Region:Global

Author(s):Geetanshi

Product Code:KRAA0085

Pages:86

Published On:August 2025

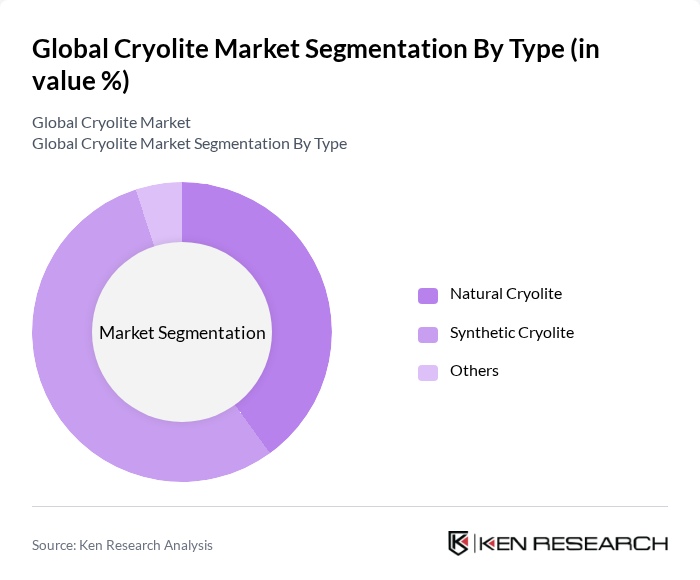

By Type:The market is segmented into Natural Cryolite, Synthetic Cryolite, and Others. Natural Cryolite is derived from mineral deposits, while Synthetic Cryolite is produced through chemical processes. The Others category includes various forms and blends of cryolite used in niche applications .

TheSynthetic Cryolitesegment is currently dominating the market due to its cost-effectiveness and consistent quality, making it the preferred choice for aluminum smelting and other industrial applications. The increasing demand for aluminum, driven by the automotive, construction, and electronics industries, has further solidified the position of synthetic cryolite. Additionally, advancements in production technologies have enhanced the efficiency and scalability of synthetic cryolite manufacturing, attracting more users in various sectors .

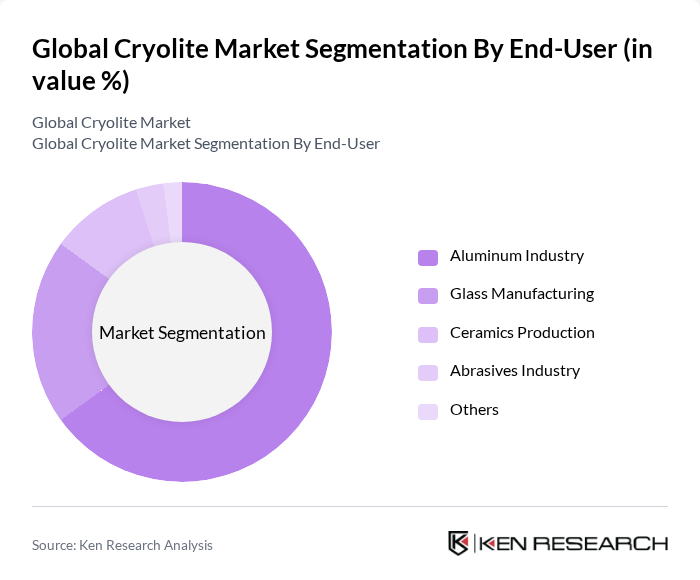

By End-User:The market is segmented into Aluminum Industry, Glass Manufacturing, Ceramics Production, Abrasives Industry, and Others. The Aluminum Industry is the largest consumer of cryolite, followed by glass and ceramics manufacturing .

TheAluminum Industryis the leading end-user segment, accounting for a significant share of the market. This dominance is attributed to the essential role of cryolite as a flux in aluminum smelting, which enhances the efficiency of the process and reduces energy consumption. The growing demand for aluminum in various applications, including automotive, construction, and electrical sectors, continues to drive the need for cryolite in this sector .

The Global Cryolite Market is characterized by a dynamic mix of regional and international players. Leading participants such as Solvay S.A., Fluorsid S.p.A., DFD Chemical (Shandong Dongyue Future Hydrogen Energy Materials Co., Ltd.), Shandong Rich Billows Group, Xingxiangfuhuagong (Henan Province Xingxiang Fluorine Chemical Co., Ltd.), Zhengzhou Tianzhirui New Material Technology Co., Ltd., Nanhan Chemicals, Huber Engineered Materials, Sibelco, Rio Tinto Group, Nordic Mining ASA, Chemours Company, Imerys S.A., Minera de Óxido de Aluminio S.A., K+S AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cryolite market appears promising, driven by increasing demand in aluminum production and expanding applications in glass and ceramics. As industries focus on sustainability, the shift towards synthetic cryolite and eco-friendly production methods is expected to gain momentum. Additionally, technological advancements will likely enhance production efficiency, further supporting market growth. The ongoing expansion in emerging markets will also create new opportunities for cryolite applications, ensuring a dynamic market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Cryolite Synthetic Cryolite Others |

| By End-User | Aluminum Industry Glass Manufacturing Ceramics Production Abrasives Industry Others |

| By Application | Flux in Aluminum Smelting Filler in Glass and Ceramics Abrasives Manufacturing Welding Agents Others |

| By Production Method | Mining Chemical Synthesis (from Fluorspar and Aluminum Compounds) Others |

| By Geography | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Packaging Type | Bulk Packaging Bagged Packaging Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aluminum Production Facilities | 60 | Plant Managers, Production Supervisors |

| Glass Manufacturing Companies | 45 | Operations Managers, Quality Control Heads |

| Chemical Suppliers and Distributors | 40 | Sales Managers, Supply Chain Coordinators |

| Research Institutions and Universities | 40 | Research Scientists, Academic Professors |

| Environmental Regulatory Bodies | 40 | Policy Analysts, Environmental Compliance Officers |

The Global Cryolite Market is valued at approximately USD 260 million, driven by increasing demand in aluminum production and expanding applications in glass, ceramics, and electronics sectors.