Region:Global

Author(s):Dev

Product Code:KRAC0371

Pages:81

Published On:August 2025

By Type:The crowdfunding market can be segmented into various types, including Reward-Based Crowdfunding, Equity Crowdfunding, Debt/P2P Lending Crowdfunding, Donation-Based Crowdfunding, Real Estate Crowdfunding, Revenue-Share/Profit-Share Crowdfunding, and Hybrid Models (e.g., Equity + Rewards). Among these, Reward-Based Crowdfunding has strong traction for creative and consumer-product launches due to tangible rewards and community-building dynamics, while Equity Crowdfunding has expanded with clearer regulatory frameworks (e.g., Reg CF in the U.S. and FCA-regulated platforms in the U.K.). Donation-based models remain material for personal and social causes, amplified by social media distribution .

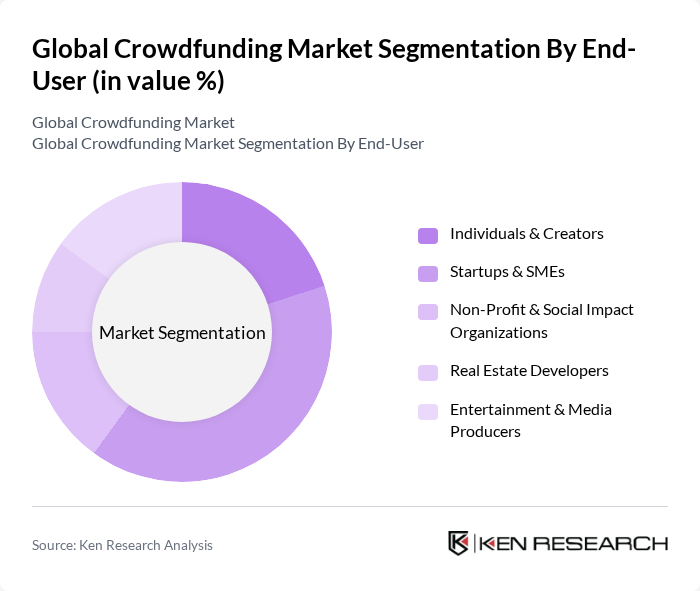

By End-User:The end-user segmentation of the crowdfunding market includes Individuals & Creators, Startups & SMEs, Non-Profit & Social Impact Organizations, Real Estate Developers, and Entertainment & Media Producers. Startups & SMEs are prominent end-users for equity, reward, and revenue-share campaigns to fund product development and market entry, while Individuals and Non-Profits dominate donation campaigns. Creative and entertainment sectors frequently leverage reward platforms for pre-orders and community validation .

The Global Crowdfunding Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kickstarter PBC, Indiegogo, Inc., GoFundMe, Inc., Crowdcube Ltd., Seedrs Limited, Fundable LLC, Patreon, Inc., CircleUp Network, Inc., Wefunder Inc., StartEngine Crowdfunding, Inc., Fundrise, LLC, RealtyMogul, Co., Crowdfunder Ltd., Kiva Microfunds, Fundly, Republic (OpenDeal Portal LLC), Companisto GmbH, DonorsChoose, Chuffed.org Pty Ltd, ConnectionPoint Systems Inc. (FundRazr), Crowdera Inc., Ketto Online Ventures Pvt. Ltd., Wishberry Online Services Pvt. Ltd., Ioby (In Our Backyards), GGF Global Ltd. (GiveGab/Bonterra) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the crowdfunding market in the None region appears promising, driven by technological advancements and evolving consumer preferences. As platforms increasingly adopt innovative technologies like artificial intelligence for campaign optimization, user experience is expected to improve significantly. Additionally, the growing emphasis on social impact and sustainability will likely attract a new wave of investors, fostering a more diverse and inclusive crowdfunding ecosystem that aligns with contemporary values and priorities.

| Segment | Sub-Segments |

|---|---|

| By Type | Reward-Based Crowdfunding Equity Crowdfunding Debt/P2P Lending Crowdfunding Donation-Based Crowdfunding Real Estate Crowdfunding Revenue-Share/Profit-Share Crowdfunding Hybrid Models (e.g., Equity + Rewards) |

| By End-User | Individuals & Creators Startups & SMEs Non-Profit & Social Impact Organizations Real Estate Developers Entertainment & Media Producers |

| By Investment Source | Retail Backers/Individual Investors Accredited/Institutional Investors Family Offices & Angel Syndicates Corporate/Strategic Investors |

| By Campaign Duration | Short-Term Campaigns (?30 days) Standard Campaigns (31–60 days) Extended Campaigns (?61 days) |

| By Platform Type | Online Platforms (Web & Mobile) White-Label/Hosted Solutions Niche/Sector-Specific Platforms |

| By Geographic Focus | Local/Community Campaigns National Campaigns Cross-Border/International Campaigns |

| By Policy Support | Government Subsidies/Grants Tax Incentives Regulatory Support (e.g., securities exemptions) Investor Protection & Compliance Requirements |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Rewards-based Crowdfunding Campaigns | 120 | Campaign Creators, Marketing Managers |

| Equity Crowdfunding Platforms | 90 | Investors, Financial Advisors |

| Debt Crowdfunding Initiatives | 80 | Loan Officers, Small Business Owners |

| Sector-specific Crowdfunding Insights (Tech, Arts, etc.) | 70 | Sector Experts, Industry Analysts |

| Backer Experience and Preferences | 110 | Crowdfunding Backers, Consumer Behavior Researchers |

The Global Crowdfunding Market is valued at approximately USD 1519 billion, reflecting a consolidation across various segments such as donation, reward, equity, and real estate crowdfunding, driven by increased platform adoption and social media engagement.