Region:Global

Author(s):Geetanshi

Product Code:KRAA1234

Pages:83

Published On:August 2025

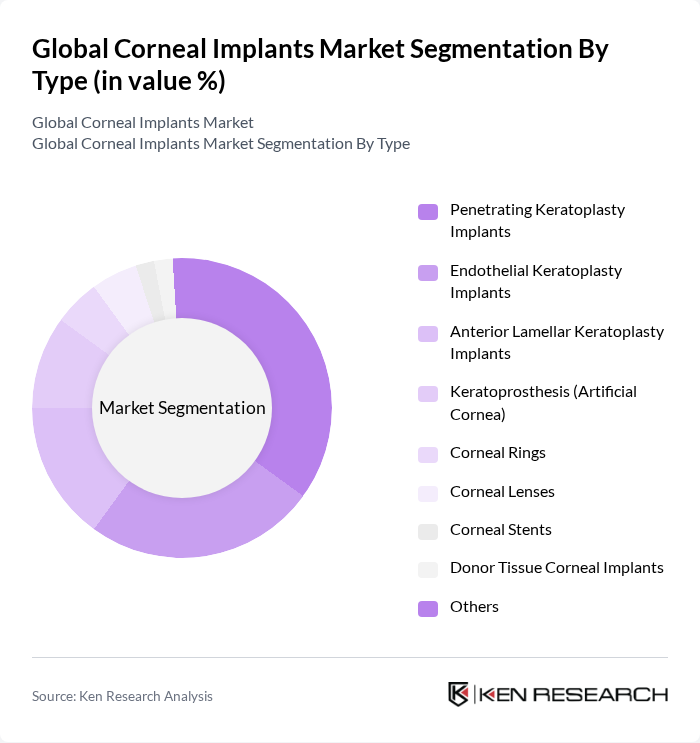

By Type:The market is segmented into various types of corneal implants, including Penetrating Keratoplasty Implants, Endothelial Keratoplasty Implants, Anterior Lamellar Keratoplasty Implants, Keratoprosthesis (Artificial Cornea), Corneal Rings, Corneal Lenses, Corneal Stents, Donor Tissue Corneal Implants, and Others. Among these, Penetrating Keratoplasty Implants are the most widely used due to their effectiveness in treating severe corneal diseases. The increasing number of corneal transplant surgeries and advancements in minimally invasive surgical techniques contribute to the dominance of this segment. Endothelial keratoplasty, particularly Descemet Membrane Endothelial Keratoplasty (DMEK), is gaining rapid adoption due to better visual outcomes and lower rejection rates. Artificial corneas (keratoprosthesis) are also gaining traction as they address donor tissue shortages and offer shelf stability .

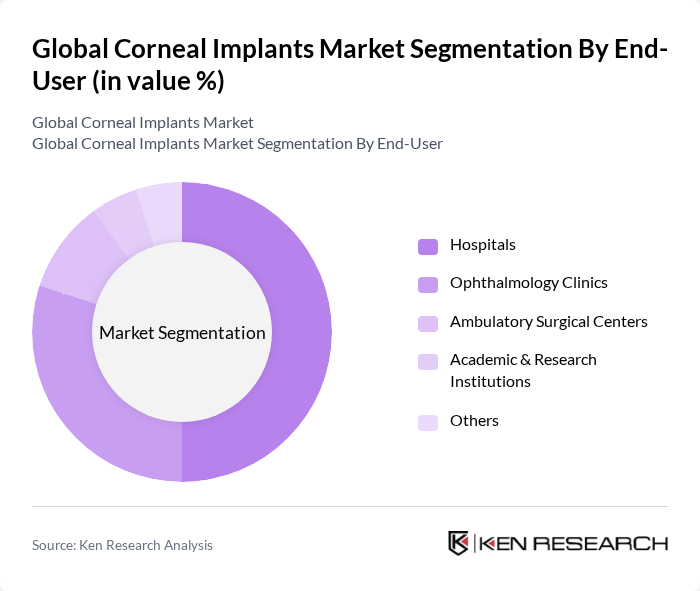

By End-User:The end-user segmentation includes Hospitals, Ophthalmology Clinics, Ambulatory Surgical Centers, Academic & Research Institutions, and Others. Hospitals are the leading end-users due to their capacity to perform complex surgeries and provide comprehensive patient care. The increasing number of surgical procedures and the availability of advanced medical technologies in hospitals contribute to their dominance in the market. Ambulatory Surgical Centers are also experiencing notable growth as they offer cost-efficient, same-day corneal procedures, shifting some surgical volume away from hospitals .

The Global Corneal Implants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alcon Inc., Bausch + Lomb, Johnson & Johnson Vision, CorneaGen, EyeTechCare, KeraLink International, Rayner Intraocular Lenses Limited, Santen Pharmaceutical Co., Ltd., STAAR Surgical Company, Thea Pharmaceuticals, Visioneering Technologies, Inc., Ziemer Ophthalmic Systems AG, Avedro, Inc., OptiMedica Corporation, AJL Ophthalmic SA, DIOPTEX GmbH, KeraMed, Inc., Florida Lions Eye Bank, Aurolab, Massachusetts Eye and Ear, San Diego Eye Bank, Alabama Eye Bank, Inc., Presbia Plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the corneal implants market appears promising, driven by ongoing technological advancements and increasing healthcare investments. As minimally invasive procedures gain traction, the demand for innovative implant materials is expected to rise. Additionally, the integration of telemedicine in eye care is likely to enhance patient access to specialists, facilitating timely interventions. These trends indicate a shift towards more efficient and patient-centered care, which will be crucial for addressing the challenges currently faced in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Penetrating Keratoplasty Implants Endothelial Keratoplasty Implants Anterior Lamellar Keratoplasty Implants Keratoprosthesis (Artificial Cornea) Corneal Rings Corneal Lenses Corneal Stents Donor Tissue Corneal Implants Others |

| By End-User | Hospitals Ophthalmology Clinics Ambulatory Surgical Centers Academic & Research Institutions Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Others |

| By Material | Polymeric Implants Silicone Implants Collagen Implants Biological Materials Composite Materials Others |

| By Application | Corneal Transplantation Refractive Surgery Keratoconus Treatment Corneal Healing Corneal Scarring Vision Restoration Cosmetic Enhancement Research and Development Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Range Mid Price Range High Price Range Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ophthalmic Surgeons | 100 | Corneal Specialists, General Ophthalmologists |

| Hospital Administrators | 80 | Procurement Managers, Medical Directors |

| Medical Device Manufacturers | 60 | Product Managers, R&D Directors |

| Patients with Corneal Implants | 90 | Post-operative Patients, Caregivers |

| Regulatory Experts | 40 | Compliance Officers, Regulatory Affairs Managers |

The Global Corneal Implants Market is valued at approximately USD 1.4 billion, driven by the increasing prevalence of corneal diseases, advancements in surgical techniques, and rising awareness regarding eye health.