Region:Global

Author(s):Dev

Product Code:KRAA2240

Pages:84

Published On:August 2025

By Product Type:The product type segmentation includes various categories such as skincare products, haircare products, makeup (color cosmetics), fragrances & perfumes, oral care products, personal hygiene products, sun care products, men's grooming products, and others like baby care and nail care. Among these, skincare products dominate the market due to the increasing focus on skin health, the rising popularity of anti-aging products, and heightened consumer awareness about environmental stressors and UV protection. The demand for products with natural, organic, and cruelty-free ingredients is also driving growth in this segment .

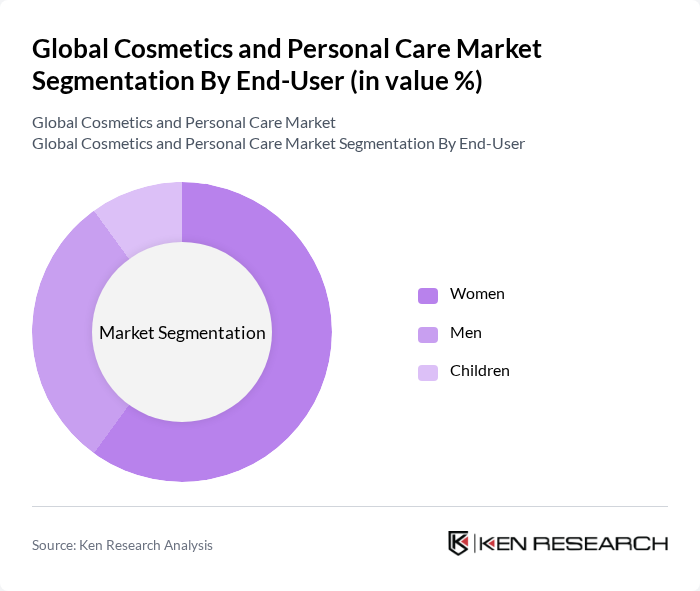

By End-User:The end-user segmentation includes women, men, and children. Women represent the largest segment due to their higher spending on beauty and personal care products, driven by societal norms and marketing strategies that target female consumers. Men's grooming products are also gaining traction as more men invest in personal care, reflecting changing attitudes towards grooming and increased marketing of male-specific products. Children's personal care is a smaller but growing segment, with rising demand for gentle, safe, and hypoallergenic formulations .

The Global Cosmetics and Personal Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as L'Oréal S.A., The Procter & Gamble Company, Unilever PLC, The Estée Lauder Companies Inc., Coty Inc., Shiseido Company, Limited, Revlon, Inc., Johnson & Johnson, Amway Corporation, Mary Kay Inc., Avon Products, Inc., Beiersdorf AG, Henkel AG & Co. KGaA, Kao Corporation, Oriflame Holding AG, LG Household & Health Care Ltd., Natura &Co Holding S.A., Amorepacific Corporation, LVMH Moët Hennessy Louis Vuitton SE, Colgate-Palmolive Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cosmetics and personal care market appears promising, driven by evolving consumer preferences and technological advancements. As personalization becomes a key trend, brands are expected to leverage data analytics to tailor products to individual needs. Additionally, the clean beauty movement will likely gain momentum, with consumers increasingly prioritizing transparency and sustainability. Companies that adapt to these trends will be well-positioned to capture market share and foster brand loyalty in an increasingly competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Skincare Products Haircare Products Makeup (Color Cosmetics) Fragrances & Perfumes Oral Care Products Personal Hygiene Products (Deodorants, Bath & Shower, Feminine Hygiene, etc.) Sun Care Products Men's Grooming Products Others (e.g., Baby Care, Nail Care) |

| By End-User | Women Men Children |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Pharmacies/Drugstores Direct Sales Others (e.g., Department Stores, Convenience Stores) |

| By Price Range | Premium Mid-range Economy |

| By Packaging Type | Bottles Tubes Jars Sachets Pumps & Sprays |

| By Ingredient Type | Natural/Organic Ingredients Synthetic Ingredients |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Skincare Product Usage | 100 | Consumers aged 18-35, Beauty Enthusiasts |

| Haircare Trends | 60 | Salon Owners, Haircare Product Managers |

| Makeup Preferences | 80 | Makeup Artists, Retail Beauty Advisors |

| Men's Grooming Products | 50 | Male Consumers, Grooming Product Managers |

| Natural and Organic Products | 40 | Health-Conscious Consumers, Eco-Friendly Brand Managers |

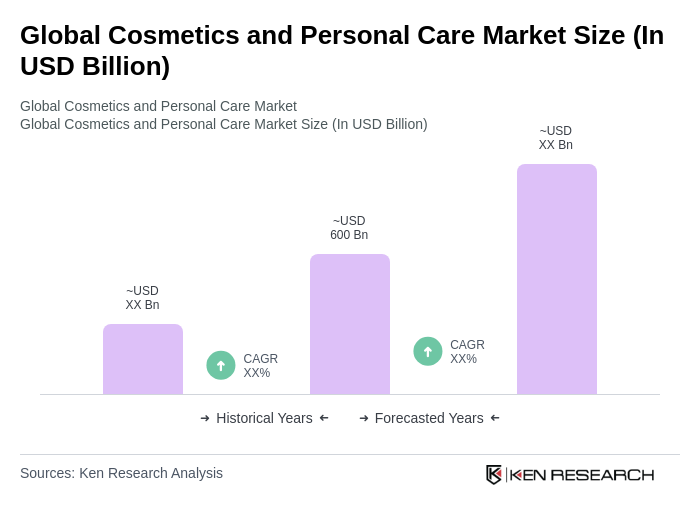

The Global Cosmetics and Personal Care Market is valued at approximately USD 600 billion, reflecting significant growth driven by consumer awareness, e-commerce expansion, and a shift towards organic and sustainable products.