Region:Global

Author(s):Geetanshi

Product Code:KRAD0106

Pages:88

Published On:August 2025

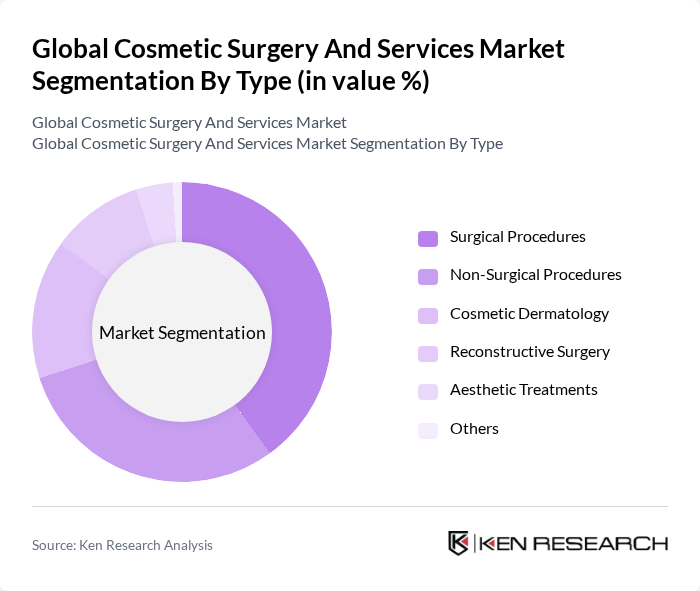

By Type:The market is segmented into various types, including Surgical Procedures, Non-Surgical Procedures, Cosmetic Dermatology, Reconstructive Surgery, Aesthetic Treatments, and Others. Surgical procedures are often preferred for their long-lasting results, while non-surgical options are gaining popularity due to their minimal downtime, lower risk, and advancements in minimally invasive technologies. Cosmetic dermatology focuses on skin-related enhancements such as laser treatments and injectables, while reconstructive surgery addresses medical needs including trauma and congenital conditions. Aesthetic treatments encompass a wide range of services aimed at improving appearance, including body contouring and skin rejuvenation .

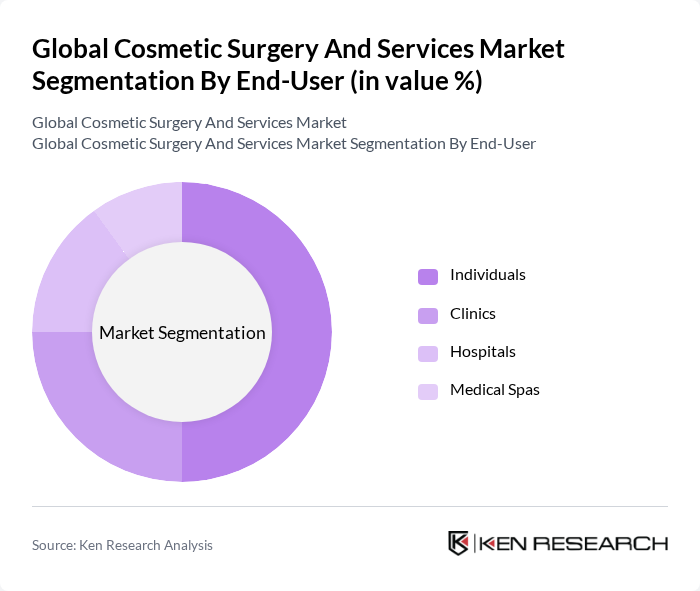

By End-User:The end-user segmentation includes Individuals, Clinics, Hospitals, and Medical Spas. Individuals are the primary consumers of cosmetic procedures, driven by personal desires for aesthetic enhancement and the influence of social media. Clinics and hospitals provide a comprehensive range of surgical and non-surgical services, while medical spas offer a more relaxed environment for non-invasive treatments. The increasing number of clinics and medical spas is making cosmetic procedures more accessible to a broader audience, particularly for non-surgical and minimally invasive treatments .

The Global Cosmetic Surgery and Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Allergan Aesthetics (an AbbVie company), Galderma S.A., Merz Pharmaceuticals GmbH & Co. KGaA, Sientra, Inc., Revance Therapeutics, Inc., Hologic, Inc. (Cynosure Division), Ipsen S.A., Cynosure, LLC, Mentor Worldwide LLC (Johnson & Johnson), InMode Ltd., Acelity L.P. Inc. (now part of 3M), ZELTIQ Aesthetics, Inc. (now part of Allergan/AbbVie), Cutera, Inc., Lumenis Ltd., Solta Medical (a division of Bausch Health Companies Inc.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cosmetic surgery market in the None region appears promising, driven by ongoing technological advancements and a growing acceptance of aesthetic procedures. As the industry evolves, the integration of artificial intelligence and virtual reality in pre-surgical consultations is expected to enhance patient experiences. Additionally, the increasing focus on safety and regulatory compliance will likely foster consumer trust, encouraging more individuals to consider cosmetic enhancements as viable options for self-improvement and confidence.

| Segment | Sub-Segments |

|---|---|

| By Type | Surgical Procedures Non-Surgical Procedures Cosmetic Dermatology Reconstructive Surgery Aesthetic Treatments Others |

| By End-User | Individuals Clinics Hospitals Medical Spas |

| By Procedure Type | Breast Augmentation Liposuction Rhinoplasty Facelifts Botox Injections Eyelid Surgery (Blepharoplasty) Tummy Tuck (Abdominoplasty) Hair Transplantation Dermal Fillers Laser Skin Resurfacing |

| By Age Group | 30 Years 45 Years 60 Years + Years |

| By Gender | Male Female |

| By Geographic Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low-End Procedures Mid-Range Procedures High-End Procedures |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cosmetic Surgery Clinics | 120 | Plastic Surgeons, Clinic Managers |

| Non-Surgical Aesthetic Procedures | 90 | Dermatologists, Aesthetic Practitioners |

| Patient Experience and Satisfaction | 140 | Patients who have undergone cosmetic procedures |

| Medical Tourism for Cosmetic Surgery | 80 | Travel Agents, Medical Tourism Coordinators |

| Regulatory and Compliance Insights | 60 | Healthcare Regulators, Policy Makers |

The Global Cosmetic Surgery and Services Market is valued at approximately USD 57 billion, reflecting significant growth driven by increased consumer awareness, advancements in techniques, and a cultural shift towards aesthetic enhancements.