Region:Global

Author(s):Rebecca

Product Code:KRAA1464

Pages:98

Published On:August 2025

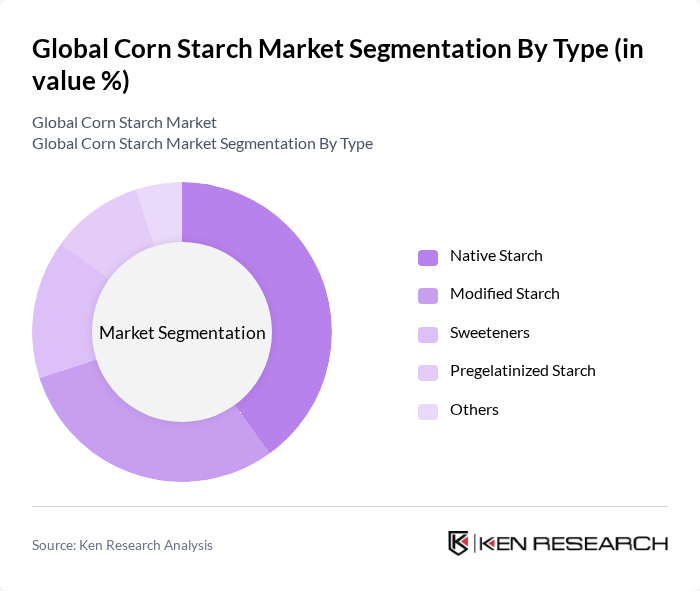

By Type:The corn starch market is segmented into various types, including Native Starch, Modified Starch, Sweeteners, Pregelatinized Starch, and Others. Each type serves distinct applications and industries, catering to diverse consumer needs. Native starch is widely used in food products for its thickening and stabilizing properties, while modified starch finds applications in pharmaceuticals, chemicals, and industrial processes due to its enhanced functionality. Sweeteners derived from corn starch, such as glucose and high fructose corn syrup, are increasingly popular in the food and beverage sector, reflecting changing consumer preferences for alternative sweetening agents.

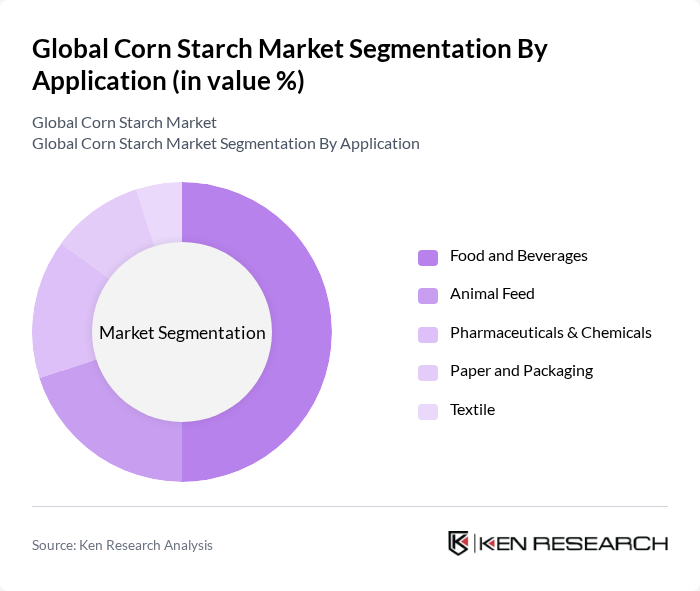

By Application:The applications of corn starch are diverse, including Food and Beverages, Animal Feed, Pharmaceuticals & Chemicals, Paper and Packaging, Textile, and Others. The food and beverage sector is the largest consumer of corn starch, driven by its use as a thickening agent, stabilizer, and texturizer in processed foods, dairy products, sauces, and confectionery. The pharmaceutical industry utilizes corn starch for its binding and disintegrant properties in tablet formulations, while the paper and packaging sector benefits from its biodegradable and adhesive characteristics. Corn starch is also increasingly used in textiles and animal feed, reflecting its versatility across industries.

The Global Corn Starch Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cargill, Incorporated, Archer Daniels Midland Company (ADM), Ingredion Incorporated, Tate & Lyle PLC, Roquette Frères S.A., Global Bio-Chem Technology Group Company Limited, Bunge Limited, Emsland Group, Universal Starch-Chem Allied Ltd., Sweetener Supply Corporation, AGRANA Beteiligungs-AG, Nisshin Seifun Group Inc., Tereos S.A., Zhucheng Xingmao Corn Developing Co., Ltd., COFCO Biochemical (Anhui) Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the corn starch market appears promising, driven by increasing consumer preferences for sustainable and health-oriented products. Innovations in starch modification techniques are expected to enhance product functionality, catering to diverse applications across industries. Additionally, the expansion into emerging markets, particularly in Asia-Pacific and Latin America, will provide new growth avenues. As consumers increasingly seek clean label products, manufacturers will need to adapt to these trends to maintain competitiveness and market relevance.

| Segment | Sub-Segments |

|---|---|

| By Type | Native Starch Modified Starch Sweeteners Pregelatinized Starch Others |

| By Application | Food and Beverages Animal Feed Pharmaceuticals & Chemicals Paper and Packaging Textile Others |

| By End-User | Food and Beverage Industry Industrial Applications Pharmaceutical Industry Animal Feed Industry Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, France, UK, Spain, Italy, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, Australia, Rest of APAC) Latin America (Brazil, Mexico, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| By Packaging Type | Bulk Packaging Retail Packaging Custom Packaging |

| By Price Range | Economy Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Manufacturers | 100 | Product Development Managers, Quality Assurance Specialists |

| Pharmaceutical Companies | 60 | Formulation Scientists, Regulatory Affairs Managers |

| Industrial Applications | 50 | Process Engineers, Supply Chain Managers |

| Agricultural Producers | 40 | Corn Farmers, Agronomists |

| Research Institutions | 40 | Market Analysts, Agricultural Researchers |

The Global Corn Starch Market is valued at approximately USD 29 billion, reflecting a robust growth trajectory driven by increasing demand across various sectors, including food, pharmaceuticals, and industrial applications.