Region:Global

Author(s):Shubham

Product Code:KRAD0651

Pages:96

Published On:August 2025

By Type:The market is segmented into various types of assay kits, each catering to different testing methodologies and preferences in clinical settings. The subsegments include Jaffe’s Kinetic Assay Kits, Enzymatic Assay Kits (Creatininase/Creatinase, Sarcosine Oxidase), Colorimetric Assay Kits, Fluorometric Assay Kits, ELISA-based Creatinine Assay Kits, Creatinine-PAP Test Kits, and Others (HPLC Reference Kits). Among these, the Enzymatic Assay Kits are gaining traction due to their higher specificity and reduced interference compared with Jaffe methods, which supports preference in many clinical laboratories for accuracy and standardization, while Jaffe remains widely used for cost-effectiveness and legacy workflow compatibility .

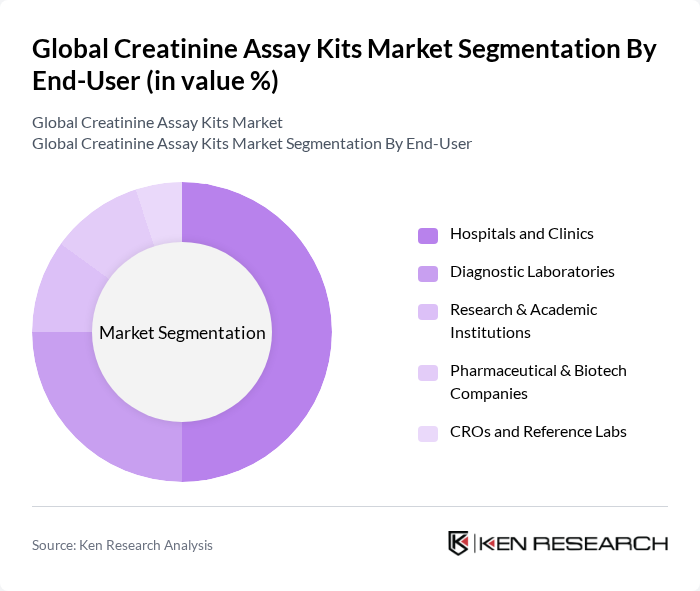

By End-User:The end-user segmentation includes Hospitals and Clinics, Diagnostic Laboratories, Research & Academic Institutions, Pharmaceutical & Biotech Companies, and CROs and Reference Labs. Hospitals and Clinics dominate this segment due to the high volume of routine renal function testing and CKD/AKI monitoring conducted in inpatient and outpatient settings, with diagnostic labs also representing a substantial share due to centralized chemistry analyzers running high test throughput .

The Global Creatinine Assay Kits Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abbott Laboratories, Siemens Healthineers, Thermo Fisher Scientific Inc., Roche Diagnostics, Beckman Coulter, Inc. (a Danaher company), Bio-Rad Laboratories, Inc., Ortho Clinical Diagnostics (QuidelOrtho Corporation), Revvity, Inc. (formerly PerkinElmer), FUJIFILM Wako Pure Chemical Corporation, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., DiaSorin S.p.A., Sysmex Corporation, Merck KGaA (Sigma-Aldrich), QuidelOrtho Corporation, Cell Biolabs, Inc., Randox Laboratories Ltd., Arlington Scientific, Inc., Abcam plc, Cayman Chemical Company, BioVision, Inc. (a part of Vector Laboratories) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the creatinine assay kits market appears promising, driven by ongoing advancements in technology and a growing emphasis on preventive healthcare. As healthcare systems increasingly adopt digital health solutions, the integration of telemedicine and remote monitoring will likely enhance the accessibility of kidney function testing. Furthermore, the shift towards personalized medicine will create opportunities for tailored diagnostic approaches, ensuring that patients receive the most effective care based on their unique health profiles.

| Segment | Sub-Segments |

|---|---|

| By Type | Jaffe’s Kinetic Assay Kits Enzymatic Assay Kits (Creatininase/Creatinase, Sarcosine Oxidase) Colorimetric Assay Kits Fluorometric Assay Kits ELISA-based Creatinine Assay Kits Creatinine-PAP Test Kits Others (HPLC Reference Kits) |

| By End-User | Hospitals and Clinics Diagnostic Laboratories Research & Academic Institutions Pharmaceutical & Biotech Companies CROs and Reference Labs |

| By Distribution Channel | Direct Sales (Company Websites/Inside Sales) Distributors/Channel Partners Online Marketplaces (eCommerce/Third-party) Group Purchasing Organizations (GPOs) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Application | Clinical Diagnostics (CKD, AKI, Renal Function Panels) Research Applications (Nephrology, Toxicology, Metabolism) Drug Development and Preclinical Studies Veterinary Diagnostics Others (Dialysis Monitoring, POCT) |

| By Sample Type | Urine Blood/Serum/Plasma Dried Blood Spot and Other Biological Matrices |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Laboratories | 120 | Laboratory Managers, Technicians |

| Hospitals and Healthcare Facilities | 100 | Healthcare Administrators, Renal Specialists |

| Assay Kit Manufacturers | 80 | Product Managers, R&D Directors |

| Regulatory Bodies | 40 | Regulatory Affairs Specialists, Compliance Officers |

| Research Institutions | 70 | Clinical Researchers, Academic Professors |

The Global Creatinine Assay Kits Market is valued at approximately USD 1.2 billion, based on a five-year historical analysis. This valuation reflects the increasing demand for reliable creatinine measurement due to the rising prevalence of chronic kidney disease and acute kidney injury.