Region:Global

Author(s):Dev

Product Code:KRAB0372

Pages:96

Published On:August 2025

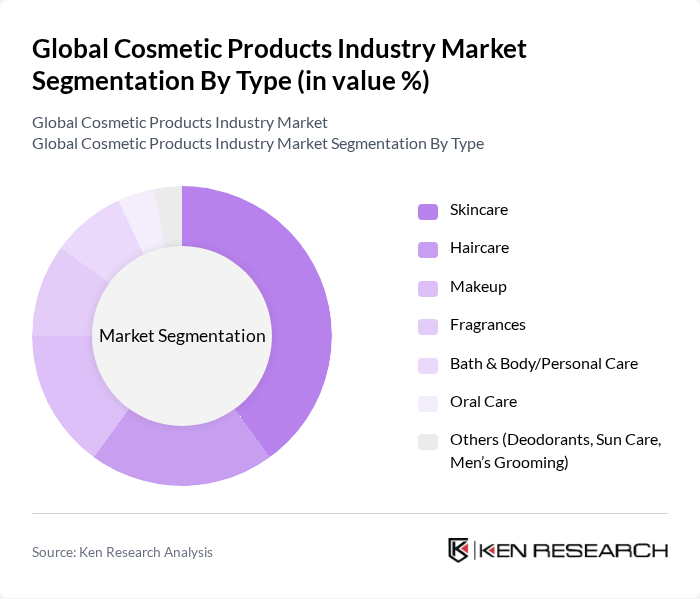

By Type:The cosmetic products market is segmented into various types, including skincare, haircare, makeup, fragrances, bath & body/personal care, oral care, and others such as deodorants, sun care, and men’s grooming. Among these, skincare products dominate the market due to the increasing focus on skin health, sun protection, and the rising popularity of anti-aging, dermocosmetics, and hydrating/moisturizing products. Consumers are increasingly investing in multi-step skincare routines, actives (e.g., retinoids, niacinamide, vitamin C), and hybrid skincare-makeup formats, driving demand for innovative and efficacious solutions .

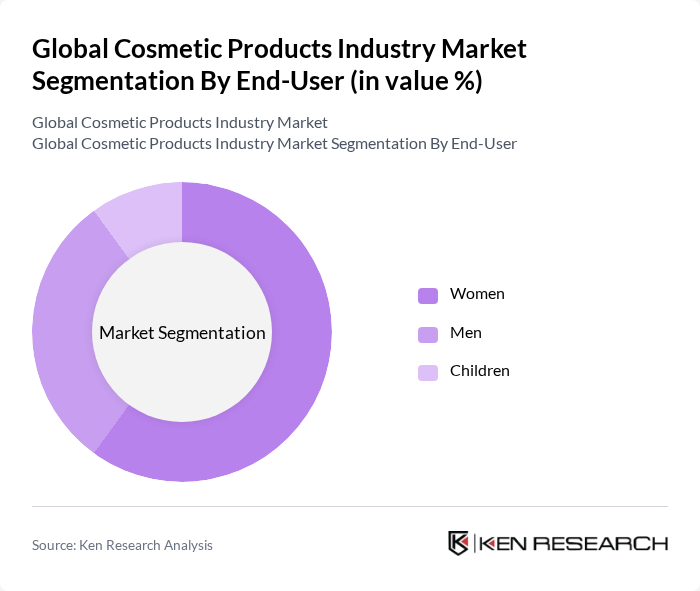

By End-User:The market is segmented by end-user into women, men, and children. Women represent the largest segment, driven by higher spending on skincare, makeup, and prestige beauty. The men’s segment is expanding with increased grooming awareness, skincare adoption, and targeted offerings in haircare and fragrances, while the children’s segment is supported by demand for gentle, hypoallergenic, and safety-certified products suitable for young skin .

The Global Cosmetic Products Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as L’Oréal S.A., The Estée Lauder Companies Inc., Procter & Gamble Co., Unilever PLC, Coty Inc., Shiseido Company, Limited, Beiersdorf AG, Kao Corporation, Johnson & Johnson (Consumer Health/Beauty), LVMH Moët Hennessy Louis Vuitton (Parfums & Cosmetics), Amorepacific Corporation, Natura &Co Holding S.A., Mary Kay Inc., Oriflame Holding AG, Henkel AG & Co. KGaA contribute to innovation, geographic expansion, and service delivery in this space .

The future of the cosmetic products industry appears promising, driven by evolving consumer preferences and technological advancements. As the demand for clean beauty continues to rise, brands are likely to invest in sustainable practices and innovative formulations. Additionally, the integration of artificial intelligence in marketing strategies will enhance customer engagement and personalization. Companies that adapt to these trends will likely capture a larger market share, positioning themselves favorably in an increasingly competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Skincare Haircare Makeup Fragrances Bath & Body/Personal Care Oral Care Others (Deodorants, Sun Care, Men’s Grooming) |

| By End-User | Women Men Children |

| By Distribution Channel | Online Retail (D2C, Marketplaces) Supermarkets/Hypermarkets Specialty Beauty Retailers Pharmacies/Drugstores Direct Sales/MLM Others (Department Stores, Convenience Stores, Duty-Free) |

| By Price Range | Premium/Luxury Mass/Mid-Range Economy/Value |

| By Packaging Type | Bottles Tubes Jars Sachets |

| By Ingredient Type | Natural/Organic Synthetic Hybrid (Naturally Derived + Safe Synthetics) |

| By Occasion | Daily Use Special Occasions Seasonal Travel/On-the-Go |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Skincare Product Development | 120 | Product Managers, R&D Specialists |

| Makeup Consumer Preferences | 100 | Beauty Influencers, Makeup Artists |

| Haircare Market Trends | 90 | Brand Managers, Market Analysts |

| Natural and Organic Cosmetics | 80 | Sustainability Experts, Product Developers |

| Cosmetic Retail Insights | 80 | Retail Managers, Sales Directors |

The Global Cosmetic Products Industry Market is valued at approximately USD 425 billion, reflecting significant growth driven by increasing consumer demand for beauty and personal care products, urbanization, and the trend towards self-care and wellness.