrics Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as NEC Corporation, Thales Group, IDEMIA, HID Global Corporation, Suprema Inc., Aware, Inc., Precise Biometrics AB, Fingerprint Cards AB, ZKTeco Co., Ltd., NEC Smart Face (NEC’s NeoFace Solutions), Cognitec Systems GmbH, Innovatrics s.r.o., VisionLabs B.V., Daon, Inc., Veridium Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

As the demand for contactless solutions continues to rise, the contactless biometrics market is expected to evolve significantly. Innovations in artificial intelligence and machine learning will enhance the capabilities of biometric systems, making them more efficient and user-friendly. Additionally, the integration of these technologies with IoT devices will create new applications across various sectors, including healthcare and security, further driving market growth and adoption in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Facial Recognition Iris Recognition Voice Recognition Contactless Fingerprint / Palm Vein Recognition Multimodal Contactless Biometrics |

| By End-User | Government and Public Sector Banking, Financial Services and Insurance (BFSI) Healthcare and Life Sciences Transport and Logistics (including Airports & Border Control) Consumer Electronics and Retail Defense and Security Others (Education, Hospitality, Enterprise) |

| By Application | Physical and Logical Access Control Identity Verification, KYC and eKYC Border Control and Immigration Payments and Transactions Authentication Time and Attendance Management Surveillance and Law Enforcement Others |

| By Technology | D Facial and Iris Recognition D and Depth-Sensing Recognition Thermal and Infrared Imaging Behavioral Biometrics (Gait, Typing, Device Interaction) AI-driven Multimodal Fusion and Liveness Detection |

| By Deployment Mode | On-Premises Cloud-Based Hybrid Edge / Embedded Deployment |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Policy Support | Government Grants Tax Incentives Research and Development Support Digital Identity and e-Governance Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Biometric Implementations | 100 | IT Managers, Security Officers |

| Healthcare Biometric Applications | 80 | Healthcare Administrators, IT Directors |

| Government Identity Verification Systems | 70 | Policy Makers, IT Security Managers |

| Retail Customer Authentication Solutions | 90 | Operations Managers, Customer Experience Directors |

| Security and Surveillance Biometric Technologies | 75 | Security Managers, Technology Consultants |

The Global Contactless Biometrics Technology Market is valued at approximately USD 21 billion, reflecting significant growth driven by the demand for secure identification methods across various sectors, including government, healthcare, and finance.