Region:Global

Author(s):Dev

Product Code:KRAB0334

Pages:95

Published On:August 2025

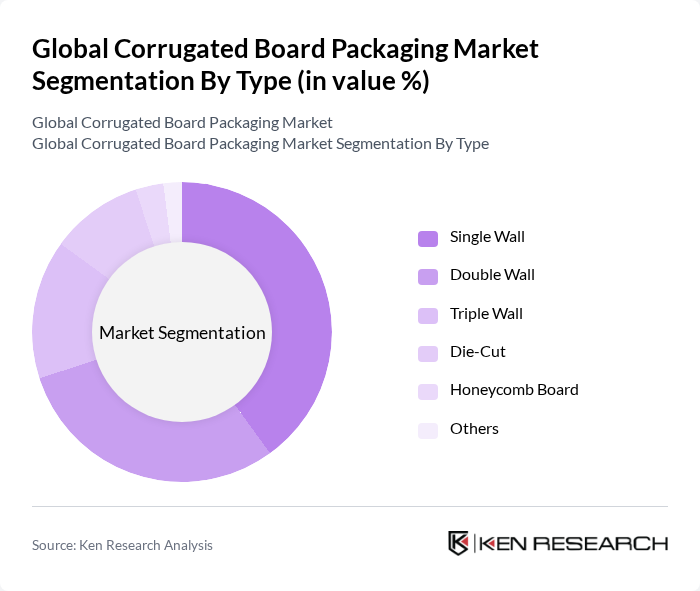

By Type:The corrugated board packaging market is segmented into Single Wall, Double Wall, Triple Wall, Die-Cut, Honeycomb Board, and Others. The Single Wall segment is the most dominant due to its lightweight, cost-effective, and versatile nature, making it a preferred choice for a wide range of consumer and industrial applications. Double Wall and Triple Wall segments are gaining traction, particularly in sectors requiring enhanced durability and protection for heavy or fragile goods during shipping. Die-cut corrugated packaging is increasingly used for custom and branded packaging solutions, while honeycomb board is favored for its strength-to-weight ratio in specialized applications.

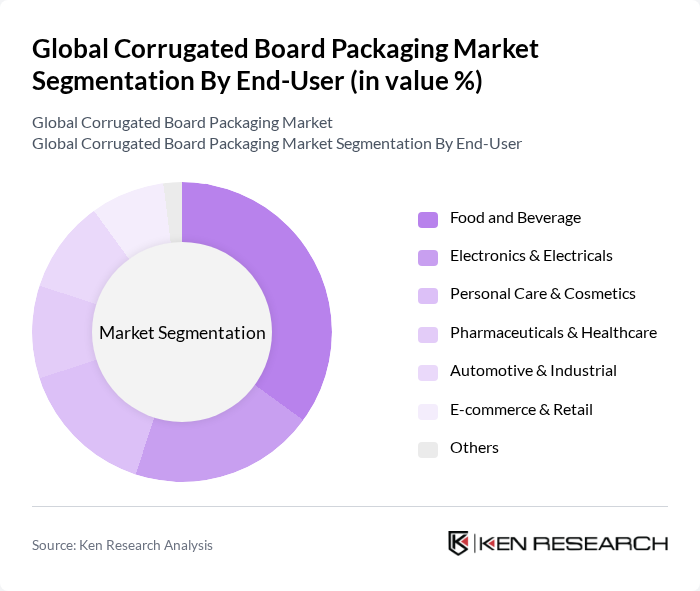

By End-User:The end-user segmentation includes Food and Beverage, Electronics & Electricals, Personal Care & Cosmetics, Pharmaceuticals & Healthcare, Automotive & Industrial, E-commerce & Retail, and Others. The Food and Beverage sector is the largest consumer of corrugated board packaging, driven by the need for safe, hygienic, and sustainable packaging solutions. The E-commerce sector is experiencing rapid growth as online shopping continues to rise, increasing the demand for protective and efficient packaging. Electronics, personal care, and healthcare sectors are also significant consumers, leveraging corrugated packaging for product safety and sustainability.

The Global Corrugated Board Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as International Paper Company, WestRock Company, Smurfit Kappa Group, DS Smith Plc, Mondi Group, Packaging Corporation of America, Stora Enso Oyj, Georgia-Pacific LLC, Sappi Limited, Sonoco Products Company, Rengo Co., Ltd., Nippon Paper Industries Co., Ltd., Klabin S.A., Cascades Inc., Tetra Pak International S.A., Oji Holdings Corporation, Nine Dragons Paper (Holdings) Limited, Pratt Industries Inc., Lee & Man Paper Manufacturing Ltd., and Mayr-Melnhof Karton AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the corrugated board packaging market appears promising, driven by increasing consumer awareness of sustainability and the rapid growth of e-commerce. As companies invest in innovative packaging solutions, the integration of smart technologies and eco-friendly materials will likely become standard practice. Additionally, the ongoing shift towards a circular economy will encourage manufacturers to adopt sustainable practices, enhancing their competitive edge and meeting evolving consumer demands for responsible packaging solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Single Wall Double Wall Triple Wall Die-Cut Honeycomb Board Others |

| By End-User | Food and Beverage Electronics & Electricals Personal Care & Cosmetics Pharmaceuticals & Healthcare Automotive & Industrial E-commerce & Retail Others |

| By Application | Retail Packaging Industrial Packaging Shipping and Transport Packaging Protective Packaging Display Packaging Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Wholesalers Third-Party Logistics Providers Others |

| By Material Type | Recycled Paper Virgin Paper Kraft Paper Coated Paper Others |

| By Design Type | Standard Design Custom Design Eco-friendly Design Printed/Branded Design Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food & Beverage Packaging | 100 | Packaging Managers, Supply Chain Coordinators |

| Consumer Electronics Packaging | 60 | Product Development Managers, Logistics Directors |

| Pharmaceutical Packaging Solutions | 50 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Retail Packaging Innovations | 40 | Marketing Managers, Brand Strategists |

| Industrial Packaging Applications | 50 | Operations Managers, Procurement Specialists |

The Global Corrugated Board Packaging Market is valued at approximately USD 200 billion, driven by the increasing demand for sustainable packaging solutions, the growth of e-commerce, and the need for efficient shipping and storage options.