Region:Global

Author(s):Geetanshi

Product Code:KRAB0095

Pages:97

Published On:August 2025

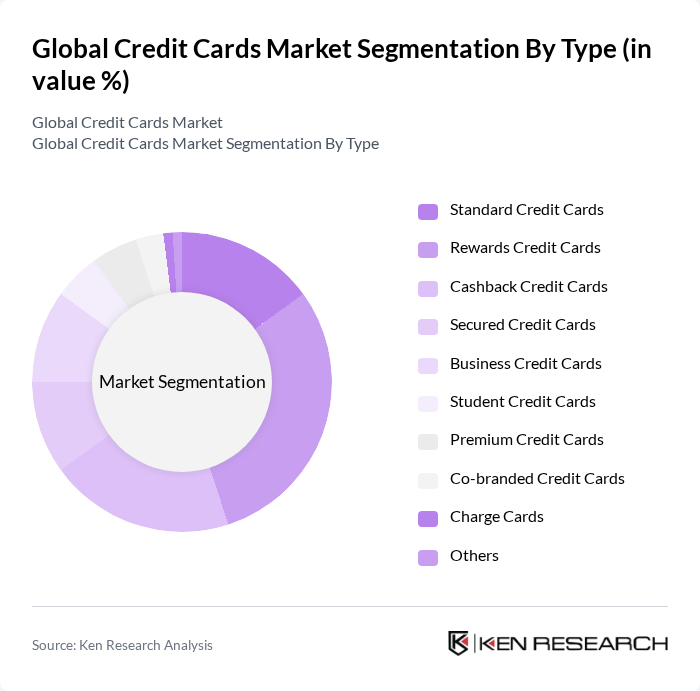

By Type:The credit cards market is segmented into various types, including Standard Credit Cards, Rewards Credit Cards, Cashback Credit Cards, Secured Credit Cards, Business Credit Cards, Student Credit Cards, Premium Credit Cards, Co-branded Credit Cards, Charge Cards, and Others. Among these, Rewards Credit Cards are particularly popular due to their attractive benefits and incentives, which encourage consumer loyalty and spending. The trend towards personalization, tailored rewards programs, and integration with digital wallets has further solidified their dominance in the market .

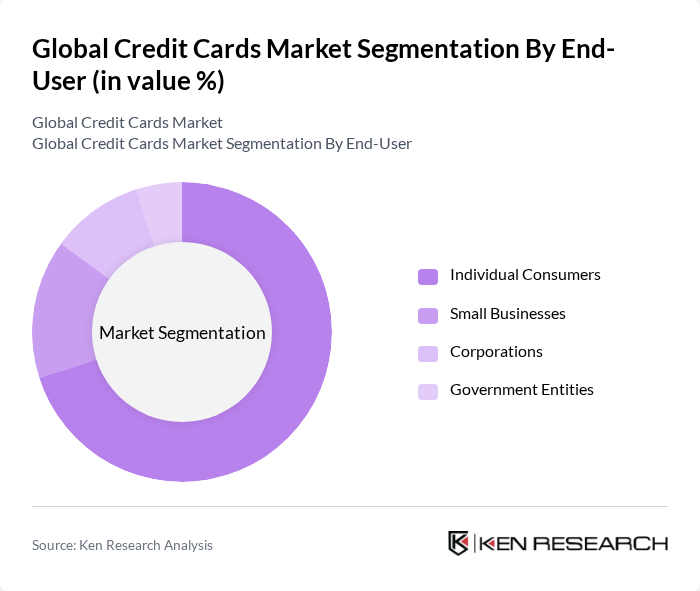

By End-User:The end-user segmentation includes Individual Consumers, Small Businesses, Corporations, and Government Entities. Individual Consumers dominate the market, driven by the increasing trend of personal credit usage and the growing preference for cashless transactions. The rise of e-commerce and online shopping has further propelled the demand for credit cards among consumers, making them a vital part of everyday financial transactions. Small businesses and corporations are also increasing their adoption of credit cards for expense management and operational efficiency, while government entities are gradually integrating credit card payments for public services .

The Global Credit Cards Market is characterized by a dynamic mix of regional and international players. Leading participants such as Visa Inc., Mastercard Incorporated, American Express Company, Discover Financial Services, Capital One Financial Corporation, JPMorgan Chase & Co., Citigroup Inc., Bank of America Corporation, Wells Fargo & Company, Barclays PLC, HSBC Holdings PLC, Synchrony Financial, U.S. Bancorp, PNC Financial Services Group, TD Bank Group, Industrial and Commercial Bank of China (ICBC), China Construction Bank, Banco Santander S.A., Société Générale S.A., Sumitomo Mitsui Financial Group, Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the credit card market in None appears promising, driven by technological innovations and changing consumer preferences. As digital payment solutions gain traction, credit card companies are likely to enhance their offerings, focusing on personalization and rewards. Additionally, the integration of AI in fraud detection will bolster consumer trust. However, addressing regulatory challenges and managing consumer debt will be crucial for sustainable growth in the coming years, ensuring a balanced approach to market expansion.

| Segment | Sub-Segments |

|---|---|

| By Type | Standard Credit Cards Rewards Credit Cards Cashback Credit Cards Secured Credit Cards Business Credit Cards Student Credit Cards Premium Credit Cards Co-branded Credit Cards Charge Cards Others |

| By End-User | Individual Consumers Small Businesses Corporations Government Entities |

| By Application | Online Purchases In-Store Purchases Bill Payments Travel and Entertainment Daily Consumption |

| By Pricing Strategy | Low-Interest Rate Cards High-Interest Rate Cards No Annual Fee Cards Premium Fee Cards |

| By Distribution Channel | Direct Bank Issuance Online Platforms Retail Partnerships Financial Advisors Fintech Platforms |

| By Customer Segment | Millennials Gen X Baby Boomers High Net-Worth Individuals Unbanked/Underbanked |

| By Geographic Presence | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Credit Card Usage | 120 | Cardholders aged 18-65, diverse income levels |

| Business Credit Card Insights | 60 | Small to medium business owners, finance managers |

| Rewards Program Effectiveness | 50 | Frequent travelers, loyalty program members |

| Credit Card Fraud Awareness | 40 | Consumers with recent fraud experiences, security experts |

| Payment Technology Adoption | 45 | Tech-savvy consumers, fintech industry professionals |

The Global Credit Cards Market is valued at approximately USD 1.27 trillion, driven by the increasing adoption of digital payment solutions, rising consumer spending, and the expansion of e-commerce platforms.