Region:Global

Author(s):Geetanshi

Product Code:KRAA1308

Pages:98

Published On:August 2025

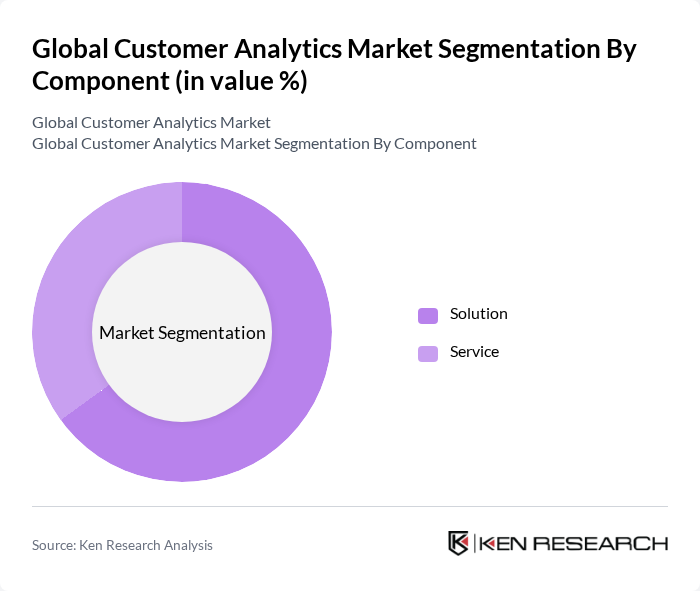

By Component:

The components of the market include solutions and services. The solution segment is currently dominating the market due to the increasing demand for advanced analytics tools that provide actionable insights. Businesses are increasingly investing in software solutions that enable real-time data analysis, predictive modeling, and visualization, which enhances decision-making processes. The service segment, while growing, primarily supports the implementation, customization, and maintenance of these solutions, making it essential but secondary in terms of market share .

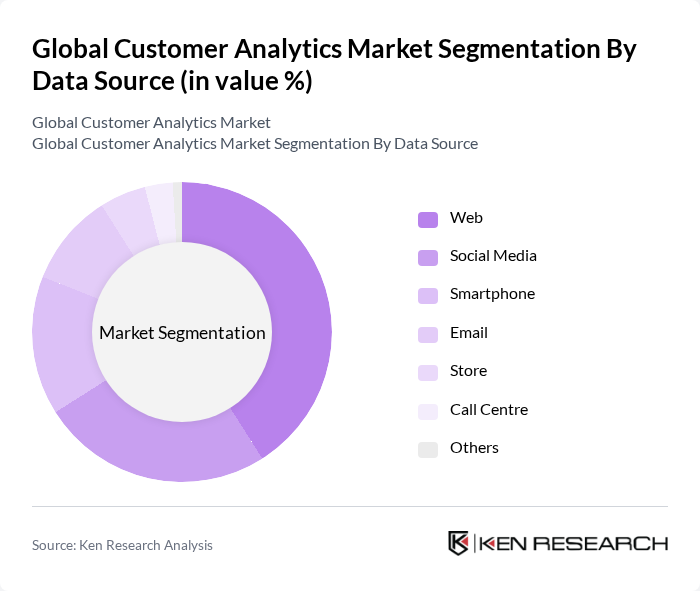

By Data Source:

The data sources for customer analytics include web, social media, smartphone, email, store, call center, and others. The web data source is leading the market as businesses increasingly rely on online interactions to gather customer insights. The proliferation of e-commerce and digital marketing has made web analytics crucial for understanding customer behavior. Social media data is also gaining traction, as companies leverage platforms to engage with customers and analyze sentiment, but it remains secondary to web data. Notably, the web segment accounts for the largest share, reflecting the ubiquity of digital presence and the centrality of websites in customer journeys .

The Global Customer Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Salesforce.com, Inc., Adobe Inc., SAS Institute Inc., IBM Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, Google LLC, Tableau Software, LLC, QlikTech International AB, Teradata Corporation, HubSpot, Inc., Amplitude, Inc., Mixpanel, Inc., Segment.io, Inc., NICE Ltd., Zendesk, Inc., Verint Systems Inc., Dun & Bradstreet Holdings, Inc., Medallia, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of customer analytics is poised for significant evolution, driven by technological advancements and changing consumer behaviors. As organizations increasingly adopt predictive analytics, the focus will shift towards leveraging real-time data to enhance customer experiences. Furthermore, the integration of customer feedback loops will become essential for refining marketing strategies. Companies that prioritize these trends will likely gain a competitive advantage, positioning themselves to meet the dynamic demands of the market effectively.

| Segment | Sub-Segments |

|---|---|

| By Component | Solution Service |

| By Data Source | Web Social Media Smartphone Store Call Centre Others |

| By Application | Brand Management Campaign Management Churn Management Customer Behavioural Analysis Product Management Customer Experience Management Marketing Optimization Sales Forecasting Others |

| By Deployment Mode | Cloud-Based On-Premises |

| By Organization Size | Small and Medium-Sized Enterprises (SMEs) Large Enterprises |

| By End-User Industry | Banking, Financial Services, and Insurance (BFSI) Retail and E-commerce Telecommunications and IT Energy and Utilities Manufacturing Transportation and Logistics Government and Defence Healthcare and Life Sciences Media and Entertainment Travel and Hospitality Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East and Africa |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Customer Analytics | 100 | Marketing Managers, Data Analysts |

| Financial Services Analytics | 80 | Risk Analysts, Customer Relationship Managers |

| Healthcare Customer Insights | 60 | Patient Experience Officers, Data Scientists |

| Telecommunications Customer Behavior | 50 | Product Managers, Customer Service Directors |

| E-commerce Analytics Solutions | 60 | eCommerce Managers, Digital Marketing Specialists |

The Global Customer Analytics Market is valued at approximately USD 17 billion, driven by the increasing need for businesses to understand customer behavior and enhance marketing strategies through advanced analytics tools, particularly those utilizing artificial intelligence and machine learning.