Region:Global

Author(s):Geetanshi

Product Code:KRAB0129

Pages:88

Published On:August 2025

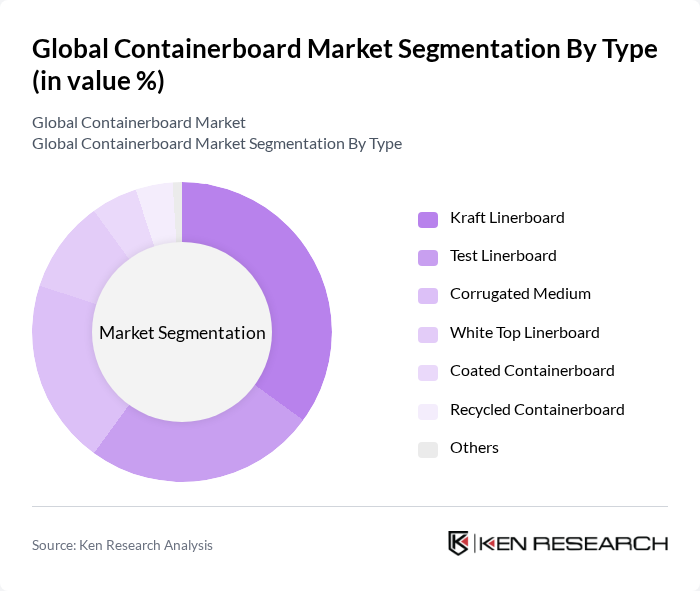

By Type:The containerboard market is segmented into Kraft Linerboard, Test Linerboard, Corrugated Medium, White Top Linerboard, Coated Containerboard, Recycled Containerboard, and Others. Kraft Linerboard is primarily used for the outer layers of corrugated boxes due to its strength and durability. Test Linerboard, made from recycled fibers, serves as a cost-effective alternative for less demanding applications. Corrugated Medium forms the fluted inner layer, providing cushioning and rigidity. White Top Linerboard offers a printable surface for high-quality graphics. Coated Containerboard is used for enhanced printability and moisture resistance. Recycled Containerboard is increasingly favored for its sustainability, and the "Others" category includes specialty grades for niche applications .

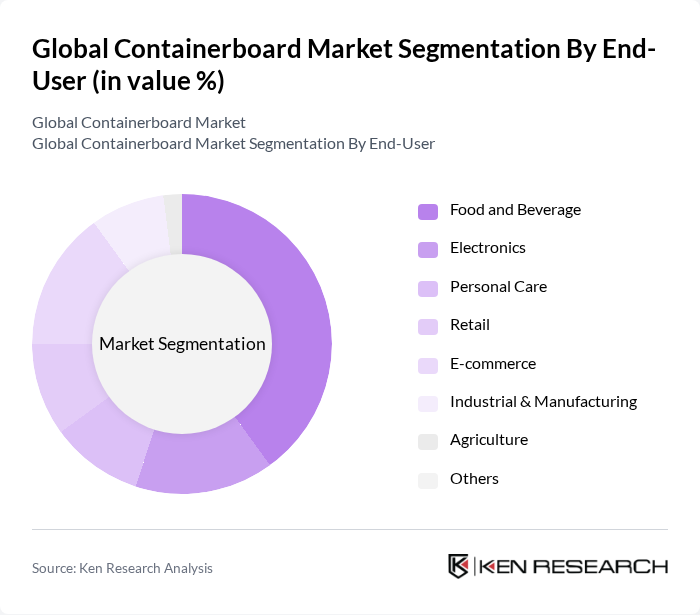

By End-User:The end-user segmentation includes Food and Beverage, Electronics, Personal Care, Retail, E-commerce, Industrial & Manufacturing, Agriculture, and Others. The Food and Beverage sector dominates due to stringent hygiene standards and the need for durable, moisture-resistant packaging. Electronics require protective packaging for safe transit. Personal Care and Retail sectors demand visually appealing and sustainable packaging. E-commerce drives demand for lightweight, sturdy, and customizable solutions. Industrial & Manufacturing prioritize strength and stackability, while Agriculture needs breathable and robust packaging for produce. "Others" encompasses pharmaceuticals and specialty goods .

The Global Containerboard Market is characterized by a dynamic mix of regional and international players. Leading participants such as International Paper Company, WestRock Company, Smurfit Kappa Group plc, Mondi Group plc, DS Smith Plc, Stora Enso Oyj, Packaging Corporation of America, Georgia-Pacific LLC, Nippon Paper Industries Co., Ltd., Sappi Limited, Oji Holdings Corporation, Nine Dragons Paper Holdings Limited, Pratt Industries, Inc., Cascades Inc., Sonoco Products Company, Lee & Man Paper Manufacturing Ltd., Shanying International Holdings Co., Ltd., and Sealed Air Corporation contribute to innovation, geographic expansion, and service delivery in this space .

The future of the containerboard market appears promising, driven by ongoing trends in sustainability and technological advancements. As companies increasingly adopt eco-friendly practices, the demand for recyclable materials is expected to rise. Additionally, innovations in digital printing and smart packaging technologies will enhance product differentiation and consumer engagement. The integration of IoT in packaging solutions will further streamline operations, providing real-time data and improving supply chain efficiency, ultimately shaping a more sustainable and efficient market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Kraft Linerboard Test Linerboard Corrugated Medium White Top Linerboard Coated Containerboard Recycled Containerboard Others |

| By End-User | Food and Beverage Electronics Personal Care Retail E-commerce Industrial & Manufacturing Agriculture Others |

| By Application | Packaging Shipping Storage Display & Promotional Packaging Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Third-Party Logistics Providers Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Mid Price High Price |

| By Sustainability Level | Recyclable Biodegradable FSC/PEFC Certified Conventional |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Packaging Sector | 120 | Packaging Engineers, Product Development Managers |

| Consumer Goods Packaging | 90 | Supply Chain Managers, Brand Managers |

| Industrial Applications | 60 | Procurement Officers, Operations Managers |

| Sustainability Initiatives | 50 | Sustainability Officers, Corporate Social Responsibility Managers |

| E-commerce Packaging Solutions | 70 | Logistics Coordinators, Fulfillment Center Managers |

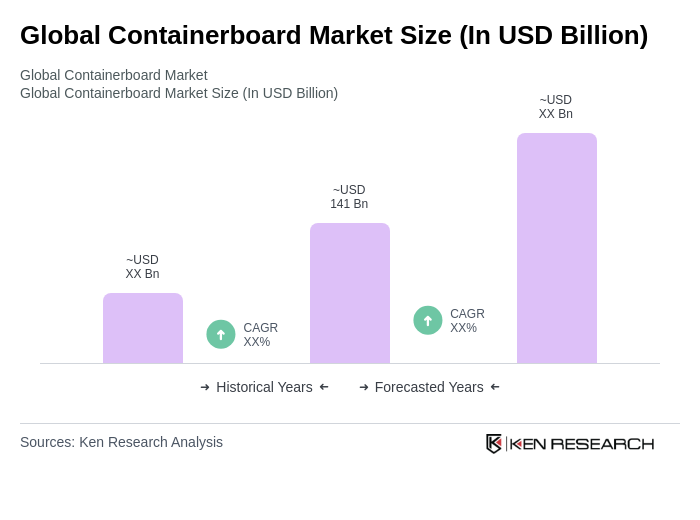

The Global Containerboard Market is valued at approximately USD 141 billion, driven by the increasing demand for sustainable packaging solutions, the growth of e-commerce, and a focus on recycling and waste reduction.