Region:Global

Author(s):Dev

Product Code:KRAC0477

Pages:82

Published On:August 2025

By Type:The cookies market is segmented into various types, including Drop Cookies, Sandwich Cookies, Bar Cookies, Molded Cookies, Rolled Cookies, No-Bake Cookies, Functional Cookies, Premium Cookies, and Others. Among these, Drop Cookies, particularly Chocolate Chip, are the most popular due to their classic appeal and widespread availability. The trend towards healthier options has also led to a rise in Functional Cookies, which cater to dietary preferences such as gluten-free and high-protein options.

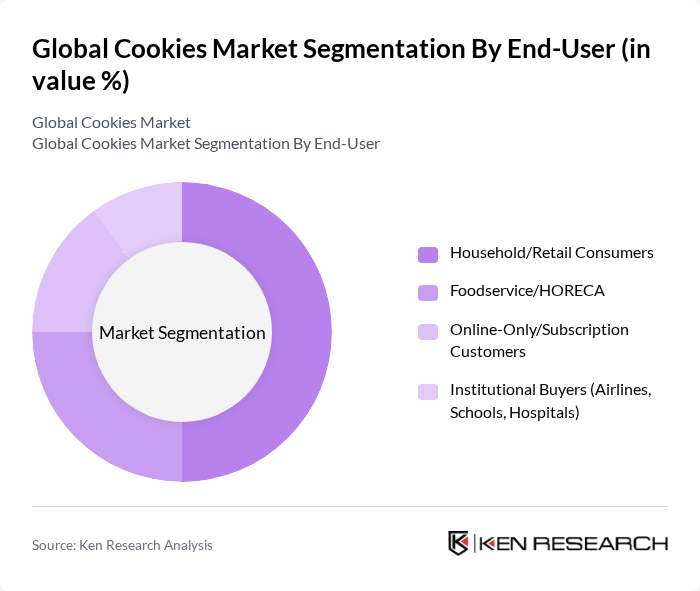

By End-User:The cookies market is segmented by end-user into Household/Retail Consumers, Foodservice/HORECA, Online-Only/Subscription Customers, and Institutional Buyers. The Household/Retail Consumers segment dominates the market, driven by the increasing trend of snacking at home and the availability of a wide variety of cookie products in retail outlets. The rise of e-commerce has also significantly boosted the Online-Only/Subscription segment, catering to consumers seeking convenience.

The Global Cookies Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mondel?z International, Inc., Nestlé S.A., Kellogg Company (Kellanova), General Mills, Inc., Pepperidge Farm, Inc. (Campbell Soup Company), Grupo Bimbo, S.A.B. de C.V., Yildiz Holding A.?. (Ülker; GODIVA; Pladis – McVitie’s), Britannia Industries Limited, Parle Products Pvt. Ltd., ITC Limited (Sunfeast), Lotus Bakeries NV, Bahlsen GmbH & Co. KG, Barilla G. e R. Fratelli S.p.A. (Mulino Bianco; Pavesi), PT Mayora Indah Tbk, LU Biscuits (Mondel?z International) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cookies market appears promising, driven by evolving consumer preferences and innovative product offerings. As health-conscious trends continue to rise, manufacturers are likely to focus on developing healthier cookie options, catering to the growing demand for nutritious snacks. Additionally, the expansion into emerging markets presents significant growth potential, as rising disposable incomes and changing lifestyles create new opportunities for cookie brands to establish a foothold in these regions.

| Segment | Sub-Segments |

|---|---|

| By Type | Drop Cookies (e.g., Chocolate Chip) Sandwich Cookies/Creme-Filled Bar Cookies/Brownie-Type Molded/Pressed Cookies Rolled/Cut-Out Cookies No-Bake/Refrigerated/Chilled Dough Functional & Better-For-You (Gluten-Free, High-Protein, Low/No Sugar) Premium/Artisanal & Organic Others |

| By End-User | Household/Retail Consumers Foodservice/HORECA Online-Only/Subscription Customers Institutional Buyers (Airlines, Schools, Hospitals) |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience & Traditional Grocery Stores Online Retail/E-commerce & D2C Specialist/Specialty & Gourmet Stores Club/Wholesale & Cash-and-Carry |

| By Packaging Type | Flexible Packs/Flow Wraps & Resealable Bags Boxes/Cartons & Trays Tins/Gift Packs Bulk/Institutional Packaging |

| By Flavor | Chocolate & Double Chocolate Vanilla/Butter & Shortbread Peanut Butter & Nut-Based Fruit, Spiced, and Specialty (e.g., Ginger, Matcha) |

| By Price Range | Economy Mid-Range/Mass Premium Premium/Super-Premium |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Cookie Sales | 150 | Category Managers, Retail Buyers |

| Consumer Preferences in Cookies | 150 | General Consumers, Health-Conscious Shoppers |

| Cookie Production Insights | 100 | Production Managers, Quality Control Officers |

| Market Trends in Gluten-Free Cookies | 80 | Product Developers, Nutritionists |

| Distribution Channel Analysis | 120 | Logistics Managers, Supply Chain Analysts |

The Global Cookies Market is valued at approximately USD 43 billion, reflecting a significant growth trend driven by consumer demand for convenient snack options and innovative product offerings catering to health-conscious consumers.