Region:Global

Author(s):Dev

Product Code:KRAB0599

Pages:84

Published On:August 2025

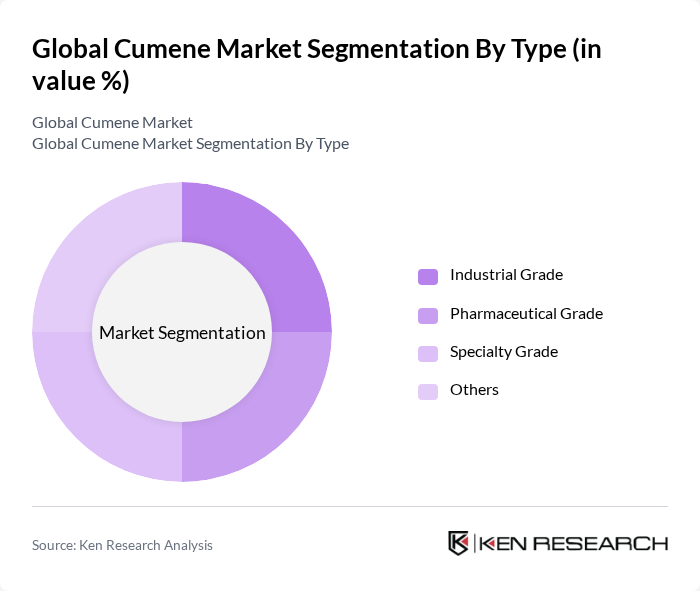

By Type:The cumene market is segmented into Industrial Grade, Pharmaceutical Grade, Specialty Grade, and Others.Industrial Gradedominates due to its extensive use in phenol and acetone production, which are critical for manufacturing plastics, resins, and adhesives.Pharmaceutical Gradeis experiencing steady growth, supported by increasing demand for high-purity chemicals in pharmaceutical synthesis.Specialty Gradecumene is gaining traction as end-users seek tailored solutions for advanced applications, including electronics and specialty coatings .

By End-User:End-user segmentation includes Phenol & Acetone Manufacturing, Chemical Intermediates, Resins & Plastics, Automotive, Construction, and Others.Phenol & Acetone Manufacturingis the largest segment, accounting for over half of global cumene consumption, reflecting the high demand for these chemicals in the production of plastics, solvents, and adhesives.Chemical IntermediatesandResins & Plasticsare also significant, driven by the expanding downstream chemical industry. TheAutomotiveandConstructionsectors are key consumers due to the need for durable materials and advanced chemical solutions in manufacturing and infrastructure .

The Global Cumene Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Shell Chemicals, ExxonMobil Chemical, INEOS Phenol, Reliance Industries Limited, LG Chem, SABIC, Eastman Chemical Company, Chevron Phillips Chemical Company, Formosa Plastics Corporation, Mitsubishi Chemical Corporation, TPC Group, Braskem S.A., LyondellBasell Industries, and Huntsman Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cumene market appears promising, driven by increasing demand for sustainable and bio-based chemicals. As industries pivot towards greener practices, the development of bio-based cumene is gaining traction, potentially reshaping production methodologies. Additionally, technological advancements in production processes are expected to enhance efficiency and reduce costs, making cumene more competitive. Strategic partnerships among key players will likely facilitate market penetration in emerging economies, further expanding the cumene market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Industrial Grade Pharmaceutical Grade Specialty Grade Others |

| By End-User | Phenol & Acetone Manufacturing Chemical Intermediates Resins & Plastics Automotive Construction Others |

| By Application | Phenol Production Acetone Production Solvents Resins Adhesives Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, France, U.K., Russia, Italy, Spain, Turkey, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, Australia, Rest of APAC) Middle East & Africa (Saudi Arabia, UAE, South Africa, Rest of MEA) South America (Brazil, Argentina, Rest of South America) |

| By Price Range | Low Medium High |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cumene Production Facilities | 100 | Plant Managers, Production Supervisors |

| Cumene End-Use Applications | 80 | Product Managers, Application Engineers |

| Supply Chain and Distribution | 70 | Logistics Coordinators, Supply Chain Analysts |

| Regulatory Compliance and Safety | 50 | Compliance Officers, Safety Managers |

| Market Research and Analysis | 60 | Market Analysts, Business Development Managers |

The Global Cumene Market is valued at approximately USD 20 billion, based on a five-year historical analysis. This valuation reflects the increasing demand for cumene's derivatives, particularly phenol and acetone, across various industrial applications.